Shares for diverse mining and production company South32 [ASX:S32] were subtly rising by just over a percentage today, with the company declaring its first-half operating unit costs will either be in line with or below its initial FY23 guidance across its projects.

The miner, who deals in metal production across a portfolio of assets, including bauxite, aluminium, copper, silver, nickel, coal, and manganese, indicated an increase in production. However, holds a cautious outlook for FY23.

S32 moved up in share value by more than 15.5% in the new year so far and is at a 9% advantage on the wider ASX 200 benchmark over a continuing 12-month average:

Source: Tradingview.com

South32 talks production and guidance for FY23

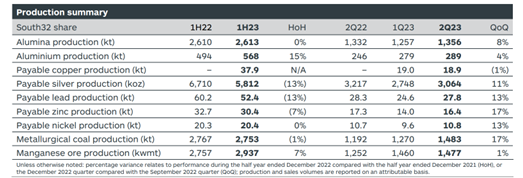

The metals miner presented its quarterly report for December 2022, revealing that copper equivalent production, manganese, and aluminium had increased.

However, the company has decided to keep its guidance in line with initial predictions, warning that it could lower across its operations.

For the first half, South32 reported group copper equivalent production increased by 12%.

It also noted recent investments in copper and low-carbon aluminium capacity delivered strong growth.

The company provided an 8% increase in quarterly alumina volume as Worsley and Brazil Alumina both operated above nameplate capacity in the December quarter.

Aluminium production in the half year had increased by 15%, with a 50% boost in low-carbon aluminium.

This result followed the company’s additional shareholding in Mozal Aluminium, while its restart of the Brazil Aluminium smelter also had an impact.

S32 reported higher copper grades for Sierra Gorda, delivering 45kt payable copper equivalent production.

Cerro Matoso has commissioned an ore sorting and mechanical ore concentration project, underpinning a 15-year extension to its existing mining contract, which supports higher expected nickel production in H2 F23.

Australia Manganese saw a 7% increase in total production, adding to a record half year of production.

Illawarra Metallurgical Coal delivered a 17% increase in quarterly production, with improved volumes and greater labour productivity and a new industrial agreement at Appin.

And yet, FY23 production guidance at Cannington was revised lower by 11% due to decreasing mill throughput and labour availability impacting mining rates, and at Brazil Aluminium (by 25%) on slower ramp up to nameplate capacity.

Graham Kerr, S32’s CEO, commented:

‘Despite industry wide inflationary pressures, we expect Operating unit costs for the first half to be in-line with or below guidance for the 2023 financial year at the majority of our operations. We remain focused on delivering safe and stable operational performance, and efficiencies to mitigate cost pressures and capture higher margins as markets improve.

‘We returned US$927 million to shareholders during the period, paying record fully-franked dividends in respect of the June 2022 half year and continuing our on-market share buy-back.

‘Looking forward, our capital management framework and disciplined approach to capital allocation is designed to reward shareholders as we grow our production and realise the benefits of improving market conditions. At the same time, we continue to reshape our portfolio toward metals critical for a low-carbon future, advancing construction work, studies and exploration at our high-quality development options.’

Source: S32

Incoming! Commodity boom Australia

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multiyear boom in commodities.’

A boom where Australia and ASX stocks stand to benefit…

The next big mining boom is predicted to happen in the next few years.

The same investors that got rich last time are preparing to make their move — don’t let them take the monopoly again.

You can learn from James’s experiences AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, check out last year’s interview with James and Greg at ausbiz.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia