Super Retail Group [ASX:SUL], the Australian retail powerhouse behind brands Supercheap Auto, Rebel, BCF, and Macpac, is anticipating strong first-half sales despite inflationary headwinds impacting costs and consumer spending.

In a trading update today, the company revealed record first-half revenue of $2 billion. Final results are slated for release on 22 February, but first-half profit before tax is expected at $200–203 million.

Shares in SUL have jumped by 6% after the update this morning. Shares are trading at $16.71 per share as the retailer maintains its position as a beacon of resilience.

2023 was dubbed the ‘perfect storm’ for retailers, with three consecutive quarters of declining spending.

While Australia avoided recession, many retailers face the hard choice of forgoing expansion or reducing headcounts.

SUL’s share price has managed to avoid the worst of the fallout, up 46% for the past 12 months, outperforming the sector by over 35%.

Source: TradingView

Super Retail Navigates Cost Pressures

Super Retail Group managed to secure sales growth despite growing economic anxieties, showcasing the enduring appeal of its value brand portfolio.

BCF saw the biggest gains of its four major brands, with an 8% increase in first-half sales compared to the prior corresponding period.

SuperCheap Auto and Macpac saw a 4% increase in sales, while Rebel’s sales fell around -1%.

SUL launched Rebel Sport’s new customer loyalty program in October, hoping to shore up its sales.

SUL says this may impact profits in its final February results but has seen positive engagement. ‘More than 40% of rebel’s 3.9 million active club members have already earned points by shopping at rebel,’ it said today.

It appears cost-conscious consumers have stuck with value brands and favoured sales.

‘The group has traded well over the cyber sales and Christmas holiday trading period,’ acknowledged CEO Anthony Heraghty.

‘We maintained positive like-for-like sales growth in the first half, however, cost of living pressures on the consumer did lead to a more constrained retail trading environment at the end of the second quarter.’

It seems inflation wasn’t without its bite for the retailer.

Increased costs driven by rising wages, rent, and electricity ate into margins. Rebel Sport felt this the most due to its specific lease arrangements and higher staffing needs.

Heraghty highlighted that despite the cost challenges, ‘Gross margin in H1 FY24 is expected to be higher than H1 FY23’.

The company has started several initiatives to address cost pressures. The biggest of which is building a new automated distribution centre in VIC.

The facility cost around $80 million and will open in 2026 to serve Super Cheap Auto stores.

Outlook for Super Retail Group

The upcoming full financial results will shed further light on how each brand navigated the first half. This, along with Super Retail Group’s outlook for the remainder of the financial year, will likely push the next major share price movement.

Investors will be particularly interested in company plans to address the impact of rising costs while continuing to attract budget-conscious consumers.

Rebel Sport’s results remain a slight but noticeable stain on the preliminary results. Investors will keenly watch the impacts of the customer program, which will cost the company approximately $8 million for FY24 in deferred revenue from credits.

Rebel has turned around its sales in the past with smart initiatives such as its Matilda’s shirts and expanding its women’s apparel range.

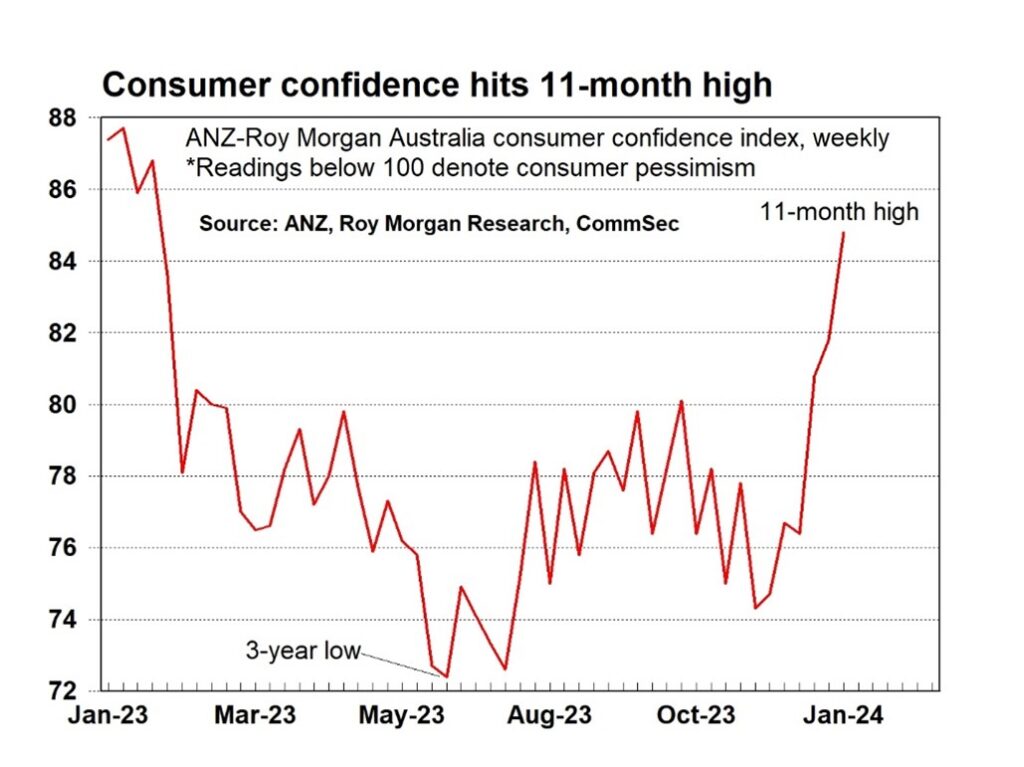

Working in SUL’s favour is improving consumer sentiment. The latest data from the ANZ-RoyMorgan Consumer Confidence Index shows an 11-month high.

Source: ANZ-Roy Morgan

The lift in sentiment should hopefully translate into more robust retail sales. This could come from steadily rising wages, but the important factor ahead are future rate cuts.

The RBA has maintained that rate cuts are coming later in the year. Whenever they come, this easing could open the door for more discretionary spending.

Overall, Super Retail Group’s first-half performance paints a fairly optimistic picture.

While inflation presents challenges, the company’s diverse portfolio, positive sales growth, and strategic cost management suggest it remains on track for a promising financial year.

Regards,

Charlie Ormond

For Fat Tail Daily