Syrah Resources Ltd [ASX:SYR] recorded strong operational performance with 29,000 tonnes of natural graphite produced in the June quarter.

The June quarter was the first full quarter following Syrah’s production restart, with natural production at Balama ‘ramping up.’ Syrah ended the quarter with a cash balance of US$85 million.

Syrah Resources shares were up 4% in early trade as a result.

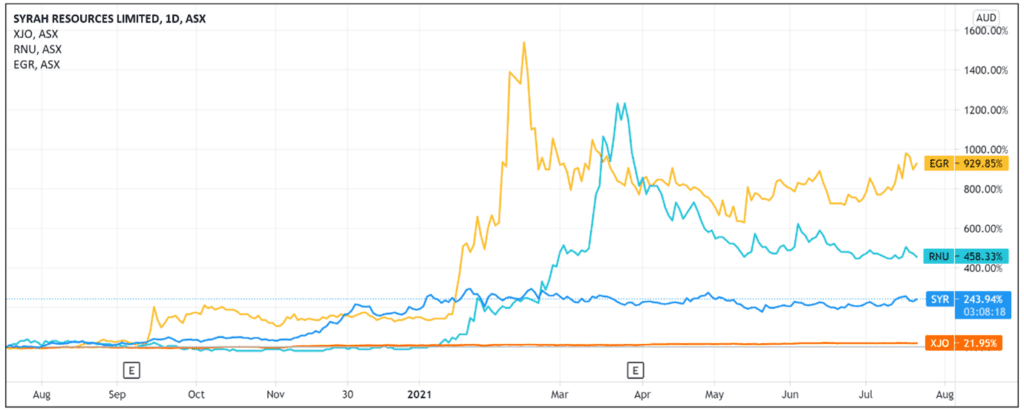

After falling below $1 in May — the first time since December 2020 — Syrah’s share price is regaining momentum.

SYR share price is up 14% this month, having gained 200% over the last 12 months.

Syrah’s June quarter update

Here are the key highlights from SYR’s June quarter results.

- ‘Natural graphite production at Balama ramping up – 29kt produced during the quarter.

- Balama C1 cash costs (FOB Nacala) of US$537 per tonne at ~10kt per month average production rate for the quarter.

- ‘On track to achieve target C1 cash costs (FOB Nacala) of US$430-460 per tonne at 15kt per month production rate.

- ‘Natural graphite sales increasing with 15kt sold and shipped, and practically all of 20kt finished product inventory contracted to customers, demonstrating strong demand.

- ‘Disruption in container shipping market currently impacting ability to match Balama production and sales with customer demand

- ‘Weighted average sales price of US$474 per tonne (CIF) reflecting volume directed to reestablishing China fines shipments

- ‘Quarter end cash balance of US$85 million.’

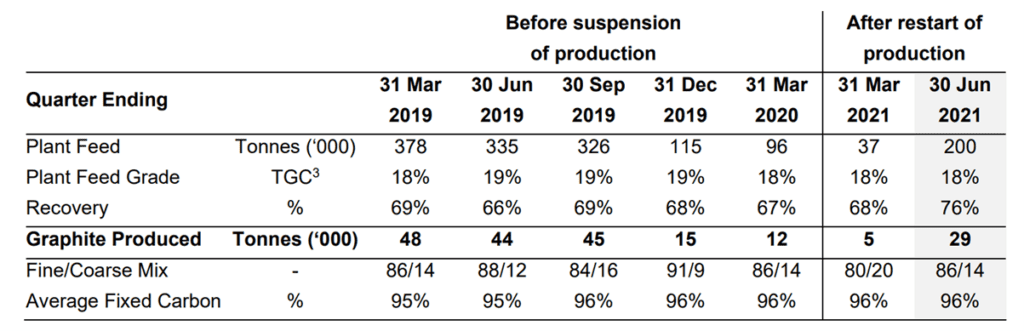

A big takeaway was Syrah saying its production ramp-up was ahead of schedule, with its Balama plant producing 29,000 tonnes of natural graphite for the quarter.

Importantly, product quality matched the ‘best performance reported during 2019’.

However, investors would likely have spotted that SYR’s C1 cash costs were US$537 per tonne at an average production of about 10,000 tonnes per month for the quarter.

This was higher than its target C1 cash cost of US$430–460 per tonne at a 15,000 tonne per month production rate.

Nonetheless, the company told the market it is still ‘on track’ to achieve the target as production continues to ramp up.

Additionally, the cash cost contrasted with a drop in the weighted average sales price of natural graphite fetched by SYR for the quarter.

The price was US$567 per tonne in the March quarter but fell to US$474 per tonne in the June quarter.

The discrepancy between the cash cost and the sales price no doubt contributed to a net cash loss for the June quarter totalling US$9.45 million.

While Syrah netted US$3.56 million from customer receipts, it also spent US$8.92 million on production costs and US$3.77 million on staff costs.

What next for the ASX SYR Share Price?

As a resource company, Syrah rides the wave of market demand for its product.

As it trades in a commodity — good competitors struggle to differentiate — Syrah can be classified as a price taker. It takes the price the market sets.

So its fortunes rest with the demand for natural graphite and the trend’s sustainability.

Well, Syrah today reported ‘sustained demand growth for natural graphite end uses, with EV sales up 165% in H1 2021 versus H1 2020 to 2.3 million units.’

The demand growth for natural graphite was corroborated by fellow natural graphite producer Talga Group Ltd [ASX:TLG].

This week, Talga announced it would seek to expand its natural graphite resource base in Sweden as ‘worldwide lithium-ion battery demand is rapidly increasing.’

If demand can outpace supply, then Syrah and Talga stand to benefit from higher prices.

That said, Syrah must also ensure it can meet this demand by resolving supply issues. As the company today admitted:

‘Disruption in the global container shipping market is currently impacting Balama product shipments and the ability to match Balama production and sales with customer demand.’

Investors will likely continue to monitor whether these shipping problems can be resolved to coincide with Syrah ramping up production.

This will be important as Syrah must produce at a large enough scale to meet its cash cost targets and boost margins.

As we’ve covered recently, stocks serving the lithium battery industry are thriving at the moment. There is certainly emerging recognition that the lithium battery and electric vehicle sector is a potential growth market.

So, if you want further reading on investment opportunities in the lithium sector, then our free report on lithium stocks is a great place to start.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here