Spirit Telecom Ltd [ASX:ST1] is having a cracker of a trading session.

The small-cap telco is trading 8.11% higher at time of writing. With the ST1 share price climbing on the back of some seriously impressive results.

It seems the first quarter of FY21 has been kind to Spirit. Making up for a far more lacklustre FY20, which was hampered by the pandemic.

And that begs the question: could this be the start of bigger trend for Spirit?

Growing strong

The standout for Spirit was their huge revenue gains.

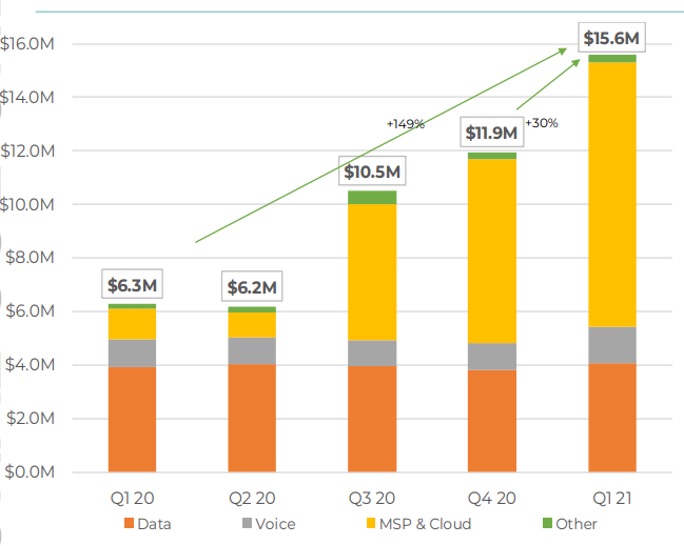

They reported 149% increase in year-on-year sales. Clocking in at $15.6 million for the quarter, compared to $6.3 million in the corresponding quarter last year.

On top of that, it was a 30% improvement from Q4 2020. Highlighting the strong growth the company is enjoying right now.

What should come as no surprise though, is where this growth is stemming from: cloud services.

In the span of a year, Spirit has turned their ‘Managed Services and Cloud’ revenue streams into a juggernaut. Transforming it from accounting for less than a quarter of their revenue, to over half of it.

Just look at this graph to see how lucrative this venture has been for Spirit:

Source: Spirit Telecom

As it shows, the yellow section represents the managed services and cloud operation. A segment that has grown 761% year-on-year!

It is truly incredible how quickly Spirit has turned this new direction into a cash cow.

However, whether it is sustainable is another matter entirely…

Can Spirit stay the course?

There is no denying that this has been a quarter to remember for Spirit. Which is precisely why their share price is on the up today.

Having said that though, they still have plenty of room for improvement.

The fact that the MSP & Cloud growth has lifted doesn’t make up for the slower gains in other areas. Especially when their data services revenue has been stagnant for so long.

For that reason, there is room to be cautious about Spirit’s future. At least, for some of their operations.

In the coming months and quarters, Spirit will need to start making more holistic headway. That is if they want to get a better market response.

Granted, they certainly aren’t performing poorly. But one can’t help but wonder if there is still room for improvement across the board.

Regards,

Ryan Clarkson-Ledward,

For Money Morning

PS: If you’re looking for small-caps with high-value prospects, we’ve got you covered. Check out our latest report, including three of our favourite stock picks, right here.

Comments