Online employment classifieds group Seek [ASX:SEK] announced continuing operations had turned a 9% increase in profit — yet the overall feeling of the group’s half-year announcement did not seem to match in positivity.

CEO Ian Narev flagged a ‘gradual moderation’ in key labour market indicators, which gave the group a more sober outlook for full fiscal 2023, heading towards the lower end of revenue guidance.

The SEK share price has been trending 12% down over the past 52-week cycle and down around the same against its industry average:

Source: tradingview.com

Seek to settle for lower guidance despite uplift in profit

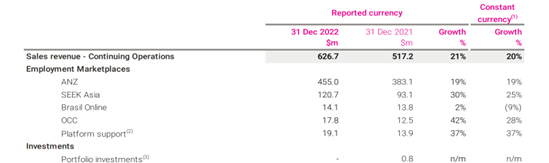

Seek reported an increase of 21% in sales revenue from continued operations for the half-year ending 31 December 2022, with a total of $626.7 million compared with $517.2 million at the same time last year.

EBITDA (earnings before interest tax depreciation and amortisation) had gone up by 13% from $250.6 million to $283.4 million. The group expanded its margins by 51% (a 2% increase from last year).

Overall, the group reported a 9% growth in profit, bringing in $135 million more than the $124.2 million earned in profits by December 2021 — which was partially offset by higher depreciation, amortisation, and net interest expenses.

Seek says its 21% uptick in revenue growth was driven by higher job ad volumes and higher yield from adopting new products and increasing ad prices. However, that momentum is not expected to last.

In terms of expenses, the group posted an increase in operating costs of 29%, including platform unification expenses of $37.3 million.

Most of Seek’s spending went on investing in new products and technology, as well as the infrastructure to support platform growth and push into growing commercial and sales markets in Asia.

Seek declared an interim dividend of 24 cents, fully franked, 1 cent up since the last posting.

Source: SEK

Seek deeper dive and guidance

After $192.5 million cash being put into financing activities and costs attributed to continuing operations, the group ended the half year with $240.7 million in cash and equivalents, down from $325.1 million in June 2022.

The company’s net debt as at 31 December 2022 was $1 billion.

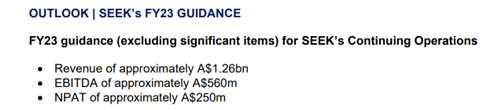

Seek says its FY23 guidance will be towards the lower end of the initial range, impacted by the ongoing volatility in economic conditions, as well as what its CEO Ian Narev described as a ‘gradual moderation in key labour market indicators and our job ad volumes.’

‘Our guidance for revenue for the remainder of this financial year remains within the range we provided in August, albeit towards the lower end of that range. Our EBITDA guidance assumes no change to our investment plans for the remainder of the year, including Platform Unification.’

Source: SEK

Australia is set for some big changes

Australia’s 30 years of abundant, robust trade has broken.

On top of that, global supply chains have changed into completely different systems than what existed years ago.

You may have noticed there’s less on our supermarket shelves and wondered why inflation is so out of control, why the banks are closing branches, and packaging is shrinking (while costing more!).

Clues and signs are everywhere, but everyday Australians don’t know what it all means. Even the media doesn’t know.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots.

He says no one is talking about how the Australian economy as we know it could soon end.

It could happen as soon as within the next 12 months…and it will change the way we all live.

Australia is going to be looking very different very soon.

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime, click here for more.

Regards,

Mahlia Stewart,

For The Daily Reckoning