In my last Money Morning piece, I promised a look at Aussie tech companies.

I’ll get to that in a moment, but first I want to provide some context.

First up is the big news that the S&P 500 Index [SPX] just cracked through an all-time high set in late February before the ‘you know what’ happened.

It would be right for people to express consternation — the world looks to be in dire straits at the moment.

And fittingly, yesterday Murray Dawes (who runs the excellent Pivot Trader service) headlined his piece ‘What the Hell Is Going on?’.

In it, he covered a lot of ground drawing on multiple data points to paint a picture of a perilous market.

Warren Buffett is selling bank shares and buying gold stocks, M2 money supply points to prolonged inflation, and a weak bond market could all be concerning.

But despite rising risks for the market, there’s nothing to say some carefully selected companies cannot do well.

Yes, they can sell-off in a crash — but if the underlying business model is resistant to pandemic trends, adaptable to them, or even thrives under these conditions — you may have a winner.

One of the lockdown trends is a move towards tech — something which fits the bill for this kind of business model.

So, with 20/20 hindsight then, I’ll look at two Aussie tech companies that have monster charts in a 10-year window and provide some insight on where I am looking for the next success story.

Bank Busters! Three Aussie tech plays outsmarting the ‘big four’ banks

Aussie Tech Success Story #1: TechnologyOne Ltd [ASX:TNE]

TNE was one of the first tech start-ups in Australia when it started in 1987 by founder Adrian Di Marco.

And it’s an impressive success story.

