BNPL provider Sezzle has partnered with Market America Worldwide, owner of e-commerce site SHOP.COM.

Early trade saw Sezzle Inc [ASX:SZL] share price rise as much as 6.3%, before settling to trade at $8.86 a share at time of writing — up 3%.

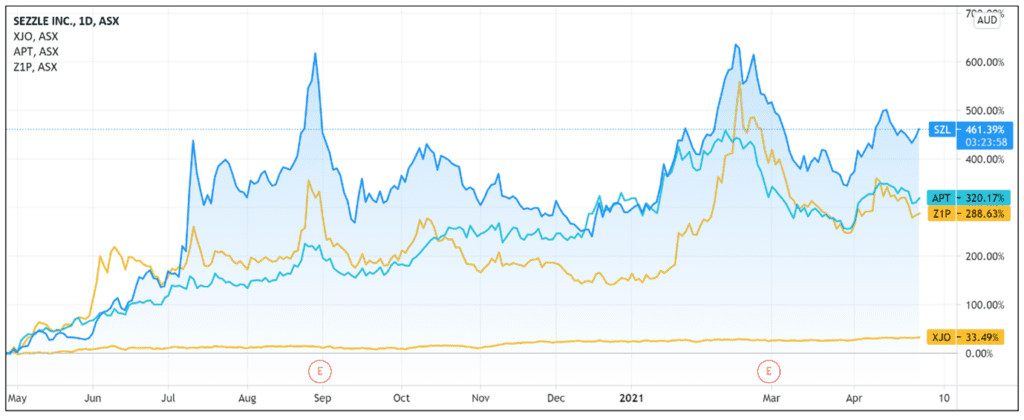

Although this year’s earlier uncertainties regarding inflation and bond yields led to a tech sell-off, ASX ‘buy now, pay later’ (BNPL) providers included, the longer-term trend is still positive for BNPL players.

Year to date, SZL shares are up 43%, and up 450% over the last 12 months.

Sezzle and Market America Worldwide partner up

Sezzle today announced its partnership with Market America Worldwide, owner of global e-commerce site SHOP.COM.

Market America Worldwide is a global product brokerage and internet marketing firm focused on one-to-one marketing.

Its primary shopping website, SHOP.COM, grants consumers access to ‘millions of products including Market America Worldwide exclusive brands and thousands of top retail brands.’

According to Sezzle’s release, SHOP.COM was ranked 19th in Newsweek’s Best US Online Shops for 2021, and 79th in Digital Commerce 360’s Top 500 and Top 1,000 Global Online Retailers for 2021.

Sezzle CEO Charlie Youakim commented that the partnership ‘opens the door for millions of shoppers to access Sezzle’s barrier-breaking, next generation of payments.’

SHOP.COM reports that it currently operates in eight countries with sales ‘annualising at $1 billion.’

Market America Worldwide President and COO Marc Ashley thought the ‘fact that Sezzle approves 9 out of 10 consumers for purchase and is routinely voted the best shopping experience and most trusted by consumers made our decision to partner with Sezzle a no-brainer.’

Sezzle’s platform will be available to all US consumers through SHOP.COM and to all US UnFranchise Owners through the UnFranchise.com website ‘beginning early summer 2021’.

The BNPL provider plans to make its platform available to online shoppers on Market America Worldwide’s additional e-commerce websites ‘over time’.

Outlook for Sezzle

As I’ve covered earlier, BNPL partnership announcements are now par for the course as the sector goes mainstream.

Global recognition of the BNPL option means major partnership announcements are more of an expectation than a happy surprise for investors these days.

That said, the market did bid up SZL shares as much as 6% on the news.

Are investors anticipating a large upside for Sezzle with its SHOP.COM partnership?

Investors may have been encouraged by Sezzle adding a major e-commerce player to its US merchant base, especially when the US looks to become the biggest BNPL market worldwide.

For instance, Afterpay Ltd [ASX:APT] counted 9.3 million US active customers as of 31 March 2021, compared to 3.5 million Australian and New Zealand customers.

The US became Afterpay’s first region to record more than $1 billion in underlying sales in a single month.

The US market is so lucrative that APT flagged it is considering listing in the US.

Not to mention that Zip Co Ltd’s [ASX:Z1P] US subsidiary Quadpay gained 674,000 new customers in Q3 FY21, up 153% year-on-year.

Zip now has 46% more customers in the US than its 2.6 million in Australia.

In today’s release, SZL noted that ‘offering Sezzle leads to higher conversions, sales and larger baskets.’

Investors will likely be hoping that with more major merchant partnerships like today’s, the higher conversions and larger baskets lead Sezzle to larger transaction volumes and revenue.

If you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, then definitely read our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning