Energy group Stanmore Resources [ASX:SMR], specialising in metallurgical and thermal coal, rose almost 5% earlier on Monday after it released its December quarter results, revealing it has achieved production guidance for the second half.

The company said it had experienced strong results, particularly at its Poitrel and South Walker Creek sites, despite less favourable weather conditions.

SMR’s share price was worth $3.66, as the stock enjoyed a whopping 244% increase over the past full year and 24% so far in 2023.

Source: TradingView

Production achievements for Stanmore

Stanmore said it had achieved its production guidance for the second half, despite unseasonal rainfall.

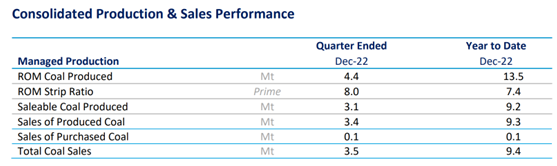

SMR reported a consolidated December quarter Run of Mine (ROM) production of 4.4Mt, while production sales amounted to 3.1Mt, and total sales of produced coal churned 3.4Mt.

This result was supported by ‘record’ monthly ROM production of 410Kt and 501kt at the Isaac Plains Complex in October and November, respectively.

SMR CEO Marcelo Matos said sales of produced coal grew stronger in the last quarter due to trailing momentum in the third quarter, as well as the benefits of new infrastructure changes.

The company reported robust ROM coal inventories at the end of the year, which were said to put the mine in a good position for 2023.

Stanmore successfully completed the acquisition of the remaining 20% interest in BHP Mitsui Coal, now renamed Stanmore SMC, and has added 100% of South Walker Creek, Poitrel, and Red Mountain to its list of assets.

Source: SMR

Stanmore and coal market sentiments

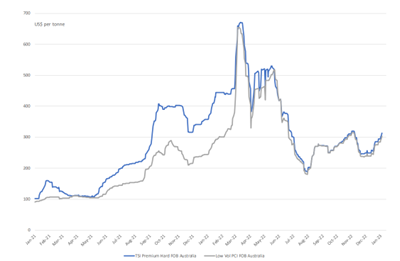

Matos praised the momentum in the metallurgical coal market, spurred on by easing import restrictions in China and easing tightness in supply.

Initially, the December quarter was said to have experienced some tension caused by tight coal supply, which resulted from production issues and regional limitations, and also due to weakening demand.

The thermal market eased in Europe, and in November, market pricing of around US$250 per tonne FOB for Australia was at a much more attractive level.

After free-trade approval between Australia and India in December, and with the re-emergence of Chinese imports, Australian coal was said to have driven the market towards early January highs of around US$315 per tonne.

Stanmore was also able to capitalise on infrastructure system opportunities to increase exports quarter-on-quarter by 14%:

Source: SMR

While still under review, Stanmore said 2022 costs-per-tonne was expected to be within guidance on a consolidated basis, Poitrel and South Walker Creek each below the low end of their range and Isaac Plains above range.

Consolidated capital expenditure for 2022 was also expected to be higher than guidance.

Stanmore ended the year with US$433 million cash and debt of US$615 million, resulting in a net debt position of US$182 million.

A new unsecured surety bonding facility of $25 million was also executed during the quarter to help facilitate the release of approximately $18 million in cash.

Australia’s next commodity boom

James Cooper, Fat Tail Investment Research’s in-house resources expert and trained geologist, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’…a boom where Australia and its stocks stand to benefit.

The next big mining boom is predicted to happen in the next few years; the question is, are you ready for it?

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, check out the recent interview with James and Greg with Ausbiz recorded in December last year.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia