Diversified investment corporation, Washington H Soul Pattinson [ASX:SOL] broadcast Group Regular profit After Tax rose 38.4% for the half year ended 31 January 2023.

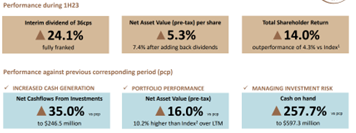

They will distribute a fully-franked interim dividend of 36 cents a share, assisting the group’s total shareholder return of 14% over the half, outperforming the All Ords by 4.3%.

The investment group was trading for around $28.59 a share at the time of writing.

In the last 52 weeks, on average the group’s stock has grown more than 7% in value:

Source: TradingView

Soul Pattinson posts growth in value, cash, and dividends

The diverse investing house said its group regular profit after tax had pulled in $475 million in 1H fiscal 2023, which was a 38.4% increase on the prior period’s $343.7 million.

Group Statutory Profit had improved by $1.1 billion — an increase of 176% — having yanked itself out of a $673.6 million loss, to $453 million.

The investments group reported a 16% jump on net asset value (pre-tax) to $10.5 billion, representing an outperformance of 10.2% versus the All Ordinaries over the 12 months January to January.

Net cash flowed made from investments also jumped 35% from $182.6 million to $246.5 million.

However, compared to the prior corresponding period, the company reported revenue had decreased 74% to $290.5 million.

The group will distribute fully franked interim dividends of 36 cents a share:

Source: SOL

Behind the numbers

Soul Pattinson said the main contributor to its net asset value growth was its Strategic Portfolio investments, which had taken a boost through commodity tailwinds and Brickworks and Apex Healthcare gains.

The group says that its portfolio is defensively positioned and is structured around a bias towards alternative assets and reserves.

SOL pointed out that higher-yielding instruments like private credit have offered favourable and risk-adjusted returns.

Group CEO Todd Barlow said:

‘The portfolio is defensively positioned, we are holding a material cash position, and our new investments target attractive, risk-adjusted returns. In a higher rate, inflationary environment, we are seeking greater exposure to real assets given the potential to offset inflation through income and growth. During the half we reduced our exposure to listed equities, particularly cyclicals and growth stocks, and invested over $400 million into private equity and structured yield products. Around 20% of the portfolio is now weighted to alternative assets and cash, which do not re-rate as frequently as equities but are strategic for risk management and longer-term investment goals.’

SOL claims strong liquidity for the current environment, offering flexibility to ‘take advantage of market dislocation’.

Soul’s total cash balance at the end of the half was $597.3 million, 257.7% higher than the previous corresponding period, with an average current yield of 4.2% annually.

Jim Rickards’ ‘Sold Out’ book offer — grab your copy now

Supermarket shelves are bare, with glaring random gaps in place of once readily available items.

Banks are permanently closing more and more branches across towns and suburbs.

Used car prices are rising, and sourcing new ones for speedy delivery is getting harder by the day.

Prices in general are skyrocketing while packaging is shrinking.

Is it all just inflation, COVID ramifications and market volatility, or is there more to the story?

Thing is, these are just some of the seemingly unrelated signs pointing to something bigger.

Mere ‘inconveniences’ are just the start.

Geopolitical expert Jim Rickards has been making very apt, on-point predictions for decades.

And now he’s predicting ensuing financial chaos — yes, more so than there is right now.

He explains it all, offering a unique perspective that should not be ignored, in his book, SOLD OUT: How Broken Supply Chains, Surging Inflation, and Political Instability Will Sink the Global Economy.

You can grab a free copy when you sign up for The Daily Reckoning Australia — also free — right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia