In today’s Money Morning…lies, damned lies, and inflation numbers…the problem…the debate…the takeaway…and more…

Dear Reader,

There’s no doubt that the topic of inflation is occupying the thoughts of economists and investment strategists all over the world right now.

What happens here will affect interest rate decisions. And that, in turn, will affect the future direction of markets.

Which is why it’s been occupying the minds of many here at Fat Tail Investment Research too.

Shortly, I’ll share a very interesting discussion I had last week with two of my fellow editors, and what could happen next.

But first, here’s why it could actually be a bigger deal than even the worrying official numbers suggest…

Lies, damned lies, and inflation numbers

You don’t need a PhD in economics to know the price of things is going up.

Whether you’re in the market for a used car or just doing your weekly food shop, you’ll feel the ‘silent tax’ of rising prices has a lot more bite than it did in times past.

And it’s the same all over the world.

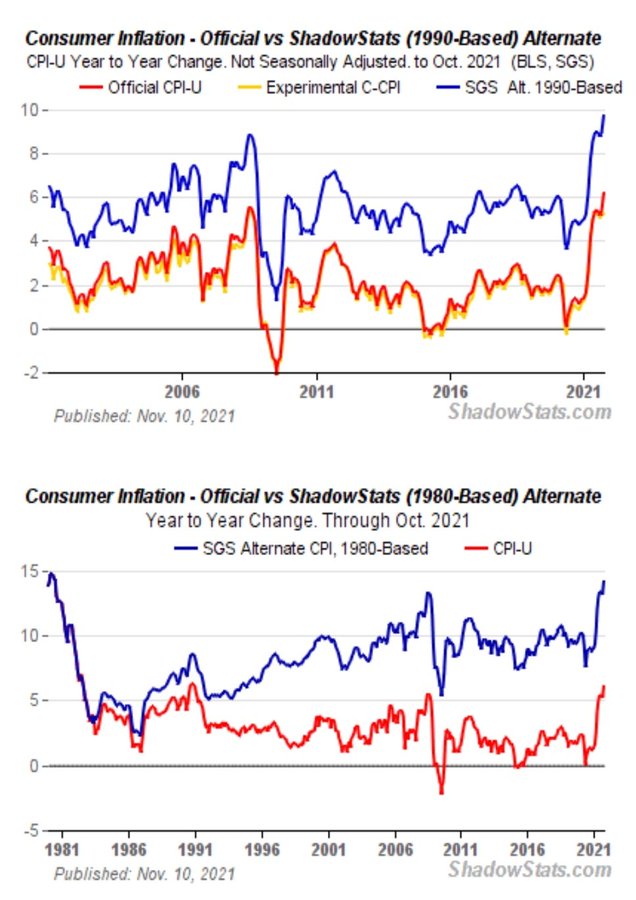

Inflation in the US is running at its fastest rate in 30 years. Last week’s number came in at a whopping 6.2%.

That’s about double what central banks usually aim for.

But even that might be understating it.

According to a pre-1980s measure of inflation, real inflation is closer to 14% right now!

|

|

|

Source: ShadowStats.com |

What’s the old saying about ‘lies, damned lies, and statistics’ again?

With inflation data, economists can decide what prices they want to include in their ‘typical basket’ of goods and services.

But their ‘normal spending’ might be vastly different from yours or mine.

And the reality for a lot of people, particularly those on lower incomes, is that the price of essential items like energy and food are going up at an alarming pace.

Even President Joe Biden acknowledged as much, saying:

‘Reversing this trend is a top priority for me…’

What can be done then?

The problem

Central bankers originally tried to calm everyone by saying these were just the transitory effects of a global economy moving out of lockdown.

But the market isn’t so sure.

You can see that from the effect on bond yields (interest rates) lately.

Yields on two-year Treasury Notes (government debt due in two years’ time) jumped higher on the inflation numbers, signalling they thought there was an increased chance of higher interest rates coming to combat this.

And that’s the thing about inflation.

The usual response to high inflation is to increase rates.

The theory is that by increasing interest rates, it will suck some spending out of the economy, as consumers and businesses have to spend more to service debts.

As demand for goods and services falls, so should prices…in theory.

Here’s the problem…

Debt loads all around the world are at record highs. And at the same time, asset prices in stock and property markets are at nosebleed levels too.

Fuelled by years of low interest rates, we’ve all binged out on debt and seen our investments soar along with it.

Who wants to be the one to stop that party?

It’s what’s known as a classic ‘debt trap.’

The situation prompted some internal debate last week between me, Editorial Director Greg Canavan, and new recruit Izaac Ronay.

