When something goes wrong at the circus, they bring in the clowns to distract the audience.

Perhaps that’s what last week’s US Presidential debate was all about?

It reminded me of an old South Park episode where the election was between a giant douche and a turd sandwich!

To have these two clowns trotted out as contenders for president suggests there’s a lot to distract us from.

And it’s no wonder my colleague Greg Canavan thinks we’re in for a ‘Decade of Decimation’.

While that sounds bad, it also throws up some interesting angles to invest in. If you can see what’s coming first.

You can read his thesis and get his entire investment playbook right here.

How bad could it get?

For starters, there’s this…

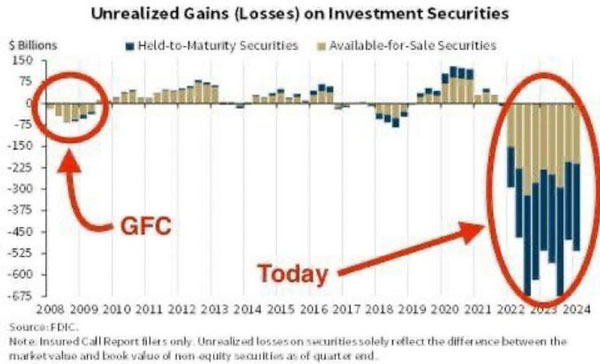

Seven times worse than the GFC

(but no one is worried yet)

Today, US banks are sitting on unrealised losses seven times greater than those during the GFC:

| |

| Source: FDIC |

These losses have accumulated from holding US Treasuries, the US government’s ‘safe, pristine’ debt in a rising interest rate environment.

The only thing that stopped the US banking industry from collapsing this past year was a new Federal Reserve facility called ‘The Bank Term Financing Program’ (BTFP).

But here’s the thing…

The BTFP was discontinued on March 11 2024.

And there are now signs that the banking industry is set for a renewed period of turmoil.

As reported:

‘U.S. banking industry is grappling with increasing insolvency issues, as highlighted in the latest quarterly report from the Federal Deposit Insurance Corporation (FDIC).

‘In the first quarter of 2024, 63 banks were preparing for bankruptcy, up from 52 in the same period the previous year. This troubling trend signals a worsening situation for the sector.’

My bet is that the money printers at the Fed will be ready to whirl at the first whiff of contagion.

And if that happens Bitcoin [BTC] could surge.

The US isn’t the only country with big money problems.

In Japan, the currency is in freefall with the Japanese Yen hitting 38-year lows last week.

Their central bank looks set to intervene soon and it’ll be the second intervention in just one month if they do.

Back in Australia, we’re still dealing with the consequences of the covid era splurges.

Inflation numbers surprised to the upside last week.

Many analysts are now predicting the next move from the RBA will be up.

Income tax cuts due to kick in this month may soften the blow, but they might also stoke more inflation.

Which could lead to more rate rises!

Oh, and the Julian Assange saga was finally resolved, too…

What a week!

With all this drama playing out, you might expect markets to be under pressure.

Apparently not…

The US, Japanese, and Aussie markets are all UP for the month.

And the VIX index, which measures market volatility, is sitting near five-year lows:

| |

| Source: Yahoo! |

In short, no one is worried yet.

Maybe that’ll turn out to be a bad move or maybe the market knows there’s always some drama in the background. But most of the time, markets do alright regardless.

It makes you wonder if there’s any real point in paying too much attention to all this ‘big picture’ stuff.

It’s interesting, yes.

But is it useful in telling you what stocks to own?

Probably not.

In fact, investing-wise, the most useful piece of data I came across last week involved 75 burrito bowls.

Let me explain…

Not all super heroes wear capes

Hats off to the Wells Fargo analyst who recently ordered the same burrito bowl 75 times, at eight different Chipotles across New York.

He wanted to make a point about portion size inconsistency.

He even charted it!

| |

| Source: Well Fargo |

What’s next?

Counting the number of chips in a Happy Meal?

But it reminded me of an important point about investing.

The truth is, that you have to think outside the square to find a real investing edge.

A young Warren Buffett once famously counted rail cars one summer to get a handle on industrial activity.

Luckily, not all research requires such devotion (or calories).

Just pay attention to what’s happening around you.

For example, while driving with the wife and kids this weekend, I noticed someone getting an Uber Eats delivery.

Nothing weird about that, you might think.

But it was 9.30am on a Sunday morning.

Who’s getting takeaway then?!?!

This all got me thinking about how much Uber had changed the game for food deliveries.

It wasn’t just a replacement for delivery drivers. It was changing people’s eating habits too.

And it has so much brand strength, it has become a verb – like Google did.

You don’t order a takeout these days; you ‘Uber’ it.

Anyway, mulling over this, I checked out the share price chart for Uber later that day:

| |

| Source: Yahoo! Finance |

Up 68% in just one year.

Not bad!

Funnily enough, the stock price slumped in May after a disappointing earnings release.

However, the company blamed this on a write-down of company investments, not operational performance.

With the stock now bouncing back 10% and now above US$72, it seems that the earnings dip in May was a dip to buy.

My point today is…

A starting point for good ideas

I’ve no idea if Chipotle is a bad stock to own based on the standard deviation in burrito bowl size.

And I’ve no idea if all the stuff I just said about Uber is already priced in or not.

But I think it is useful information to gather. To both spur ideas and direct your research.

Remember, stocks are more than numbers on a screen. They represent real businesses with real customers and real products.

So perhaps rather than the daily headlines, you’d be better noticing the world around you more often.

Take note of what shops are busy and empty. See what your kids are doing in their spare time. Notice how any of your own habits – at home or work – are changing.

With a bit of luck, you might find a great stock at the end of it.

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments