Do you have a thought of your own?

Do you have a belief of your own?

Or is everything literally just what Donald Trump tells you?

—Rep. Dan Goldman to his Republican colleagues

Yesterday, we marveled at how fast people gave up their cherished ideas and opinions. Neither always good, nor always bad, they are always subject to influence. Colleges had regarded DEI programs with the reverence of the disciples standing before the cross.

But then, with the threat of losing federal money in front of them, administrators decided that it really didn’t matter so much. Better to deny Christ than to suffer for Him. Associated Press:

A crackdown on diversity programs is reshaping college graduation ceremonies

As a first-generation college student, Austin Kissinger was looking forward to celebrating graduation with others of similar backgrounds who helped each other find their way at the University of Kentucky. Typically, Kentucky students who are the first in their family to graduate from college pick a faculty member to join them in a special ceremony.

Earlier this month, the university canceled the ceremony, along with other convocations that recognize Black and LGBTQ+ students, citing the Trump administration’s campaign to rein in diversity, equity and inclusion programs.

Forbes:

As more companies, colleges and nonprofits are trying to avoid the political backlash of having Diversity, Equity and Inclusion (DEI) departments, a grand rebrand is happening. DEI offices, and those who sit in them, are no longer in diversity. The latest to make that change? Harvard University, which announced Monday that, effective immediately, it would rename its Office of Equity, Diversity, Inclusion and Belonging to “Community and Campus Life.”

We’re happy to see colleges and corporations climb down from the DEI fad. Separating people by race and treating them differently was pernicious and fundamentally uncivilized.

But today we turn to the federal budget. While DEI was a regrettable scam, budget control is not. So, it is with heavy heart that we see Republicans abandon their traditional concern for sensible fiscal policies in order to join Donald Trump’s gaudy parade.

Trump…Trump…Trump…we’re as tired of the subject as you are. But no person will have more effect on the economy or the Primary Trend than the man in the White House. Politics is ascendant.

He has transformed the US government from one of laws passed by Congress to one of executive orders – more than one a day for the last 100 days. Were he to turn out to be a real Milei-style reformer, our whole outlook would change.

But already, we’ve seen the Big Man add more than $100 billion to the Pentagon’s honey pot. And now… in an interview with TIME — he makes it clear that he has no intention of seriously cutting domestic spending either:

TIME: If Republicans send you a bill that cuts Social Security, Medicare and Medicaid, you commit to vetoing it?

Trump: If it cuts it, I would not approve.

TIME: So you would veto that?

Trump: I would veto it, yeah

Message to Republicans in Congress: Don’t even try.

In the coming battle between the Iron Laws of Finance and the Trump Team…the latter cannot win. The numbers just don’t add up. Every member of Congress must be able to do the math. Every politician on Capitol Hill, no matter how dim, must see that the only sane and sensible move now is retreat. Pull back from ‘full spectrum dominance.” Withdraw from spending we can’t afford. Balance the budget, for God’s sake.

Why Donald Trump has not done so is not hard to figure. He is the Big Man. Isn’t he already talking about his mug on Mr. Rushmore? Isn’t he angling for a Nobel Peace Prize? Doesn’t he ‘run the whole world,’ and want everyone to know it?

| |

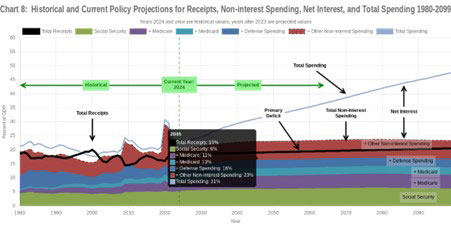

| Source: Financial Report of the US Government, Government Accounting Office |

But what about members of Congress? Neither the House nor the Senate shows any sign of wanting to avoid the coming financial crisis. With one notable exception — Rep. Thomas Massie from Kentucky — Republicans in Congress are as servile and sycophantic as Trump’s cabinet. The House budget bill would bring total US debt in 2035 to nearly $70 trillion. And the Senate version put the total over $70 trillion.

Budget assumptions are so riddled with ledgerdemain (our own word…don’t look it up) that it’s hard to figure out exactly what the figures mean. But according to former White House budget director, David Stockman, the feds are expected to collect $65 trillion in revenue over the next ten years. And they are expected to spend $94 trillion. Republicans talk about spending cuts. But they dare not go near either of the two major holes in the ground — domestic transfers or the Pentagon. Trump has put them off limits.

So, US debt is programmed to rise to the aforementioned $70 trillion…more or less. And that assumes there would be no serious emergency requiring more outlays or reducing income…no recession…no further tax cuts…no panic in the bond market…and no increase in interest rates.

What are the odds?

Regards,

|

Bill Bonner,

For Fat Tail Daily