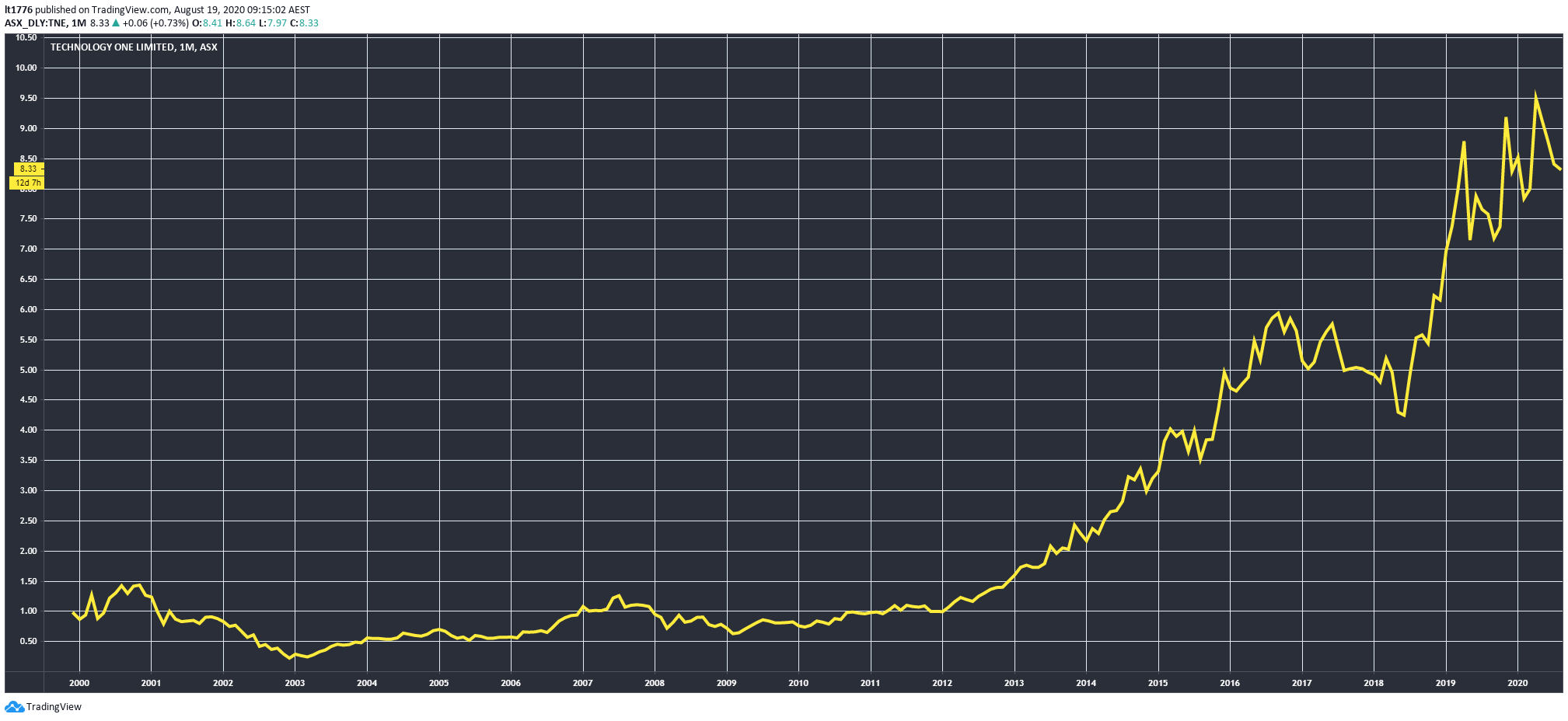

Following its listing in 1999, the TNE share price took until 2012 to get going, but then went on a massive run to where it is today:

|

|

|

Source: tradingview.com |

They do ERP SaaS — which sounds like acronym overload.

ERP stands for enterprise resource planning and SaaS is software as a service. ERP is:

‘A process used by companies to manage and integrate the important parts of their businesses. Many ERP software applications are important to companies because they help them implement resource planning by integrating all of the processes needed to run their companies with a single system. An ERP software system can also integrate planning, purchasing inventory, sales, marketing, finance [and] human resources.’

Think of it as the glue which holds together the various data points in a business.

By having all eyes focused on the same set of data, you can make better decisions.

By licensing out their ERP software (SaaS), TNE provides companies with the tools to run a better business.

And it’s proving to be a profitable model — it’s firmly within the ASX 200 after humble beginnings.

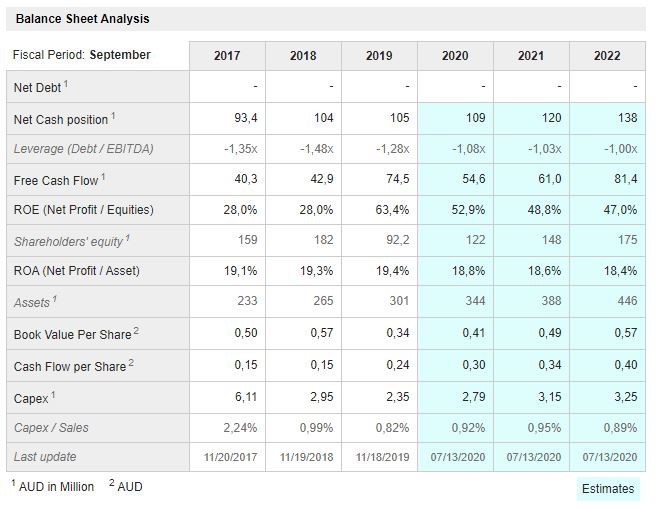

You can see a breakdown of its improving finances below:

|

|

|

Source: MarketScreener |

An impressive ROE, particularly in 2019, as it expands its user base.

They operate across education, government, financial services, and the healthcare sector.

Turns out, the demand for business ‘databases on steroids’ is strong for the company.

Obviously, this is a much more mature business than when it listed in 1999, but it goes to show the potential for local Aussie tech companies if they are well run and have a promising product.

Aussie Tech Success Story #2: Dicker Data Ltd [ASX:DDR]

DDR’s history reaches back further than TNE’s going all the way back to 1978 when it was founded.

Over the last four decades, the company carved out a niche as a distributor of both IT hardware and software.

By 2000 it had more than $100 in revenue and by 2011 it listed on the ASX.

