Western Australia-based rutile metals and mineral sands explorer Sovereign Metals [ASX:SVM] released an update on its graphite co-product Kasiya and says recent testing shows ‘superior qualities’ for use in lithium-ion batteries.

The miner reported finding near-perfect crystallinity — an indication of good battery anode performance.

Further test work is underway to discover more about graphite mineralisation and ways to optimise for the best purification.

SVM was down 2.5% by mid-morning, trading at 40 cents per share.

The metals stock has fallen by 8% in the past month and tracks 14% below the wider market:

Source: tradingview.com

Kasiya graphite dubbed a good choice for lithium-ion battery development

Sovereign Metals was looking to update ASX investors today on the most recent news regarding its downstream testing of the Kasiya graphite co-product.

The most recent testing was carried out by an independent German industrial mineral specialist, who found that the minerals had turned out ‘superior qualities and excellent suitability as feed stock’ in its intended purpose of powering lithium-ion batteries.

According to the company, the Kasiya project has the potential to be one of the world’s lowest global warming sources of natural graphite.

Being perhaps the largest natural rutile deposit and one of the largest flake graphite deposits in the world, the explorer reminded investors that both of these minerals are critical to much of the world’s decarbonisation plans and goals.

Kasiya reportedly has a few geological benefits with both natural graphite and its rutile found in soft material at surface. Therefore, it is more accessible for mining and beneficiation, and to be purified with a much lower carbon footprint than hard-rock operations or even synthetic graphite production.

Last year saw the lithium-ion battery anode market become the biggest end-market for natural flake graphite.

As the world moves closer to a world with heavily enforced net zero carbon goals, there will also be an increase in higher demand for greater capacity batteries for those needed in electric vehicles (EVs), which is also expected to drive higher demand for graphite over coming years.

Dr Julian Stephens, Managing Director of Sovereign Metals, commented:

‘The latest graphite downstream testwork confirms the superior crystallinity and purity of Kasiya’s natural graphite. Kasiya will potentially be one of the lowest cost flake graphite projects in the world and is also estimated to have one of the lowest global warming potentials of any current and future graphite projects. Producers and end users of lithium-ion batteries are already closely monitoring the carbon footprint associated with the raw materials that feed into battery technology.

‘These results bolster Kasiya’s competitive advantage, indicating that not only does the project have the potential to be a dominant rutile supplier, but also a dominant supplier of graphite suitable for the lithium-ion battery industry. Kasiya’s PFS is progressing well with the Company looking forward to releasing the outcomes of the study in coming months.’

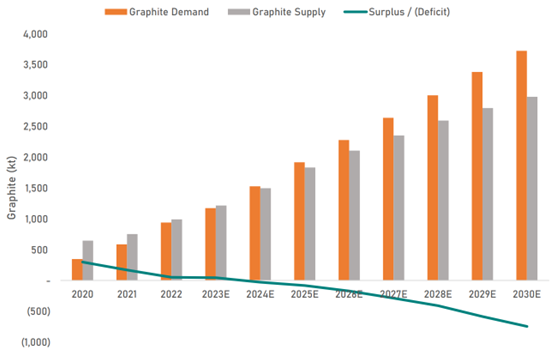

Sovereign Metals pointed out that demand for anodes grew 46% in 2022 compared to only 14% in natural flake graphite supply.

As time goes on, it is expected the demand for graphite will continue to outstrip supply, calling for more need for graphite mining to meet world demand, as you can see below:

Source: SVM

Three copper mining stocks to watch in 2023

Aside from graphite, copper is a hot topic right now, and there are certain stocks worth watching in 2023.

If you subscribe to Fat Tail Commodities, you can instantly download our resident geologist and commodities expert, James Cooper’s most recent copper stock report — all for free.

In James’ latest report, not only will you get instant access to three of the latest top stock picks for the copper industry — including one of the biggest, multi-billion-dollar copper producers — but also ongoing access to integral information that every resources investor should know but might not know.

Learn about the copper supply crisis and learn how you can position yourself to take advantage of changes that are already happening.

Keen to get started with three not-to-be-ignored copper stock tips?

Then you should click here today.

Regards,

Fat Tail Commodities