Australian fertiliser and energy producer Strike Energy [ASX:STX] has been granted a production licence by the Western Australian government for its 100% owned and operated South Erregulla Gas Field in the Perth Basin.

With the L24 production licence under their belt, Strike has not lost any time in pushing forward the project, which will now only require the submission of the gas field’s Facility Safety Case and Environment Plan to regulators before proceeding with Phase 1 development in the area — which some analysts speculate could come as soon as the end of September.

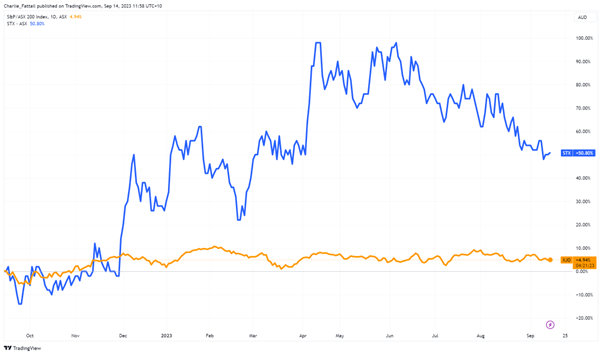

Shares of the company are flat today, but it’s been a surging year for the company, with shares up 51% as declining production from legacy fields has opened the market for smaller players to enter and offset the supply shortfalls.

With the pins lined up at the South Erregulla Field, will they manage a Strike?

Source: TradingView

Strike on the fast track

Strike Energy is moving forward with the final steps before beginning Phase 1 development at its South Erregulla Gas Field after being granted a production licence by regulators.

At the South Erregulla-2 (SE-2) site, a well was spud on 22 August, 2023. Drilling, casing and pressure testing of the top-hole section has been completed down to ~2,100m measured depth. Since then, Strike has drilled the intermediate section down to 4,259m to test the continuity of the gas field to the west to expand the reserves before development.

The company has managed a rapid pace at the site after the WA Government endorsed Strike as part of its gas acceleration and development strategy that was announced in early June.

Under the strategy, Strike was awarded ‘Lead Agency Service’ by the Department of Jobs, Tourism, Science and Innovation of WA in an effort to accelerate LNG projects to help alleviate supply shortfalls.

The endorsement gave Strike’s gas projects a direct case management for government interfaces and fast-tracked many of their proposals in an effort by the government to help ensure the four planned gas projects make it to market as planned by the end of 2025.

‘The award of Lead Agency Service from the Western Australian government in support of Strike’s Gas Acceleration Strategy is recognition of the important role that Strike will play in the state’s future energy security,’ said Strike MD and CEO Stuart Nicholls.

‘This framework will help Strike meet its target of bringing its four gas fields online by the end of 2025 when the Western Australian gas market is forecast to be in a severe tightness.’

The first of these projects that is set for production will be the Walyering Gas Field, which has received all approvals and is set to begin production this quarter with 33 terajoules/day and 250 b/d condensate output.