While none of us has all the answers, I think the email discussion is worth sharing. So they both kindly allowed me to share the thread…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The debate

It started with an email from Izaac…

IZAAC:

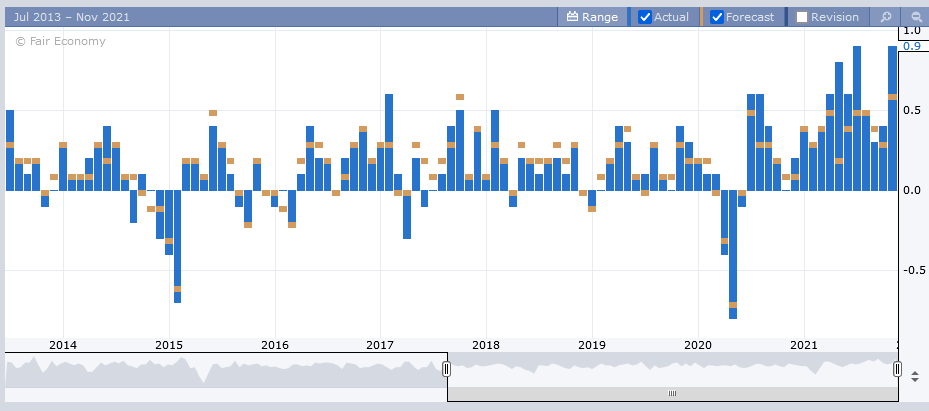

‘6.2% inflation is quite concerning. The trend is more concerning.

|

|

‘Forget about electric cars. The biggest economic driver (excuse the pun) of the next decade is as old as innovation.

‘If these numbers are maintained we will be seeing 8–9% inflation in the first half of next year in the US.

‘Biden’s response that he will prioritise controlling inflation is somewhat comical. His stimulus packages are the cause of it. Not to mention that he is still trying to push through a $2trillion dollar spending bill. I haven’t looked yet, but would be interesting to show on the above chart where his stimulus packages happened.

‘He may well go down in history as the worst president in American history. (OK yes, this is hyperbolic.)

‘OK. Rant over.’

GREG:

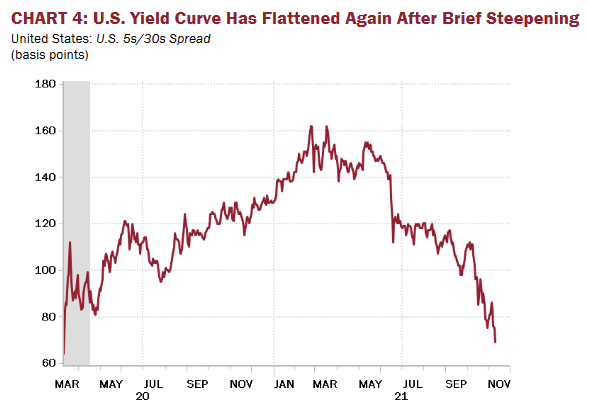

‘Don’t know what your view on the 5/20 spread is, but this chart tells you the bond market views any tightening/pick up in short rates will cause a slowdown.

|

|

‘This is because of the debt. As Lacy Hunt points out, the marginal productivity of debt just keeps falling…the more we add, the worse it gets: Debt trap.’

RYAN:

‘Yeah, that was my basic view too.

‘You can’t increase rates to combat inflation because, although marginal productivity of debt is declining, marginal negative wealth effect if you increase rates actually increases due to immense debt levels.

‘In government eyes, inflating away debt is probably THE GOAL here…not the problem.’

IZAAC:

‘Well, this is actually why I think we will get inflation. I think everyone will be way to scared to pull the trigger on tightening. Everyone is so terrified of being responsible for derailing the economic recovery that they would rather risk big inflation for a while.

‘Agree completely on the diminishing returns of debt. All of our debt is going straight into bonds and etfs and that is slowing the velocity of money through the system.’

GREG:

‘The holy grail is inflation above interest rates, but not too much. Financial repression to work off the debt.

‘I’m writing about it in this monthly issue.’

The takeaway

The discussion broadened further to the role of Bitcoin [BTC] and the future dominance of the US dollar as a global reserve currency. But I won’t stray down that field of enquiry today as it’s a whole new can of worms to go over!

Suffice to say, we all agree that central bankers are currently stuck between a rock and a hard place.

Not that we should feel sorry for them, as it’ll be us mug punters that bear the brunt of their ‘solutions.’

Whether that’s a sustained period of severe inflation, major hikes in interest rates and a huge economic downturn, or something else…just remember whose meddling got us there.

Because when it all hits the fan, they’ll tell us ‘Only they can save us’…from a calamity of their own making!

Don’t believe it.

Constant meddling with money and trying to micromanage the business cycle is what got us here.

The future needs to be about less economic intervention, not more.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here