Syrah Resources Ltd’s [ASX:SYR] share price spiked on Thursday after striking a graphite supply deal with EV giant Tesla Inc [NASDAQ:TSLA].

SYR shares gained as much as 35% in early trade, reaching the graphite stock’s 52-week high of $1.795 a share.

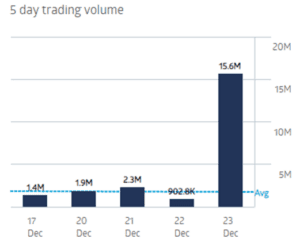

Trading in Syrah shares was somewhat subdued this year, but Tesla’s involvement triggered a trading frenzy.

SYR’s deal with the EV automaker saw trading volume soar well above Syrah’s average.

Syrah and Tesla strike a deal

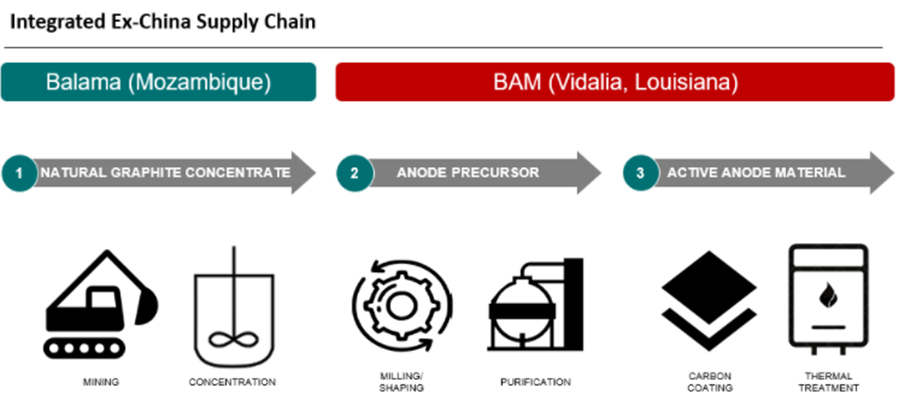

Syrah and Tesla signed an offtake agreement where SYR will supply the EV automaker natural graphite active anode material (AAM) from Syrah’s vertically integrated facility in Vidalia, US.

The deal is set to make Tesla Vidalia’s main customer.

Under the offtake, Tesla will claim the majority of SYR’s proposed expansion of AAM production capacity at Vidalia at a fixed price for an initial four-year term.

The deal rests on Syrah achieving a commercial production rate, subject to a final qualification.

Offering its take on the news, SYR commented:

‘The Agreement provides a compelling foundation to proceed with the initial expansion of Vidalia’s production capacity and Syrah plans to make a final investment decision for construction of this expanded facility in January 2022, subject to financing commitments.

‘Syrah is advancing commercial and technical engagement with other target customers to develop Vidalia AAM for mass production and secure additional long-term purchase commitments for Vidalia.’

Through Vidalia, Syrah aims to become the first major integrated ex-China producer of natural graphite AAM.

SYR, Tesla, and the ASX lithium boom

The rushing green tide has lifted plenty of boats — none higher than lithium stocks. But the inflow of investment in the lithium sector has priced in plenty of potential.

While the hype is still there — junior developer Lake Resources N.L. [ASX:LKE], for example, is up over 1,000% in 2021 – plenty of the potential is already priced in.

Meaning further gains lie in de-risking costly projects, securing affordable funding, and finding customers for future production via offtake agreements.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

And no customer looms larger in the industry’s imagination than Tesla.

Tesla, the EV pioneer. Elon Musk, the real-life Tony Stark.

SYR isn’t the only ASX lithium stock to jump on news it’s partnering with Tesla.

Piedmont Lithium Inc [ASX:PLL] shares surged 90% in one day when PLL announced a supply agreement with Tesla.

And Tesla’s part in the local lithium boom is set to continue.

Earlier this year, the EV carmaker said it expects to spend more than US$1 billion a year on battery raw materials from Australia.

Tesla already sources three quarters of its lithium feedstock from Australia and over a third of its nickel.

Robyn Denholm, chair of the company, told a Minerals Council event in June:

‘We expect our spend on Australian minerals to increase to more than $1 billion per annum for the next few years.

‘Australian mining companies do have a good reputation, great expertise, professionalism and are preferred by manufacturers increasingly concerned about meeting both today’s and the future’s ESG requirements.’

If you want extra information on evaluating and comparing lithium miners, I suggest reading our comprehensive lithium guide.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector and individual lithium stocks.

Additionally, if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here