At the time of writing, the Sezzle Inc [ASX:SZL] share price is up 3.85% to trade at $6.74 per share.

The SZL share price pushed as high as $7.17 in early trading today, on the news of a new deal.

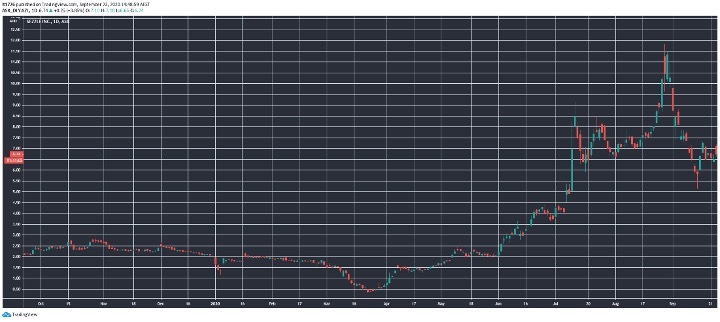

Sezzle shares went ballistic between the start of June and late August, as you can see below:

Source: Tradingview.com

The deal with Ally Lending is a positive, but details in the announcement were sparse.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

SZL share price gets a small boost from deal

Here are the key passages from the deal with Ally Lending:

‘The partnership between Ally Lending and Sezzle will give Sezzle merchants and shoppers access to long term financing options, complimenting Sezzle’s existing short-term, interest-free offering, without adding any balance sheet impact to Sezzle.’

And this:

‘Ally Lending enables monthly fixed-rate installment-loan products that extend up to 60 months in length and US$40k per installment plan through a fully digital application process.’

So potentially much more manoeuvring room for Sezzle users is on the cards.

Many fintech companies like Afterpay Ltd [ASX:APT] built their empires on lots of small, frequent transactions.

The next logical step is to further encroach on the territory of the big banks with larger sized purchases.

If the trend continues, you could reasonably expect more pressure on credit issuers to lower rates, and even some regulatory wrangling on how to regulate this change.

Outlook for SZL share price

BNPL stocks on the ASX are slowing down after an immense run-up, along with the tech-driven gains on the S&P 500.

With the S&P 500, the dip can be attributed to increasingly lofty valuations — but perhaps more so, the uncertainty around the upcoming US election.

SZL announced on 31 August that they were operating cash flow positive — US$2.5 million.

By most companies’ metrics, this is not much.

But as always, with BNPL shares the growth is what drives the hype.

You can catch what I said about BNPL stocks including Sezzle, and risk-management on these types of investments, below:

Regards,

Lachlann Tierney,

For Money Morning

Comments