In today’s Money Morning…‘smart money’ is more afraid than retail investors…because small-caps are disruptive, geopolitics matter less…get your own analyst bonus bounty by doing the hard yards…or this…and more…

As Ryan Dinse pointed out yesterday — Bitcoin [BTC] is in the early stages of ‘Uptober’.

And it’s not just crypto that’s defying the wider fear-driven narrative.

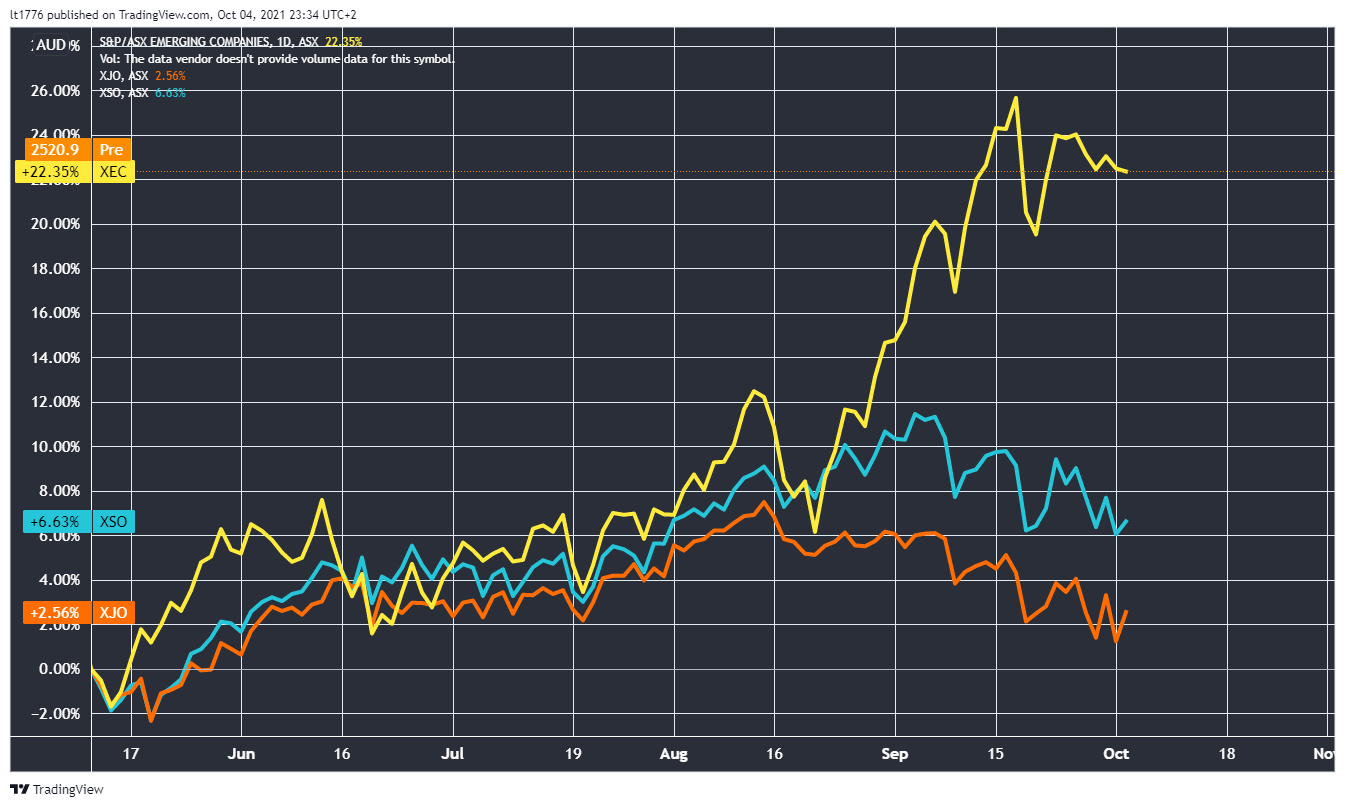

Turns out, my 70 or so strong watchlist of ASX small-caps is faring remarkably well as the ASX 200 [XJO] trends down.

Check it out:

|

|

|

Source: Tradingview.com |

That yellow line is the ASX Emerging Companies Index [XEC] matched up against the ASX 200 [XJO] and the ASX Small Ordinaries [XSO].

XEC is a useful proxy for the kind of highly-speculative (and really-exciting) companies that inhabit the Exponential Stock Investor stable.

On a recent internal call, our Editorial Director Greg Canavan asked how small-cap land was tracking as the market begins to shed points.

Ryan and I both said — not too shabby considering the overall sentiment.

Which is downright weird.

Generally, the rule of thumb is that as the overall market corrects or threatens to correct, small-caps get smacked the hardest.

This time, though, things seem different.

Here’s what could be going on…

‘Smart money’ is more afraid than retail investors

Will the US government implode over petty squabbling over how much more stimulus money to shower the market with?

Almost certainly not. As a former US resident, I’ve seen this bickering and brinksmanship all too many times.

It always gets resolved with concessions from one or both sides.

The ‘smart money’, or more rightly, the big money, could be a bit spooked by what’s going on in Washington.

Something similar is afoot in Australia, but instead of internal political beef causing the rout, it’s the brewing stoush with China triggering moves. And the iron ore sell-off effectively wrecked BHP, Rio, and FMG’s strong year in the space of a couple months.

The average retail punters that back ASX small-caps, however, are much less fazed.

Hence why XEC isn’t collapsing just yet.

Foolhardy? Courageous?

There’s HODLing in small-caps as well as crypto, you know.

Perhaps the real story is this.

Because small-caps are disruptive, geopolitics matter less

The trajectory of high-growth small-caps is more a matter of where they sit in a likely future rather than where they sit right now.

Take Afterpay Ltd [ASX:APT], for instance — it never turned a profit but that didn’t stop Square Inc [NYSE:SQ] from gobbling it up at a significant premium.

This isn’t madness — the deal actually makes sense as Rebecca James of Humm Group Ltd [ASX:HUM] rightly points out.

All because APT firmly had one foot in the future.

Now, contrast this with companies like the aforementioned BHP, Rio, and FMG…

Or even the Big Four banks.

Geopolitics and internal Australian politics matter much more for these types of companies.

So, in some ways, by holding a few choice small-caps, you may be future-proofing your portfolio.

Worried about China cutting off the iron-ore faucet?

Consider holding some smaller, alternative commodity stocks in lithium, copper, and nickel.

Worried about Aussie politicians and regulators stamping out on Big Four profits?

Think about owning a handful of nimbler fintechs that want to follow in APT’s footsteps.

And paradoxically, what’s happening in that slice of time we call ‘now’ is far messier and harder to understand than what will happen further down the track.

Which is where you, the Aussie investor, have a unique advantage…

Get your own analyst bonus bounty by doing the hard yards…or this

BHP, Rio, FMG, and the Big Four — there is an army of analysts tracking these stocks every day.

The thing is, though, these analysts are highly reactive to current events.

It’s like they all have tunnel vision on what is happening right now, and if you’re lucky, that vision extends out to a 12-month window.

Because that’s where the bonuses are.

Small-caps, on the other hand, especially disruptive ones, are best thought of over a 2–3-year time frame.

There are no real analyst bonus bounties out there on these tiny companies — which is all to your advantage.

Meaning, you can get your own clip of the system by doing the hard yards that others can’t be bothered with.

Research relentlessly — try and understand these speculative small companies from all angles.

Or if you don’t have time (which is completely fair), look at getting a subscription to Australian Small-Cap Investigator or Exponential Stock Investor.

Even if you don’t agree with our takes on certain ASX small-caps, you’ll pick up valuable insights.

Give someone a stock tip you make them happy for a day — teach someone how to wisely invest in the smaller end of the market, well, you might just set them up for a much wealthier future.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.