Beaten down A-REIT Scentre Group [ASX:SCG] registered its biggest move in a long time today.

The SCG share price climbed to $3.13 in early trading before settling for a 13.28% rise, to trade at $2.73, at time of writing.

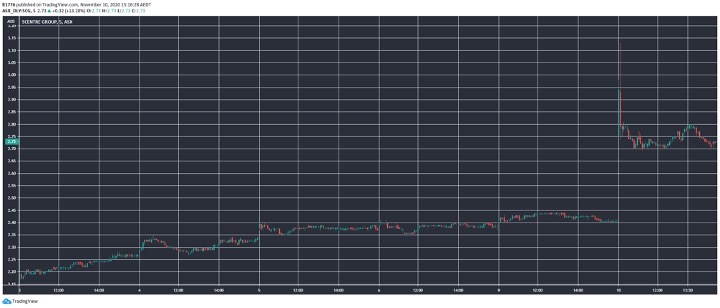

You can see how this played out on the chart below over the last five days:

Source: tradingview.com

With the daily chart for the year telling a more familiar story, we look at whether retail property is once more on the menu for investors.

SCG share price reacted strongly to vaccine news

By now you’ve probably familiarised yourself with the details of the latest vaccine hope to hit the headlines.

A 90% effective vaccine is in the works according to Pfizer Inc [NYSE:PFE].

Which definitely provides a glimmer of hope for retail property.

While its industrial property-focused peer Goodman Group [ASX:GMG] charged up the charts (perhaps a defensive move) over the last six months, the SCG share price languished.

Now the roles are reversed and GMG shed 8% today as SCG gained.

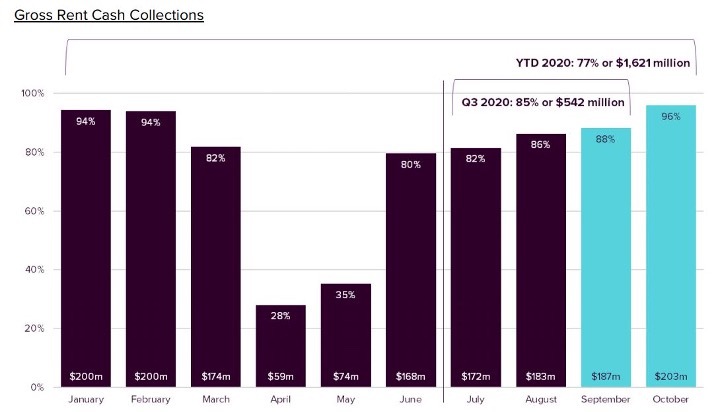

A recent operational update shows the improved rent collections through to October:

Source: marketindex.com.au

Solid figures considering what they were up against in April.

Outlook for SCG share price

Risk remains and if a vaccine hope fades, the move in the SCG share price could reverse sharply.

The remarkable rise of GMG shows how A-REITs can charge up the chart despite their usual slow and steady outlook.

It’s just a theory, but perhaps today some big funds are cycling out of their ‘no-brainer’ GMG position and into a more speculative SCG position, simply because now the ‘flip’ could be on if all goes according to plan.

That being said, retail may never be the same again.

The paltry sub $230 million Myer Holdings Ltd [ASX:MYR] is perhaps evidence of the shift away from brick-and-mortar stores.

Ecommerce is on the rise and we may never engage in the traditional method of retail therapy the way we knew it — by going to the shop.

Which is why you should be aware of these factors in the Australian property market.

It’s all about the ‘Law of Rent’ and the implications may surprise you.

Catherine Cashmore gives you special insight into a property boom that could stretch through to 2026.

Regards,

Lachlann Tierney

For The Daily Reckoning Australia

Comments