Our Melbourne-based office is closed today for the Melbourne Cup public holiday.

So I thought I’d share with you an article I wrote for the Insider — a publication exclusive to Fat Tail paying subscribers.

As you know, the RBA meets today to determine whether to instill another rate rise. Read on for what I think the effect of this will be on our economy.

Enjoy…

Markets rebounded strongly last week.

The ASX200 jumped 2.2%. The S&P500 surged nearly 6%.

Locally, property trusts were the big winners. The sector added nearly 7% this week.

As an aside, I titled my latest monthly issue ‘REITS: The biggest (contrarian) opportunity in the market right now.’ The stock I recommended jumped 12% last week. The sector is very cheap if you think bond yields will continue to head lower.

More on that later…

But first, why did the market surge last week? And is it sustainable?

Let me answer each question quickly and definitively.

Why did the market surge? By the end of October, it was heavily ‘oversold’. Technically, it was always going to bounce. The rally started going into the Fed meeting last Wednesday. Then, the Fed added fuel to that technical fire by keeping rates on hold.

Is the rally sustainable? No.

At least, history suggests it’s not. As economist Dave Rosenberg wrote in a recent note:

‘The thing is, the average decline from the time of the pause to the ultimate low in the S&P 500 historically is -25% and the median decline is -20% — because economic erosion and declining earnings estimates are what causes the pivot.’

You tell ‘em Dave!

Don’t forget, the reason for the Fed’s likely pause is because of a slowing economy. That’s not going to be good for earnings.

And even a lagging indicator like employment is starting to show it.

On Friday, US non-farm payrolls data for October came in lower than expected at 150,000. The Bureau of Labor Statistics revised down the prior two months too. And, according to Bloomberg, the unemployment rate hit a near two-year high at 3.9%.

Expect more to come…

This news was, of course, bullish for the stock market.

Why?

Because it resulted in a sharp fall in bond yields. Since Tuesday, US 10-year bond yields have declined by more than 40 basis points.

The stock market thinks the fall in bond yields is bullish because lower rates are positive for stocks.

But it’s not bullish. The bond market is finally saying that higher for longer is starting to bite. And guess what? The Fed will stick with the higher for longer mantra. They’re not going to turn on a dime and start cutting rates.

They will keep rates at this level until they can no longer deny the economy isn’t in recession.

Here’s the problem for the US stock market…

Analyst estimates for 2024 put the S&P500 on a P/E of 17.7 times. That’s equivalent to an earnings yield of 5.6%.

It’s a reasonable valuation…but these estimates factor in a 12% increase in earnings per share in 2024. 12%!

That, to me, is a low probability outcome.

With no growth, the S&P500 trades on a P/E closer to 20 times. And if a recession does hit in 2024, earnings will fall. This pushes the P/E up again.

At 20 times, the earnings yield is 5%. That compares to a current US 10-year bond yield of 4.52%. The difference is a rough proxy for the ‘equity risk premium’. At 50 basis points, it is very thin. Historically, the equity risk premium is around 300 basis points.

So, from a broad ‘market’ perspective, US stocks remain stretched here.

But I do think bond yields have peaked for this move. They should continue to head lower as more evidence of a weaker economy comes in.

What about Australia though?

The Aussie 10-year bond yield peaked on 31 October at 4.99%. It ended last week at 4.72%.

The RBA meets tomorrow to decide on its next interest rate move. Markets and economists expect an increase. The rationale is that inflation is still too high.

Fair enough. But is another rate hike really going to help on that front? I mean, the government has opened the door to half a million immigrants this year. The economy doesn’t have the capacity to absorb those numbers in the short term.

The strength in housing has nothing to do with interest rates not being high enough. It has everything to do with demand outstripping supply. More and more income will go to this essential service, cutting back elsewhere to do so.

Meanwhile, another rate rise will boost the spending power of the already cashed-up baby boomers.

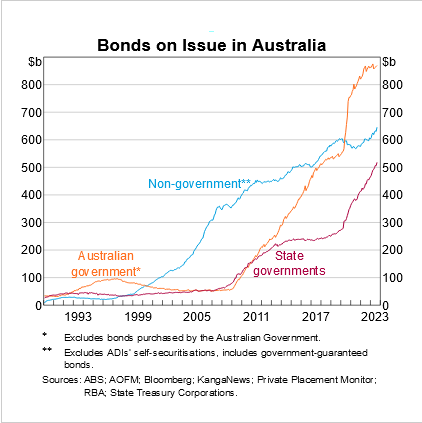

And then you have the real source of inflation in the economy — government spending. As you can see in the chart below, the COVID spending surge just hasn’t stopped.

| |

| Source: ABS |

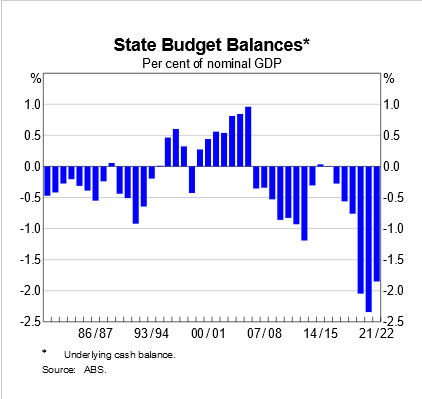

State governments are the worst…

| |

| Source: ABS |

Spending like this puts pressure on scarce resources. Inflation is the inevitable result. Is another rate hike really going to do anything?

State and Federal Governments quickly need to scale back their spending. But when you’re using someone else’s credit card, that’s hard to do.

So, it’s the mortgage holder who will bear the brunt of the fight against inflation.

If the RBA does raise rates tomorrow, keep an eye on the moves in the bond market, especially the 10-year yield. Ongoing falls will suggest another rate rise will really hurt the economy.

From an investment perspective, that could mean yield sensitive stocks are the place to be.

But as always, have a focus on value. There are plenty of good stocks on the ASX trading cheaply right now. Notwithstanding the recent rally, they may get cheaper as the RBA fights inflation with a blunt instrument.

But the opportunity to buy good stocks at good prices doesn’t come around often. Don’t let the RBA distract you while the sale is on.

Regards,

|

Greg Canavan,

Editorial Director, Fat Tail Daily