Buy-now pay-later platform Sezzle (ASX:SZL) has released its June quarter results as BNPL stocks take a breather on Friday.

Yesterday OpenPay (ASX:OPY) released its June Quarter results and soared 35% in late afternoon trade, and this morning it was Sezzle’s turn to present the quarterly figures. Take a closer look in Money Morning.

Sezzle has been one of the best performning stocks on the ASX this month, with SZL shares up more than 250%.

www.tradingview.com

Sezzle’s Quarterly Activities

It was looking dicey as Sezzle and Zip (ASX:ZIP) terminated their merger agreement, But a sudden rally in BNPL stocks has seen both Sezzle and Zip double in value in a matter of weeks.

Today, Sezzle also released its June quarter results.

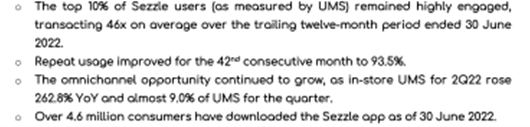

The BNPL company reported an increase of 1.9% year-on-year for Underlying Merchant Sales (UMS), a total of US$419.1 million.

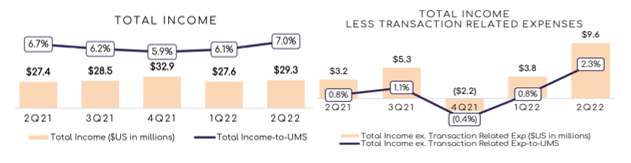

For the second quarter there was an increase of 6.8% total income growth, US$29.3 million which represents 7.0% UMS.

Merchant Fee Income also represented 80% of the group’s total income, however uncollectible accounts declined 1.9% in the second quarter of 2022 from the 3.4% reported the same time last year.

There as an 18.2% increase year-on-year of active consumers, which is now at 3.4 million:

Source: Market Index

UMS went up 52.9% year-on-year. Active consumers increased 68.2%. Active merchants leapt 58.0% in Canada.

June saw the launch of Sezzle’s premium subscription-run service, and as at 27 July, SZL calculated an excess of 47,000 subscribers.

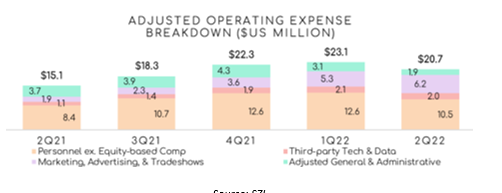

Sezzle expects US$40.0 million in expected annualised revenue on the back of cost-saver and cash flow strategies — which SZL hopes will be boosted by actions including improved card networks, reducing its workforce pulling back from the EU, Brazil and India.

SZL’s CEO, Charlie Youakim, said:

‘In the last few months, we have launched US$40.0 million worth of revenue and cost savings initiatives, as we move towards profitability and positive free cash flow generation, and we believe the results of those actions are starting to show.

‘We expect to see the full benefit of these initiatives on a run-rate basis by year end, and coupled with additional actions we are taking, we anticipate achieving positive monthly net operating income (excluding stock-based compensation and non-recurring charges) by year end. We recognize these initiatives may be at the expense of growth, but believe it is the prudent move for Sezzle at this time.’

Source: SZL

Sezzle, the great BNPL discombobulation and EVs

Sezzle expects an annual revenue improvement of US$40 million with at least US$17 million in annual cash-cost savings.

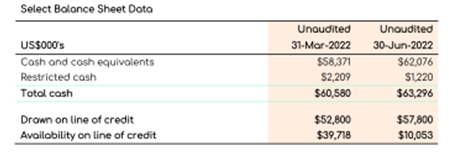

As at 30 June 2022, Sezzle’s total cash totalled US$63.3 million (unaudited) — US$62.1 million in the bank, and US$1.2 million of restricted cash.

However, Sezzle also said staff costs and benefits increased, as did marketing, admin, corporate expenses, and interest rates continue to rise.

Source: SZL

Customer receipts for the quarter totalled US$420.9 million, with Sezzle ending the quarter with operating cash outflows of US$1.7 million. SZL said:

‘Total cash on hand increased US$2.7 million during the second quarter, driven by net cash from financing activities of US$5.3 million, which was partially offset by net cash used in operating activities of US$1.7 million.’

Source: SZL

While the market makes sense of the great BNPL rally, which is ultimately sentiment-driven, the lithium-ion battery market is really ramping up.

The electric vehicle (EV) market is set to expand, especially with government initiatives and funding programs supporting production.

Joe Biden has been publicly campaigning a production boost in the US, while the EU chases its own targets by 2035.

But our energy expert, Selva Freigedo, says the global transition to EVs means the industry faces a supply crunch, sending battery materials into a new type of frenzy.

Access Selva’s battery tech metals report here, for free.

Regards,

Kiryll Prakapenka