Green packaging manufacturer Secos Group [ASX:SES] rose as much as 20% on Friday after Coles selected to launch SECOS’s compostable packaging product MyEcoBag across 770 retail stores.

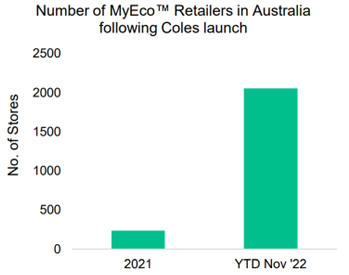

Woolworths already stocks MyEcoBag, with SES saying its MyEco branded products will range across 2,000 retail stores in Australia.

The SES stock is down 45% year to date.

Source: Trading View

Coles to stock SECOS’s compostable bags

Coles is set to launch SECOS’s compostable bags, MyEcoBags, across 770 Coles retail stores.

Secos will be launching a whole new Coles-specific range of its 36L pack and a new 27L pack bag, designed for kitchen foods and garden waste.

Ongoing supply to Coles of the EcoBag product will be subject to meeting certain sales projections, which will be reviewed on an annual basis.

The Coles deal expands SECOS’s retail footprint to 2,000 stores, with Woolworths already stocking the MyEco range.

Secos management commented:

‘In Australia, the wider availability of SECOS’ compostable bags via Coles stores will give more households participating in approved council food organic waste programs the option to dispose of the bags and food waste in their green waste bin…

‘The use of SECOS’ compostable bags offers households a clean and convenient way to assist with the separation of their food waste which is critical to ensure food does not end up in landfills.

‘SECOS continues to develop further opportunities for growth in new markets for its branded MyEcoBag™ and MyEcoPet™ line of products and is working to garner market share in grocery and convenience stores in Australia, the USA, Latin America, and elsewhere.’

Source: SES

SES did not quantify the potential revenue boost of the Coles deal.

However, the manufacturer said its new Malaysian biopolymer plant expanded its manufacturing capacity and can now support annual sales of $25 million.

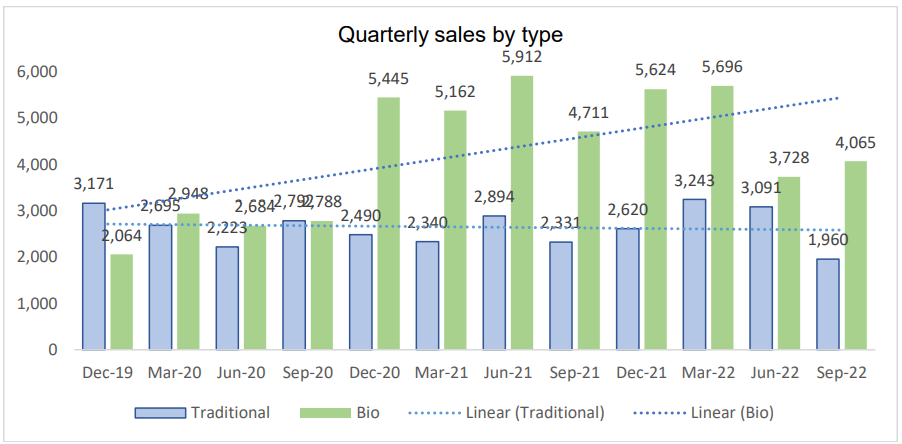

In FY22, SES reported annual revenue growth of 3.2% to $31 million with a net loss of $3 million.

In 1Q23, SECOS reported sales of $6 million, down 14.4% on the previous reporting period, affected by overcrowded distributor inventories.

Commenting on the drop in quarterly revenue, SECOS stated:

‘The global supply chain crisis has resulted in a build-up of inventory and extension of receivables to accommodate the longer lead times to deliver from order to customer. As supply chain and fulfilment timelines have begun to retract, working capital has begun to normalise.’

Source: SECOS

Five bargain stocks

Inflation is hitting many companies quite hard.

Right now, everyone is looking to save a pretty penny where they can.

But its times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what the calls are the ‘best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Kiryll Prakapenka,

For Money Morning