Today it distributes products from these companies to name a few:

|

|

|

Source: Dicker Data Ltd. |

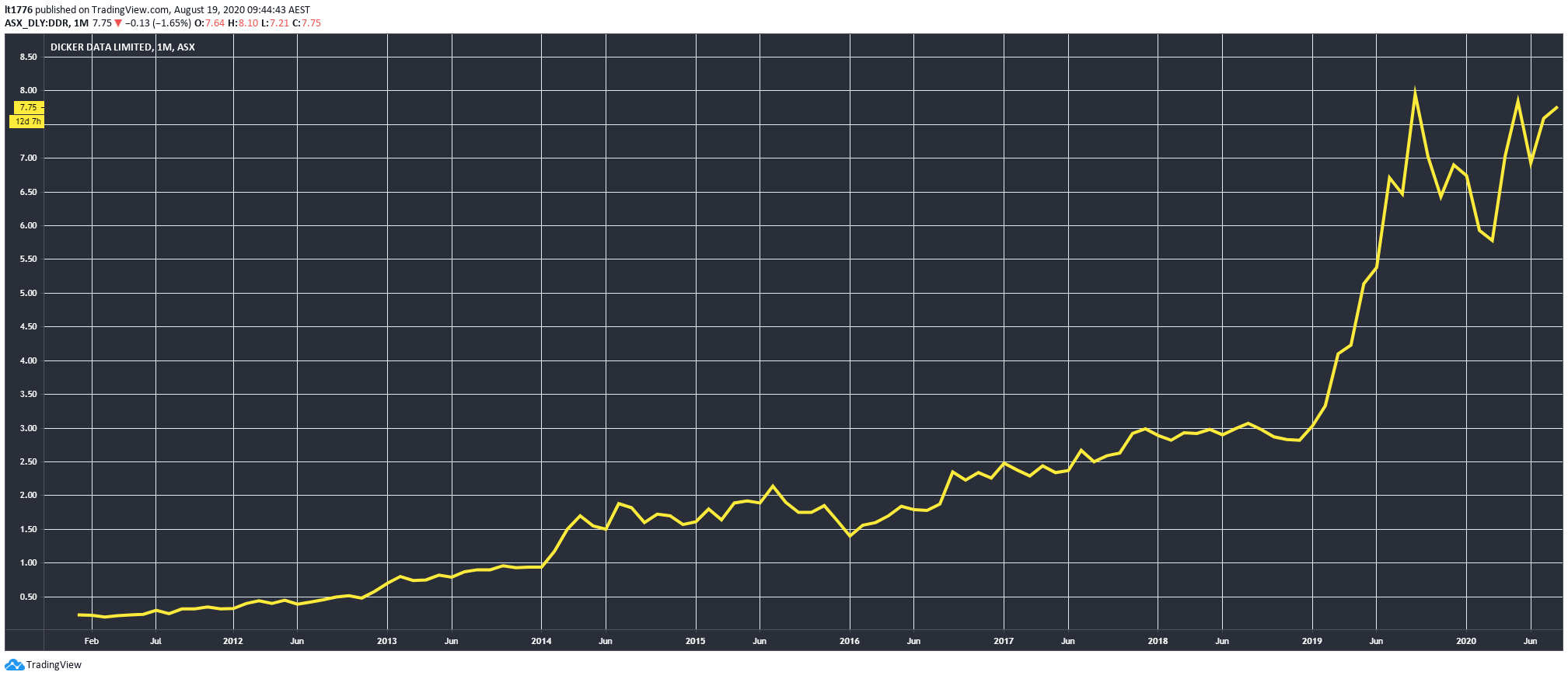

Like TNE, it took a while for the DDR share price to take off, but it started in earnest around the beginning of 2019:

|

|

|

Source: tradingview.com |

DDR is now just outside the ASX 200.

It’s well known that Australia’s IT lags the more tech-savvy developed countries, and DDR’s suite of products is helping accelerate Australia’s push to modernise its IT.

It has more than $1 billion in revenue for the half year as of a recent update, and NPAT of $29.4, up 23.5%.

A price-to-sales ratio of less than one, means it’s a potentially attractive company from a growth perspective as well.

Wouldn’t it be great if you had bought DDR and TNE years ago?

Both of these companies profiled here have similar charts and in hindsight, it would’ve been great to own these two companies before their share price went nuts.

And I think both companies are great examples of the potential that Aussie tech companies have.

Stick to core competencies which provide an innovative product or set of products and the money will come.

But where to look now?

We spoke previously of the potential for a commodities boom in Australia, and in Exponential Stock Investor we are looking closely at this space.

So, I’m currently looking at where mining meets tech, for the possible ‘piggyback’ opportunities that could flow from this potential boom.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Check out these four innovative Aussie small-cap stocks before lockdown ends. Download your free report now.