In every bullish phase of the gold price cycle, larger gains are likely to come from the speculative gold stocks space.

And certain individual explorers can deliver multiple percentage returns if you trade them at the right time. The potential for these extraordinary returns are what lure many speculators into this space.

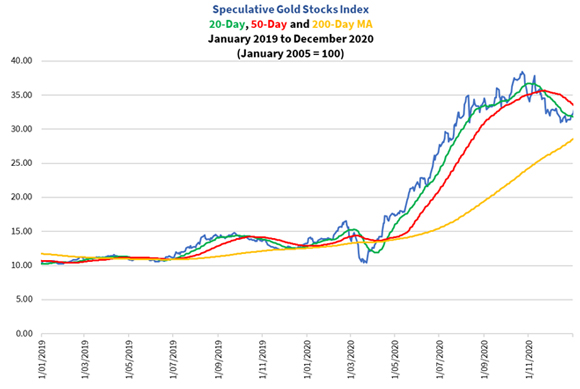

Let me hone in on the most recent bull market in 2019–20. Here is how the Speculative Gold Stocks Index performed during this period:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

The sudden market panic at the end of February 2020 saw gold explorers sell off sharply by almost 40% in a very short time span, leading to capitulation on 23 March 2020.

What followed was a phenomenal rally that lasted for around seven months. The most intense phase of the rally occurred in April–July, slowing down somewhat as many companies announced they would raise capital to fund exploration and development activities or for asset purchases.

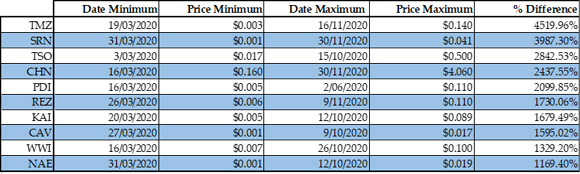

Let us have a look at the returns of the best-performing individual explorers during this 2020 bull market:

|

|

| Source: Internal Research |

Out of 71 companies in the index, 67 rallied in this bull market delivering an average return of 715%, well above the ASX Gold Index rallying 107% from September 2018 to August 2020.

The standout performers delivering over 1,000% returns were Carnavale Resources [ASX:CAV], Chalice Mining, Kairos Minerals [ASX:KAI], New Age Exploration [ASX:NAE], Predictive Discovery [ASX:PDI], Resource & Energy Group [ASX:REZ], Surefire Resources [ASX:SRN], Thomson Resources [ASX:TMZ], Tesoro Gold [ASX:TSO] and West Wits Mining [ASX:WWI].

Impressive, isn’t it?

While there can never be any guarantees in this highly speculative sector, it is my hope that you could enjoy similar returns going forward!

So, how do you go about pursuing the companies that can deliver this type of success?

Well, truth be told, no trader can honestly get in at the bottom and sell at the top. Nobody can know for certain when the next bull market will truly take off. And individual companies reach their highs and lows at different times. Those who trade purely on price and momentum signals could get shaken out.

It is difficult to resist the temptation of following the crowd in this space. This is why I contend that it is more important to understand the underlying value of an explorer and the ongoing development of the business if you want to increase your chance of success.

Let us look at how we do this…

Stock selection

Over time as I delved deeper in the speculative gold stocks space, I found that there were several common characteristics that the successful companies embodied. Let me list them out for you:

- Excellent drill results. This is based on the length and grade of gold, silver, or other metals. I will provide more details about this later.

- Project development potential. Investors want to buy a company that has achieved key milestones or are set to release news of such. These milestones are noteworthy and will attract investors to buy the company, pushing the price up afterwards.

- Adequate cash balance. Explorers and early-stage developers are not generating revenues. Instead, they rely on occasionally selling new shares or borrowing to fund their projects. However, this will dilute their shareholdings and increasing their chance of defaulting if they have debt. Those with more cash are therefore more attractive.

- Management quality. Having the right mix of board directors and senior management plays a significant part in determining the ongoing success of the company. The right leaders will create a productive work culture and seek the right opportunities to help the company progress and deliver profit.

To successfully invest with gold explorers requires you to pick the right companies. But this is only part of the work you need to do to succeed. The other is to have the right mindset. This is because these companies are volatile, and emotions, rather than fundamentals, play a bigger role in influencing the share price.

Let me talk about how to apply a long-term investing strategy to maximise your chances of success.

The ‘three arrow strategy’

When you find a company that you believe satisfies the criteria listed above and you want to buy into the business, you could go about this by adopting a strategy that I will call the ‘three arrow strategy’.

The way it works is to recognise that you should never expect or attempt to buy at the bottom and sell at the top.

It is a tall, almost impossible, order.

Rather, you should consider how much you are willing to risk buying into the company. Then split this amount into three equal payments.

You make your first purchase, or firing your first arrow, then monitor the company for any confirmed developments and setbacks. These milestones help estimate company’s approximate value as time passes.

Now the company may deliver a major milestone. This includes buying/selling existing assets, announcing the resources and reserves upgrades in their properties, developing or using new technology, or buying mining equipment to enhance mining efficiency or output. You may review the prevailing share price and find that it is below the value that you expect it should be worth. Should that be the case, you could fire your second arrow. This is a purchase based on increased conviction that the company could deliver in the future. If you are lucky, you may even make your second purchase for less than what you paid for in your first purchase. This dollar cost averaging technique is a legitimate form of managing your portfolio’s risk exposure.

There may be times when you make a purchase and the gold price cycle turns against the mining companies, causing prices to drop significantly regardless of the progress of individual companies. In such cases, this may lead to many of these companies trading at a deep discount, offering you significant opportunities ahead of a recovery. You may therefore fire your third arrow, this purchase reflecting an opportunistic move arising from weak market sentiment. Typically, we will look for cases where the share price has fallen by more than 40% before we assess whether to make this purchase.

Note that the ‘three arrow strategy’ is by no means a fail-safe. We have to adapt to changing conditions and account for your personal risk tolerance.

Two recommendations to help you build a speculative gold stocks portfolio

Now that I have explored the potential benefits of investing in early-stage gold explorers and developers, and the strategy and mindset to help you succeed, it is time to get started on building a speculative gold stocks portfolio.

I have found two companies that I believe satisfy the above criteria for a good explorer or developer. They are positioned just before the two stages of the Lassonde Curve that offers the most attractive prospects.

The rest of this report, including the two speculative gold stock recommendations, is only available to Premium members of Brian’s gold investment service The Australian Gold Report. If you’re interested in joining today, you can do so here.

Regards,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments