1) I got a glimpse of the future this morning. It’s a way to see why industrial land values could go to dizzying heights before this property cycle is done.

How so? The Australian Financial Review reports that industrial rents are set to go up as high as 50% in five years.

The roaring market is for inner-city land for fulfilment centres for online deliveries. Some landlords are achieving double-digit rental rises.

Here’s the comment that jumped out at me:

‘This won’t be an issue for e-commerce users who can defray the higher rents through cheaper fuel costs and faster delivery times.

‘Only about 10 per cent of their overall cost is rent while about 50 per cent of their cost is transport, so paying a rental premium is something they can absorb, whereas with traditional users it probably cuts more into their bottom line.’

The bit about transport costs is key for me.

The existing transport system is currently labouring with a US$90 oil price. That’s what you get when you have a regular petrol-run car, van, or scooter.

But we know that electric vehicles are coming to wipe the existing market out. The only question is the timing.

What’s a likely scenario here? Battery-powered vehicles will lower costs again, big time, thanks to solar.

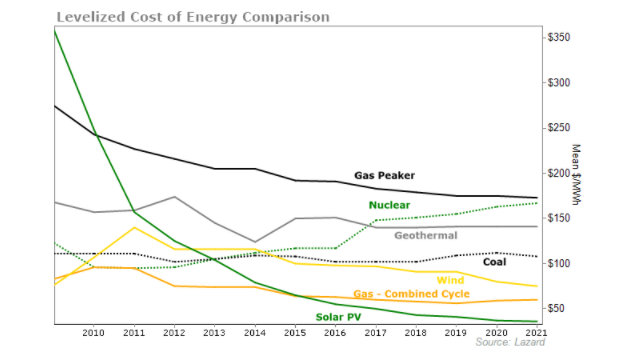

Look at this recent graph comparing the costs of power generation:

|

|

| Source: Stansberry Research |

Simple economics says solar is coming to wipe out the fossil fuels industry. Again, the question is not the outcome, but the timing.

The future is for electric transport powered with abundant, almost free, solar energy.

This means landlords will be able to ratchet up their rents again and again and keep the businesses operating on their leases viable.

My goodness. What a boom in land we are going to see. Go here to see how to take advantage of these massive tailwinds.

2) Business commentors love to spook us all with how fragile the economy is and the wicked amount of debt there is in the world.

Clearly, they don’t read much about the advertising industry, which is currently booming.

Rupert Murdoch’s News Corp came out with their results last week. Revenues were up 13% over the same time last year.

Their streaming services Binge and Kayo now both have a million subscribers. Profitability was up nearly 30%.

One swallow doesn’t make a spring. What else do we see?

There’s this report in The Australian this morning:

‘Television networks revelled in double-digit growth in their advertising revenue last year, with catch-up viewing services yielding the biggest increases.

‘Figures released on Monday show that total television advertising revenue for the six-month and 12-month periods to December 31 soared, climbing by $2.2bn and $4.1bn respectively compared to the same periods in 2020.’

Clearly advertisers are going after what they believe to be confident and cashed-up consumers.

Keep that in mind the next time you read a 0.25% interest rate rise is going to crash the housing market and send consumers into hibernation with nothing but cat food and spring water on their shopping list.

Last year I did a report on a stock I called the ‘Delta Dominator’. The idea behind it was that COVID would see more people watching TV.

Here’s more from that Australian report…

‘ThinkTV chief executive officer Kim Portrate said the most significant growth was in broadcaster video on demand (BVOD) services excluding SBS, which rose by 67.8 per cent to $362.7m for the year.

‘“People have more time on their hands because of the lockdowns and shadow lockdowns so they’ve had more opportunity to consume the broadcaster’s content,” she said.’

I had the right idea. The stock itself got caught up in recent selling so it’s still flat on my initial buy price. However, everything suggests it’s going to release a great set of results in the next few weeks. You can still check out that report here.

3) One of the most exciting projects I’m working on this year is our company podcast.

Last week, I spoke to tech guru Matt McCall. He’s a big fish over in the US. This week, I have renewable energy guru James Allen on to tell us all about carbon credits.

That might sound a bit dry, but fund managers and punters are making money by accumulating them. Businesses have to buy them to offset their emissions. Talk about a captured market!

Go here to check out the back catalogue of shows we have.

It’s all free, and there are lots of great ideas. In our first episode, I pointed out the opportunity I saw in Rio Tinto at the time. Now it’s up 20% and on track to pay 10% dividends.

Why not tune in and see if it’s for you?

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: And don’t forget to check out the presentation I did with Catherine Cashmore on why Australian wealth — and potentially yours — could boom in the next five years. We share ‘five smart money moves’ for 2022!

Comments