I could start with the December quarter CPI. Or the December retail sales. Or the US Fed rate decision. Or the Reserve Bank’s research on falling real disposal income.

But that’s so 2023.

I’ve made a 2024 resolution.

Less macro. Less ‘news flow’.

Greg Canavan, funnily enough, made the same resolution.

Macro is interesting. But does it add value? Especially to a stock picker intent on finding quality businesses?

Where is the edge in digging through Fed statements or interpreting Jerome Powell press conferences?

Often, there isn’t one.

Macro is a fascinating distraction, but a distraction nonetheless.

So, we both resolved to indulge less in macro musings. We’re not shunning macro. We’re not ghosting it. Just becoming politely estranged.

In Greg’s case, he even unsubscribed from a macro podcast he regularly listened to.

But at least he finally returned to Fat Tail’s podcast this week after a two-month absence.

In his last appearance, Greg discussed the Santa rally. Festivities have since dragged into the new year. At the start of December 2023, Greg said this:

‘Everything is about probability. And I think the probability of the Fed or the Reserve Bank pulling off a soft landing when you’ve hiked rates so sharply is quite low. Betting on this rally to continue is a low-probability event.’

But continue the rally has.

Earlier this week, both the S&P 500 and our ASX 200 hit new all-time highs.

What gives?

And does Greg still think the rally continuing is a low-probability event?

Yes.

And this episode is all about why.

Other topics discussed:

- Why US and ASX stocks are rallying

- Does the rally make sense?

- Investor sentiment is greedy and bullish

- Quality ASX stocks trading at high forward multiples

- Why Domino’s Pizza is a warning for investors

- Struggling Aussie consumers belie ASX 200’s rally

- Boring stocks versus hype stocks

- Reading recommendations: Munger, Marks, Lynch

Stock markets hit new highs

What’s going on?

We went from the market widely expecting a recession in 2023 to stocks hitting new all-time highs in January 2024.

Our humble ASX 200 reached a new all-time high on Wednesday, surpassing August 2021’s peak.

But the US rally is the big one.

Over 2023, the Nasdaq 100 gained 54%. The best annual gain since the dot-com boom in the late 1990s.

Auspicious? Inauspicious?

A 54% gain in a year is stellar, for an individual stock. But a 54% gain for an index like the Nasdaq 100? Stupendous.

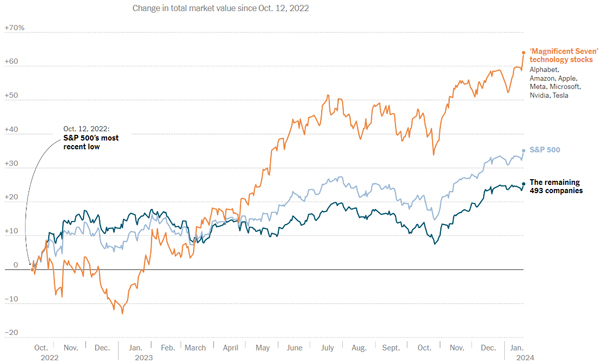

Of course, it’s the tech behemoths who did most of the lifting. Microsoft, Alphabet, Apple, Nvidia, Amazon, Meta, and Tesla.

Strip the seven away, and the rally is less exceptional.

|

|

|

Source: Sally Fang |

Brittle rally and lofty expectations

For many, the surge in US stocks is really a narrow surge in tech. Specifically AI.

That poses problems.

This is a brittle rally.

The Magnificent Seven, like Atlas, are propping up the S&P 500. Or rather, high expectations for the Magnificent Seven are doing the heavy lifting.

And as I like to say, high expectations make for high ledges.

We’re seeing that with Tesla already.

Year to date, the automaker is down ~25%.

Greg noted that analysts slashed Tesla’s FY24 earnings per share estimates 60% over the past 12 months.

And we saw that with the market’s reaction to results from Microsoft and Alphabet on Thursday. Both stocks fell after hours, despite revenue beats.

Results were strong. But clearly not as strong as investors expected.

Unmet lofty expectations leave the Magnificent Seven vulnerable. And by extension, the wider US market.

As Bloomberg’s John Authers noted:

‘These companies are now so important that their results are treated almost like macroeonomic data. All could be vulnerable to geopolitical shocks, particularly regarding Taiwan, where many of their semiconductors are made.’

That said, today we had Facebook-owner Meta Platforms come out with its results. The stock is up ~15% after hours.

Clearly, some tech giants are still capable of beating even lofty estimates.

Domino’s issues warning

The ASX doesn’t have stocks burdened with expectations as high as those foisted on the US tech giants.

But expectations hurt any stock unable to meet them.

Take Domino’s recent profit warning. On the day of the announcement, the pizza merchant fell over 30%.

It was a profit warning and an investor warning.

Beware valuations and the earnings expectations embedded in them.

Heed Greg’s caution in a recent Insider piece:

‘With many stocks trading on rich valuation multiples, the market will deal harshly with earnings disappointments.

‘Take Domino’s Pizza Enterprises [ASX:DMP]. Last week it issued a profit warning. The stock price plunged 30%.

‘Prior to the trading update, DMP traded on a P/E multiple of 40 times!

‘But consensus earnings estimates forecast 50% earnings per share growth from FY24 to FY25, so the multiple was reasonable (if you were confident in the forecast).

‘This is the problem when a stock with a growth multiple disappoints. The share price reaction is violent.’

During the episode, Greg ran the FY24 price-earnings multiples on a slew of quality ASX businesses. Here’s the quick breakdown:

- Commonwealth Bank is trading at 20x

- CSL at 35.2x

- Macquarie at 20.4x

- Wesfarmers at 26.5x

- Goodman Group at 26.3x

- Aristocrat Leisure at 21x

- James Hardie at 25.2x

- Cochlear at 54x

- Carsales at 40x

- Seek at 40x

- Breville at 32x

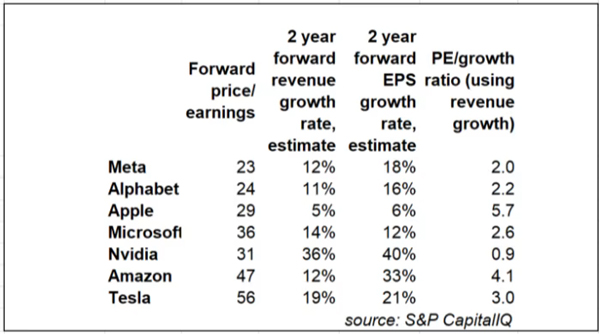

Compare that to the forward multiples of the Magnificent Seven:

|

|

|

Source: Financial Times |

It seems some household ASX names trade at higher growth expectations than the US tech giants.

I’ll reiterate my earlier point.

High expectations make for high ledges.

Enjoy the episode!

Regards,

|

Kiryll Prakapenka,

Analyst and host of What’s Not Priced In

Kiryll Prakapenka is a research analyst with a passion and focus on investigating the big trends in the investment market. Kiryll brings sound analytical skills to his work, courtesy of his Philosophy degree from the University of Melbourne. A student of legendary investors and their strategies, Kiryll likes to synthesise macroeconomic narratives with a keen understanding of the fundamentals behind companies. He’s the host of our weekly podcast What’s Not Priced In, where he and a new guest figure out the story (and risks and opportunities) the market is missing to give you an advantage. Follow via your preferred channel and check it out!