The Sezzle Inc [ASX:SZL] share price is up 20% today following a three-year BNPL agreement with Target Corporation.

SZL shares are on a tear today, exchanging hands for $9.05, up 20.7%.

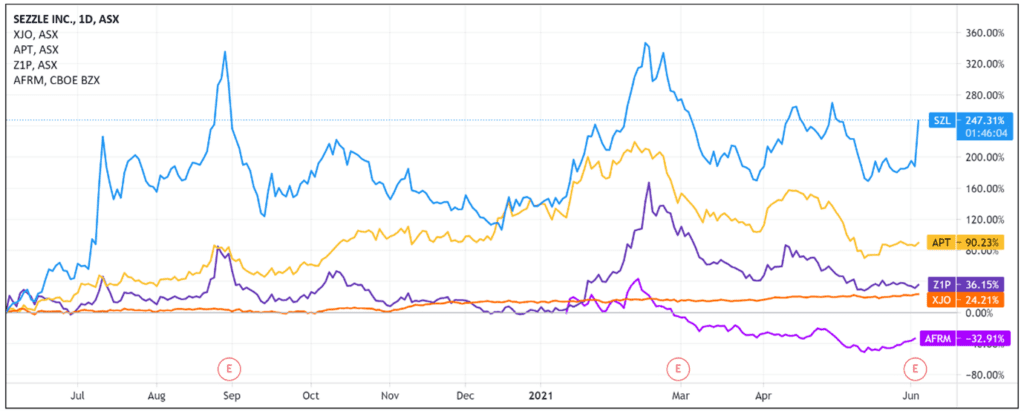

Sezzle’s gains today reflect the BNPL’s strong performance this year relative to its big rivals Afterpay Ltd [ASX:APT] and Zip Co Ltd [ASX:Z1P].

SZL shares are up 220% over the last 12 months, compared with 80% for Afterpay and 11% for Zip.

Sezzle and Target partner up

Sezzle has entered a three-year agreement with the US-based retailer Target Corp [NYSE:TGT].

The agreement comes after Sezzle concluded its proof of concept with Target, showcasing the BNPL features of its payment product.

The deal will allow Sezzle’s product to be used in-store and across Target’s digital platforms.

Target’s customers can now access interest-free instalment payment plans when making purchases.

As we’ve reported, today’s news follows Sezzle partnering with Market America Worldwide, owner of global e-commerce site SHOP.COM, this April.

Market America Worldwide is a global product brokerage and internet marketing firm focused on one-to-one marketing.

SZL Share Price ASX outlook

As we’ve covered previously, there was a time when BNPL providers partnering with major retailers was widely reported and highlighted by the market.

But the maturation of the BNPL sector blunted the excitement.

When APT teamed up with JB Hi-Fi Ltd [ASX: JBH] in April, it revealed the partnership in a media release on its Newsroom webpage — not through an ASX release.

The adoption of BNPL by merchants used to signify the legitimisation of this new payment method. Still, adoption is now widespread enough that merchants large and small partnering with BNPL providers isn’t that novel.

So why are investors bidding up Sezzle shares by 20% today?

One possible reason is Target’s significant retail presence in the lucrative US market.

BNPL investors will be aware of the rapid growth recorded by Afterpay and Zip’s Quadpay in the US market.

Afterpay counted 9.3 million US active customers as of 31 March 2021, compared to 3.5 million Australian and New Zealand customers.

The US became Afterpay’s first region to record more than $1 billion in underlying sales in a single month.

And Z1P’s US subsidiary Quadpay gained 674,000 new customers in Q3 FY21, up 153% year-on-year.

So the market may be thinking that securing agreements with big retail players in a market like the US can accelerate Sezzle’s key growth metrics.

Another possible reason lies with Target’s sales.

Target’s total 2020 sales came to US$92.4 billion.

For the full-year 2020, Sezzle processed US$856.4 million in merchant sales.

Bullish investors will see a huge potential for Sezzle to expand underlying merchant sales just from the Target partnership alone.

As a business thought experiment, if Sezzle were to process just 1% of Target’s FY2020 sales, it would end up processing US$924 million in underlying merchant sales.

This would be more than what SZL processed in its full-year 2020.

So that could explain the enthusiastic price action for Sezzle shares today.

If you’re interested in the changing payments landscape and are wondering if there are other fintech investing opportunities apart from the saturated BNPL space, then read our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here