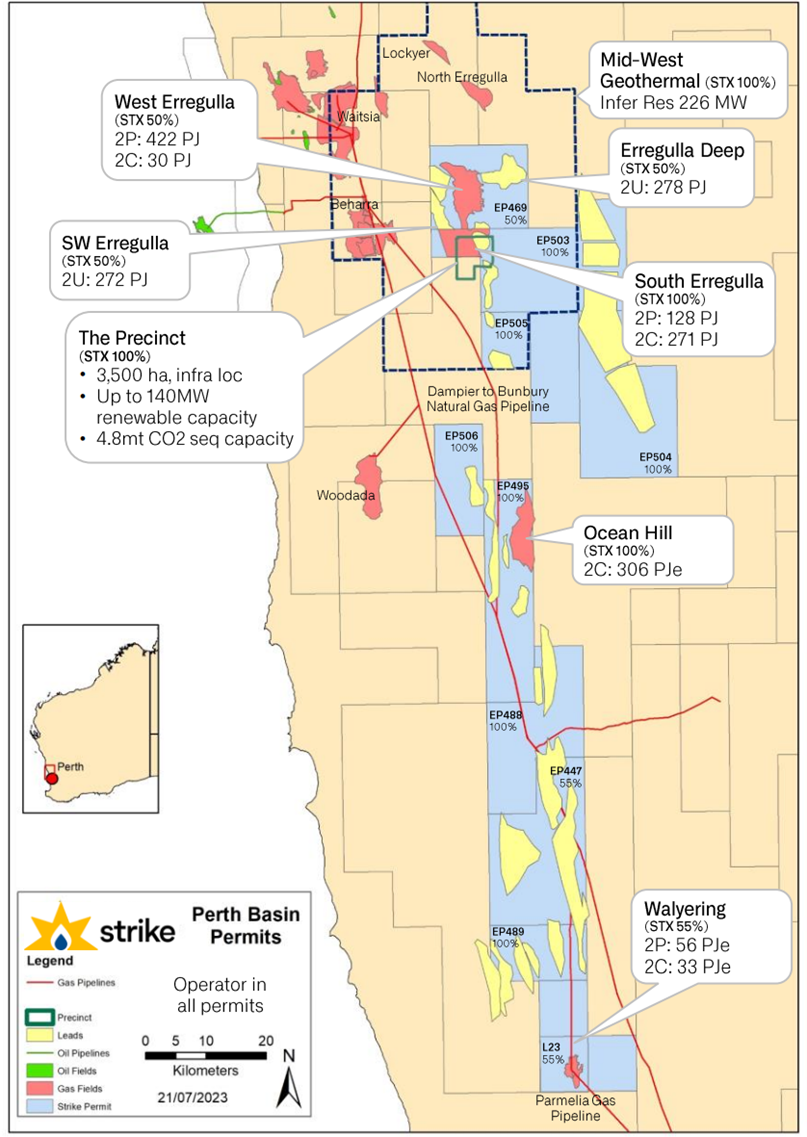

Source: Strike Energy Q1 FY23 Report

The Walyering project is operated by Strike but shared with a 45% interest by Talon Energy [ASX:TPD] and has been the subject of a messy takeover bid by Strike in recent months.

As recently as 25 July, Stike pulled its offer after lobbing a take-it-or-leave-it offer at the Talon board, which stalled.

After shareholders turned on Talon’s board members with a fiery ultimatum for not taking the talks seriously, both parties returned to the table in less than two days.

As recently as 28 August, Stike offered what it described as the ‘best and final offer’, which appears to be 5 cents per share sweeter.

Under the scheme, Talon shareholders would receive 0.4828 new Strike shares for each Talon share and the Mongolian assets would be spun off.

Is this likely to go ahead, and what’s the future for this gas producer?

Outlook for Strike Energy

Now the dust has settled after the rough and tumble of the talks; it appears the deal will likely reach a resolution.

Talon’s directors and board have unanimously recommended shareholders approve the takeover proposal, and the previously vocal shareholder contingent seems to be holding the mic.

The deal’s potential will be too good to ignore as the Strike-Talon combine is expected to have an aggregate 1,022 petajoules of Perth Basin gas 2P reserves and 2C resources.

It would also expose Talon shareholders to Strike’s upcoming drilling campaign, which is imminent as rigs free up after recently finished Mineral Resources [ASX:MIN] drilling program.

The potential for Strike to move into a strong growth period should excite investors. WA gas supplies are forecast for solid demand as a critical buffer in the government’s Net Zero strategy to move away from more carbon-intensive energy production.

This is further highlighted by an independent report published this week, has found that the domestic gas market would remain tight until 2027, when new supply would come online.

The report went on to say:

‘Gas demand will remain robust through to 2033, with new gas plants needed to support the planned coal retirements and the expansion of renewables in the power sector alongside an almost doubling of industrial demand for gas.’

This spells an undervaluing of Strike’s current assets and should see its Gas Acceleration Strategy bearing fruit at the perfect time.

Progress at odds with sense

There is a catch, as there often is in politics.

This progress appears to be at odds with the WA Domestic Gas Policy, where the state is expecting to spend huge sums of money to walk back much of this progress.

The Centre for Decommissioning Australia (CODA) estimates that over the next 50 years, approximately $56.9 billion will need to be spent to decommission Australia’s offshore oil and gas infrastructure.

According to Australian Petroleum Production & Exploration Association (APPEA) director Caroline Cherry, this work and regulatory hurdles in the sector mean that ‘critical investment has been put at risk at a time when the state needs more gas supply to meet growing demand.’

Our Editorial Director Greg Canavan has been doing a deep dive into the costs and political manoeuvring that is happening behind the scenes of the Net Zero movement.

If you want an insider political perspective, then check out Greg’s interview with Cory Bernardi.

Click here to watch now.

Regards,

Fat Tail Commodities