Australia’s once bustling major international hub for airlines is currently a ghost town.

How will this impact the Sydney Airport [ASX:SYD] share price?

Less travellers, means less money.

With the global lockdown in full swing, companies such as Sydney Airport are struggling.

Trading at $5.50 at the time of writing, SYD looks to be flatlining on the weekly chart:

Source: Optuma

What’s happening at Sydney Airport?

Not much! Sydney Airport’s passenger numbers are down significantly.

In normal circumstances, there are people everywhere day and night coming and going from all corners of the world.

Sydney Airport recently announced its comparative traffic figures for 2019–20. It makes for a sobering read.

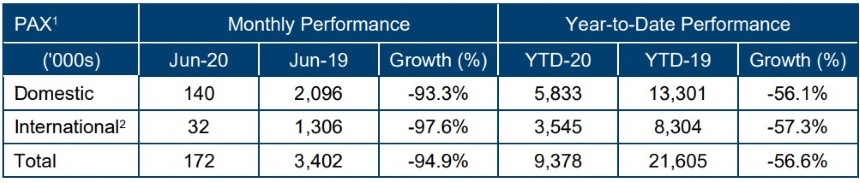

Outlined in the traffic performance for June 2020:

Source: Sydney Airport

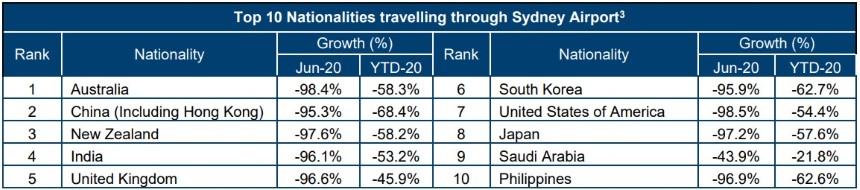

Across the board global airports are experiencing the same abandonment rates as COVID-19 rages on:

Source: Sydney Airport

As can be seen in both of the above tables, the world is currently at a standstill.

And with no immediate end in sight, what does this mean for Sydney Airport?

Where to from here for Sydney Airport?

In a recent article we discussed Flight Centre Travel Group Ltd [ASX:FLT] and the strain they are under from COVID-19.

The pandemic is touching everything. This includes hotels, amusements parks, and unsurprisingly, airports.

With airports being the central hubs for movement, organisations like Sydney Airport cannot go unscathed through all this.

Looking at the charts, we can see from the high in mid-December 2019 the price fell a touch over 53%.

It bounced up into a June high before falling over again.

Currently the price is down 40.22% from the December high, with the most recent push taking place on relatively strong volume.

Source: Optuma

The price is currently holding above the support level of $5.41, if it can continue to push up, the next level that may give future resistance is $5.83.

On the downside, should the price fall away, then levels of $5.41 and $4.93 may provide support to halt the fall.

Source: Optuma

The chart says it all, Sydney Airport isn’t going anywhere. When normality returns to the world and people start moving freely again, the airport will likely once again become a hive of activity.

When green shoots appear SYD could be one for the watchlist, we just have to wait ‘til that time comes. Patience can be profitable.

Regards,

Carl Wittkopp,

For Money Morning

PS: ‘The Coronavirus Portfolio’: The two-pronged plan designed to help you deal with the financial implications of COVID-19. Download your free report here now.