Seven Group, led by billionaire Kerry Stokes and his family, has launched a bid to acquire the remaining 28.4% of Boral [ASX:BLD].

Boral operates over 300 industrial sites nationwide, producing concrete, cement, asphalt, and quarrying stone. They also recycle construction and demolition waste.

The move aims to bring the building materials company under complete control of the diversified industrial group Seven.

The offer involves a combination of cash and scrip, with an initial price of $6.05 per share. This could potentially increase to $6.25 depending on the number of minority shareholders who accept the offer.

Shares in Boral are up by 4.72%, trading at $6.11 per share as investors hope to skim a premium from the offer.

Boral’s shares are up by 58.8% in the past 12 months as it successfully turned from significant losses during the pandemic to a ‘home focus’.

This involved Boral selling off its $4 billion American assets to focus on its Australian construction roots.

So what would the deal mean for the company moving forward?

Source: TradingView

Simplifying the portfolio

Seven Group, which already owns 71.6% of Boral, believes that fully integrating the company aligns with its strategic vision.

Ryan Stokes, chairman of both Boral and Seven Group, described the offer as ‘a natural evolution’ and emphasised its finality.

The deal was firmly offered as a ‘best and final‘ bid, with no chance of a higher offer.

The bid involves a $6.05 per share price, potentially increasing to $6.25 based on acceptance levels.

The structure combines cash and Seven Group shares (scrip). The reasoning behind the offer is to simplify Seven Group’s portfolio and fully integrate Boral’s operations.

Seven Group is owned mainly by The Stokes family, which holds approximately 57% of the industrial group.

Seven owns significant chunks of Seven West Media, Westrac, Coates Hire, and Beach Energy [ASX:BPT] .

Analysts at Evans and Partners said the acquisition came as a ‘surprise’ given the group’s decision last year to sell a 1% stake at $4.90 after it claimed the company had reached full value.

In a note, Evans’ analysts said:

‘Despite the short-term dilution to our [earnings per share] forecasts, we suspect the move reflects management’s view that the upside to Boral’s earnings is much more than the market has assumed.’

Boral’s board committee is reviewing the offer, and shareholders are advised to wait for further information before making any decisions.

If the offer falls through, Seven will seek to delist Boral and change its board to favourable members who would pursue a capital management approach that aligns with them, seven said.

Earlier this month, Boral upgraded its FY24 underlying earnings forecast to $330–350 million and pleased investors with a 51.8% increase in EBITDA for 1H24.

Outlook for Boral

The offer values the remaining Boral stake at around $1.9 billion. An independent expert will assess the fairness of the offer for Boral shareholders, but on first pass, the deal looks fair.

However, the potential impact on Boral’s dividend payout remains a point of discussion.

Investors will be carefully watching Boral’s independent board committee, which will carefully evaluate the offer.

For now, shareholders have been told to take no action and await a response around mid-March.

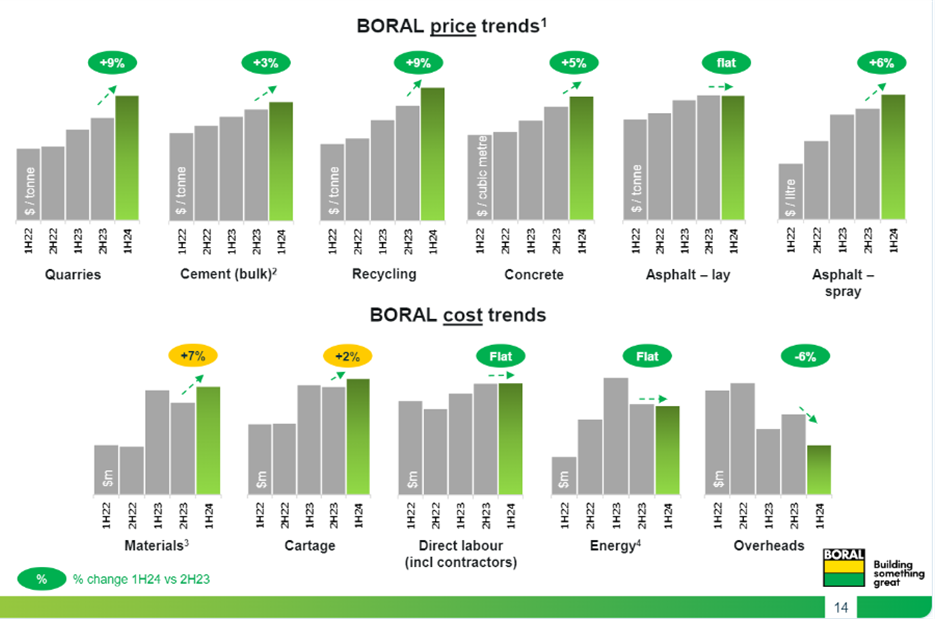

For Boral, it seems the inflationary pains that afflicted them post-pandemic have subsided.

Cost pressures that had previously outstripped price trends have now reversed to benefit the company.

Source: Boral Investor Presentation 09/02/24

For the second half of this financial year, the company said it expects volumes to remain largely unchanged.

Therefore, Boral will focus on ‘maintaining [ing] strong discipline on price and cost‘. Moving into an eventual falling interest rate environment should also be positive for building material demands.

Lower interest rates will also help the company’s debts, although much of this hangs on the books as US bond notes.

The company has made good progress in reducing its debt in the past 12 months, with its gearing ratio dropping from 14.3% to 3.8% from June to December 2023.

Overall, the company’s simplification strategy seems to be paying dividends for a company that has returned to its roots.

Golden opportunity

It’s not just large building companies that will benefit from a falling interest rate environment.

As interest rates inevitably come down this year, bonds and other investments become less appealing to investors— but then what wins? Gold.

When bonds lose their favour in the markets, the thing that naturally rises in their stead is the world’s oldest currency.

But it’s not just bonds that shift the tide to gold; unemployment levels are rising worldwide.

When economies are under pressure and jobs are thinning, Central Banks cut interest rates to spur action.

But before that point, gold takes off as people search for safety.

That’s where we think we’re headed.

But before we get there, we have found an incredible window into some of Australia’s best gold mining stocks.

To find out more and learn how you can get access to this free online event, click here.

Make sure you don’t miss this golden opportunity.

Regards,

Charlie Ormond

For Fat Tail Daily