Woolworths Group [ASX:WOW] chief executive Brad Banducci announced his retirement today as the company reported mixed half-year results.

The move comes while the company is under intense scrutiny over rising prices amidst a growing cost of living crisis.

Banducci, who has led the company for over eight years, will step down in September, marking the end of an era for Woolworths.

His departure is set against a backdrop of public discontent and a viral moment of controversy, highlighting the pressures facing the retail giant.

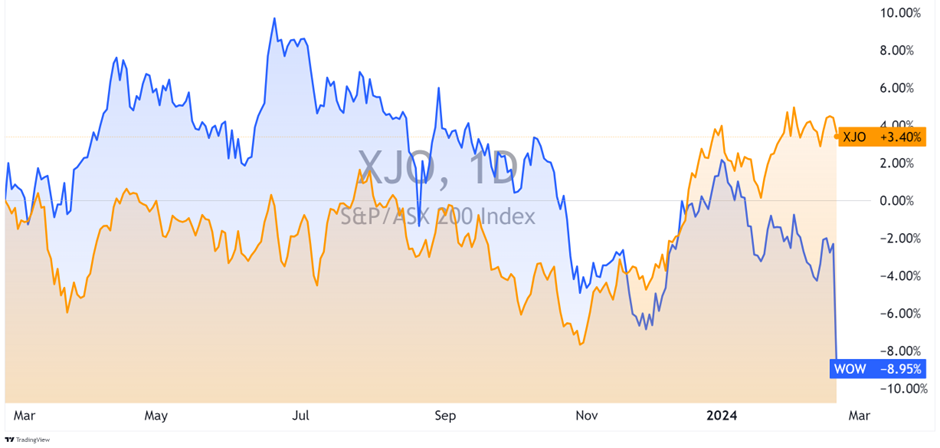

The announcement was made alongside Woolworths’ disclosure of a softening sales growth forecast, causing its shares to plummet by as much as 9.1% in early trading.

Woolworths shares closed down by 6.61%, trading at $33.50 per share. That has put Australia’s largest retailer down by 8.77% in the past 12 months.

Source: TradingView

Mixed half-year results

Today’s drop marks the most significant intraday decline for the company in more than two years, underlining investor concerns over the company’s near-term prospects.

The headline shocker for the company was a net loss of $781 million for 1H24.

Much of this was driven by a $1.5 billion write-down of its NZ grocery business, Foodland, and ASX-listed Endeavour [ASX:EDV], which owns BWS and Dan Murphy’s bottle shops.

Endeavour has struggled as the cost of living crisis has hit its hotel bookings and alcohol revenues.

WOW’s stake in Endeavour’s was written down by $209 million for the half.

Excluding these one-offs, Woolworths pulled in a 2.5% rise in half-year profits to $929 million.

The results show its Australian food sales increased by 5.4% in the first half, and pre-tax profits increased by 9.9%.

EBIT margins also increased for their flagship business, rising to 6% from their prior 5.8%.

For many, these results were at the heart of recent accusations of price gouging.

The competition watchdog ACCC is currently investigating the pricing practices of Woolworths and Coles [ASX:COL], which is expected to conclude early next year.

But for many, the supermarkets have already failed the ‘pub test’, and prices appear to be out of line with inflation expectations.

Today, the Australian Council of Trade Unions echoed those sentiments, saying, ‘Woolworths’ profits show they have far too much power.’

Mr Banducci’s recent interview with current affairs program Four Corners was enough to stir up the conversation again.

The moment in question can be seen here. Woolworths has said that his resignation was not connected to the interview, but questions remain.

Outlook for Woolworths

Banducci’s resignation was unexpected for many. He leaves in a similar vein to Qantas’ Alan Joyce.

After bringing the company to record profits, these CEOs exit with public perceptions in tatters.

The company faces a Senate inquiry next month over its pricing practices, a situation exacerbated by the video.

Taking the helm from Banducci is Amanda Bardwell, a Woolworths veteran of 23 years, who will become the first female CEO in the company’s century-long history.

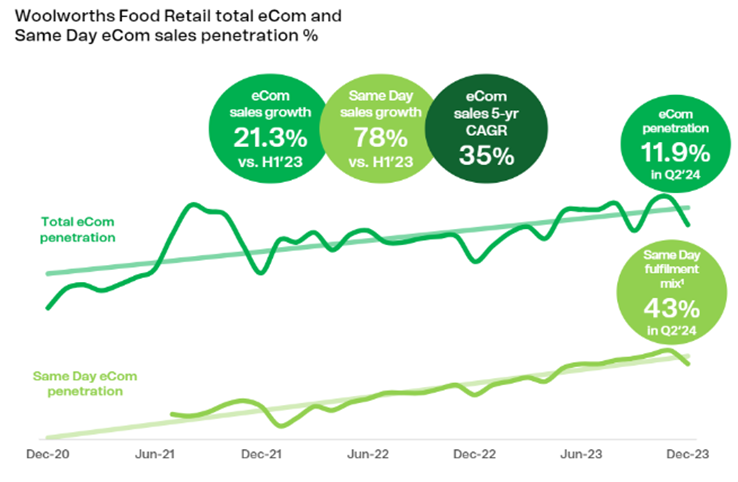

Bardwell, currently leading the retailer’s loyalty and e-commerce divisions, has undoubtedly done her time at the company.

But as a rookie CEO taking the helm at the company’s most turbulent time in decades, it will certainly be a challenge.

Investors today show they are concerned about the scale of the issue, and I don’t blame them.

Potential ACCC fines aside, the company will likely have to spend to return itself to the public’s good graces.

For now, much of their investment has been geared towards the hotly contested online e-commerce space.

Source: Woolworths

Their scale and investment in online shopping have been crucial to their success but have also led to scrutiny over their market power and pricing tactics.

As Bardwell prepares to take over, Woolworths’ key focus will likely be addressing public and regulatory concerns over pricing and restoring strained supplier relationships.

The transition offers an opportunity for renewal, but it’s a tall order for a new CEO to rebuild trust with consumers after such a bumpy exit.

Golden opportunity opens tomorrow

As interest rates inevitably come down this year, bonds and other investments become less appealing to investors— but then what wins? Gold.

When bonds lose their favour in the markets, the thing that naturally rises in their stead is the world’s oldest currency.

But it’s not just bonds that shift the tide to gold; unemployment levels are rising worldwide.

When economies are under pressure and jobs are thinning, Central Banks cut interest rates to spur action.

But before that point, gold takes off as people search for safety.

That’s where we think we’re headed.

But before we get there, we have found an incredible window into some of Australia’s best gold mining stocks.

To find out more and learn how you can get access to this free online event, click here.

Make sure you don’t miss this golden opportunity.

Regards,

Charlie Ormond

For Fat Tail Daily