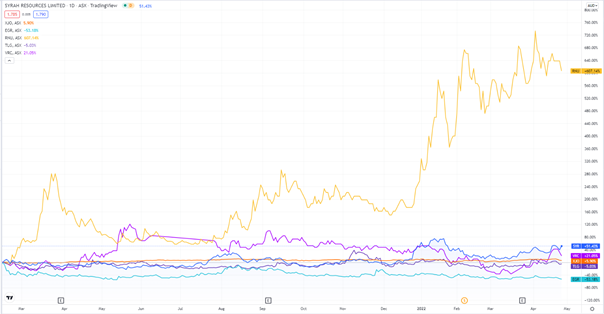

Graphite mining company Syrah Resources [ASX:SYR] rose on Tuesday after a positive graphite production March quarter.

In late afternoon trade, SYR shares were up 10%.

Over the past 12 months, Syrah has gained 55%.

Source: Tradingview.com

SYR March Update

Here are the quick highlights for Syrah’s March quarter:

- ‘Balama produced 46kt natural graphite at 76% recovery with 35kt sold and shipped during quarter

- ‘Product quality consistent with previous quarters with stable grade, and higher recovery relative to historical quarters with an equivalent production rate

- ‘Balama C1 cash costs (FOB Nacala/Pemba) of US$464 per tonne

- ‘Weighted average sales price increased to US$573 per tonne (CIF), with very strong incremental demand and higher new contract prices’

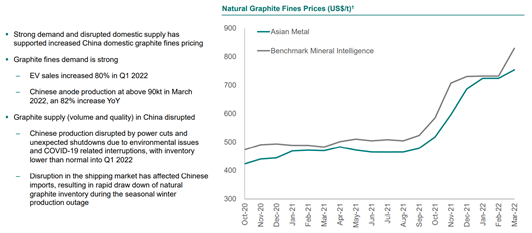

Syrah also noted that graphite pricing in China has increased as the market balances in the industry’s favour:

Source: Syrah

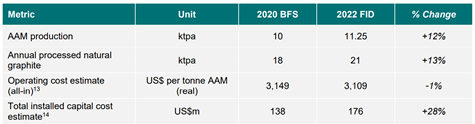

The Vidalia AAM facility in Louisiana is still going ahead with expansion to increase by 11.25 thousand tonnes a year in production capacity.

Project engineering has reached 60% completion, with construction fast approaching within the forecasted budget and schedule — production is expected by September next year.

Tesla plans to offtake 11.25 thousand tonnes natural graphite a year from the Vidalia AAM facility.

Syrah hopes to secure additional offtake agreements with its targeted customers for the facility.

Below is the estimated figure for the Vidalia Initial Expansion project:

Source: Syrah

Natural graphite sales reached 35 thousand tonnes for the March quarter. In March alone, 19 thousand tonnes natural graphite was sold despite COVID-19 disruptions in China.

Source: Syrah

Syrah had also completed an entitlement offer for AU$250 million as part of its capital raise.

SYR reports the company’s cash balance concluding 31 March 2022 was US$205 million.

SYR share price outlook

The past year has been busy for Syrah.

In December, the graphite miner signed a graphite supply deal with EV bellwether Tesla.

And last week Syrah shares spiked after announcing a commitment from the US government to provide it a US$107 million loan.

It looks like Syrah is hitting its stride at the right time.

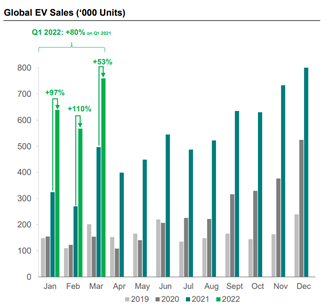

SYR today highlighted that EV sales are soaring with an 80% increase in sales between Q1 2022 and Q1 2021.

In March alone, global EV sales were up around 750,000 units.

Source: Syrah

Demand for EV materials has been a strong theme over the last 18 months at least, and Syrah believes it is the ‘most progressed’ natural graphite supply alternative for North American and European battery supply chains.

However, Syrah must still focus on tamping down costs and turning the strong market conditions into profits.

After all, despite the rising graphite prices, SYR still reported a net cash operating loss of US$13.9 million as production costs (US$29.3 million) dwarfed customer receipts (US$18 million).

Now, while lithium has taken most of the limelight, the EV revolution cannot happen without lithium’s other siblings — copper, nickel, cobalt, and, of course, graphite.

In 2021, eight of the top 10 best-performing stocks in Australia were lithium stocks.

But according to Money Morning’s latest report, there’s a smarter way to play the rise of lithium in 2022.

It involves what you might call lithium’s ‘little brother’.

Access the ‘The NEXT Lithium?’ report here to find out more.

Regards,

Kiryll Prakapenka,

For Money Morning