Earlier today, energy property and equity investment company Washington H Soul Pattinson & Company [ASX:SOL] released its 1Q business update, along its AGM summary and chairman’s address.

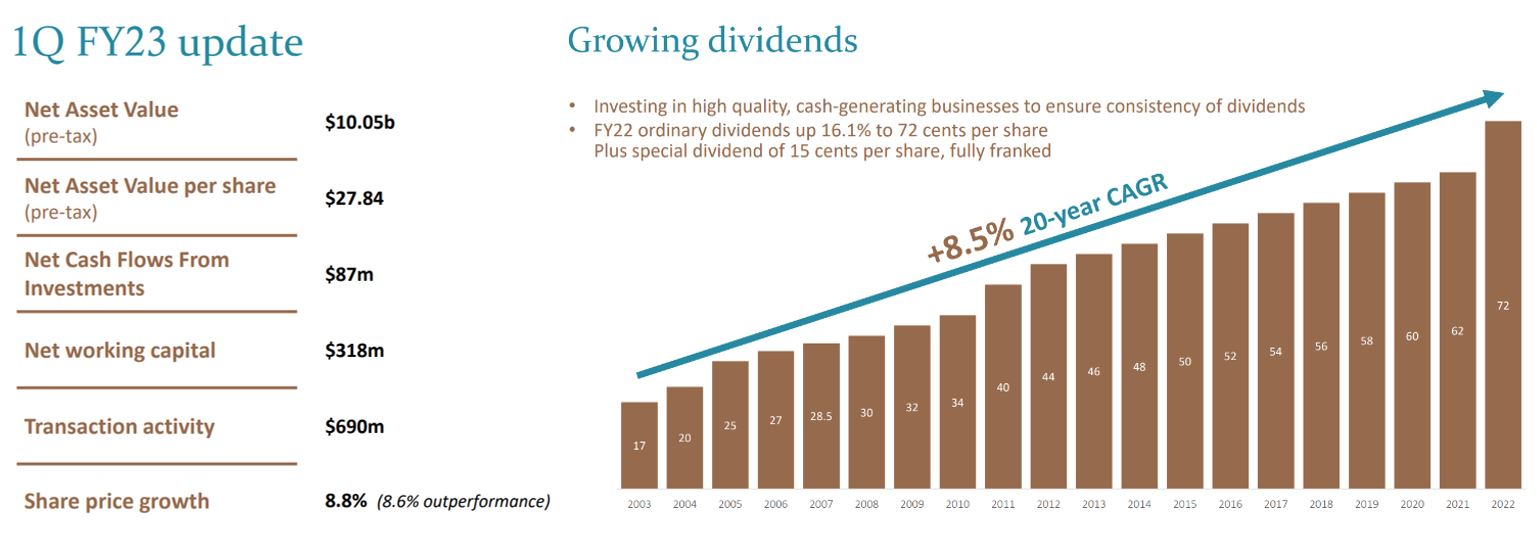

The company reported a 1% increase in pre-tax Net Asset Value of $10.05 billion during Q1 FY23 — representing $27.84 a share for the company.

2022 has become the 22nd consecutive year that Soul Pattinson shares have paid out a dividend that has been higher than the previous year.

Pattinson’s stock price has fallen more than 14% over the last 365 days and is currently 12% below the market’s annual average.

Source: TradingView

Soul Pattinson’s 1Q business update highlights

Pattinson has been a tenacious ASX stock that’s been trading since 1903 — before the ASX was called the ASX — and has recently been steadily raising its returns to shareholders each year over the last 22 years.

Today, we look at how this investment managing company, now worth more than $10 billion in market capitalisation, performed in the first quarter of FY23 — a notoriously tumultuous time across all industries.

Throughout 1Q23, the company reported portfolio transaction activity had surpassed $690 million.

Net cash flow from investments went up 2% per share in comparison with the same time last year, and the business has secured higher yielding investments.

Net working capital went up $44 million in the first quarter, while liquidity increased, and the group moved to explore further opportunities in uncorrelated and defensive assets, like agriculture.

Agricultural assets were expanded by $73 million in 1Q 2023.

SOL commented on the continuing volatility with increasing interest rates, a tight labour market, supply chain issues, and increasing energy costs — not to mention the disruptive weather conditions.

However, difficulties experienced across businesses gave way to slow economic growth conditions, which, according to Pattinson, provided ‘interesting opportunities’ for its portfolios.

In FY22, SOL underwent its merger with Milton, increasing its value per share 13.8%, allowing the company to outperform the All Ordinaries Index by 20.2% in what was recognised as a highly volatile year.

‘We continue to have significant access to liquidity for new opportunities with cash levels currently at approximately $473m, undrawn facilities of over $328m and significant liquid assets in the portfolio’, the company said.

Source: SOL

At the company’s AGM, SOL announced the impending retirement of Warwick Negus — the previous Remuneration Committee Chair — this month, and that David Baxby will move into the position of Non-Executive Director from February.

The group remains optimistic on its high liquidity and strong cash generation, which — it says — has and will continue to support its track record of strong dividend growth.

Resources Boom — an insider’s attack plan

You’ve probably already heard about the next big mining boom that’s been predicted to happen in the next few years.

It’s a topic that’s fast heating up in the media.

Similar patterns that occurred 20 years ago are happening again.

Rich and powerful execs were capitalising on the signs last time, reaping big gains.

But this time, you can get insider intel from an on-the-ground veteran geologist, our commodities expert James Cooper.

James is ‘convinced the gears are in motion for another multi-year boom’, and Australia is in line to benefit greatly.

You can access James’ plan of attack, get his unique and exclusive insight into the industry, and watch back the informative Q&A session by viewing yesterday’s Ausbiz webinar…

This event will only be live for a few days, so click here to make sure you don’t miss out!

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia