Graphite mining and technology corporation Syrah Resources [ASX:SYR] saw its shares dipping today despite the announcement of record graphite production and sales for 2022.

Syrah reported US$106 million in revenue while hitting records in production and sales to 31 December, but despite the touting of these achievements over the past full year, shares were dropping 3% to $1.63 each in the hours following the announcement.

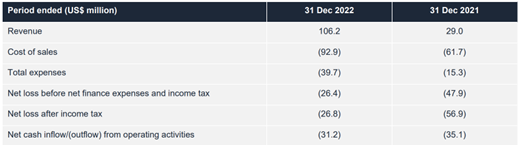

This could be because, despite Syrah reporting a net profit of $13 million, the group also reported a $27 million loss for the year.

Year to date the graphite miner’s stock has decreased by 21% and fallen nearly 8% in the last month alone:

Source: TradingView

Syrah reports record figures yet losses also add up

This morning graphite heavyweight Syrah Resources released its annual full-year report for 2022, ending 31 December.

The miner reported revenue of US$106 million, gross profit of $13 million and a net loss after income tax of $27 million in the year.

Syrah said that it had hit record annual graphite sales of 162,000 tonnes weighted at the average price of US$661 per tonne (CIF).

SYR said it has begun bulk shipments through Pemba port, which also represented a major new logistics option and positive channel for Balama.

The graphite miners have executed a binding loan facility of up to US$102 million from the US Department of Energy (the DOE) to finance its Vidalia expansion project, with the first advance already completed.

Syrah has also been granted approval for a DOE Bipartisan Infrastructure Law Battery Materials Processing and Battery Manufacturing grant of US$220 million, which may lead to funding a fair portion of the group’s capital costs for the Vidalia expansion.

On top the grants and loans, the graphite miner recently completed a $250 million equity raising, which is also expected to assist with the expansion project, as well as other costs related to Vidalia and the Balama tailings storage facility expansion.

The above boosted funds are also expected to support further capital costs and general corporate expenses.

Syrah said it has experienced positive momentum in the key EV end of the market, with global sales increasing 63% between 2021 and 2022.

However, the group did run into interruptions at Balama throughout the year when, in September and through October, the company had to contend with illegal industrial action, which was led by a small group of local employees and contractors.

The actions of these employees greatly impacted production, sales, and costs, and the worksite was forced to shut down while authorities — and Syrah — dealt with the situation.

Syrah chose to look at the bright side, stating that the resulting solutions brought about an orderly renewal of the Company Level Agreement, improving overall employment outcomes for 450 of its employees.

Still, the disruptions and otherwise halting shipping availability throughout the year — not to mention harsh labour, security conditions and a rapid increase in Vidalia’s expansion project hours — took its toll on the group, resulting in a greater loss than profit in 2022.

Source: SYR

Drill Baby Drill

Some industries are making raging bull market-like gains regardless of recession fears, interest rates, and what the wider market does.

Compared to other industries, they’ve made some extreme gains, while most other stocks were battered last year.

This can be described as an alternate universe, the universe of booming drillers.

Aussie mining is at its best right now, but who, where? If so many of them topped 2022, can they really do it again in 2023?

There are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

It’s a big universe, and you may need a little help — that’s where our commodities expert James Cooper comes in.

He’s found six ASX mining stocks that are heading to top the charts for 2023.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia