Australian lithium darling Sayona Mining [ASX:SYA] has proclaimed its North American Lithium (NAL) operation in Québec, Canada, has already produced 1,200 tonnes of saleable lithium since its restart this month.

The miner said its NAL operation is producing SC6 (6% lithium grade), placing it back on track to become a leader in hard-rock lithium production in North America.

Shares for Sayona were trading around 21 cents each at the time of writing, having dropped slightly in daily trade.

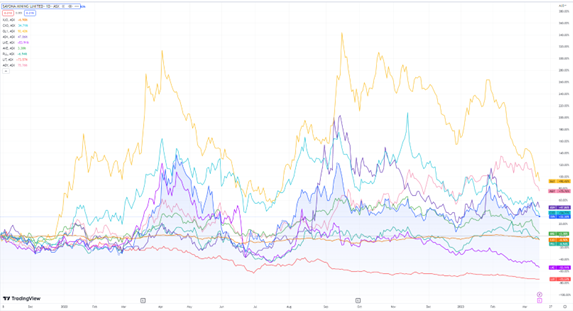

In the year, however, SYA has risen by nearly 29% and remains a highflyer in both its sector and the wider market — underperforming the likes of Global Lithium Resources [ASX:GL1], Argosy Minerals [ASX:AGY], and Anson Resources [ASX:ASN]:

Source: tradingview.com

NAL hits new milestone

Sayona Mining, the emerging Australian lithium concentrate and raw materials producer, has revealed the undertaking of a new milestone by its flagship North American Lithium operation in Québec, Canada.

Around 1,200 tonnes of lithium concentrate have now been produced, which is made up of high-quality SC6 — 6% lithium grade.

Having hit this milestone, the lithium resources miner now continues all the more confidently in arranging commissions, and has been able to more boldly demonstrate Sayona’s ability to produce a commercial concentrate product — especially after its recent successful production of the first lithium concentrate earlier in the month.

Sayona also wished to let its shareholders know that NAL’s restart is still tracking along to schedule and to budget, with the first lithium shipment to sail by July this year.

The dual lithium miner-producer aims for total production to be between 85,000-15,000 tonnes for the first half of the 2024 financial year.

Engineering for the next sub-project, the Crushed Ore Storage Dome, is also progressing well. Sayona revealed that certain engineering targets underwent some acceleration strategies.

Brett Lynch, Sayona’s Managing Director, said:

‘Congratulations to the whole team at NAL for delivering yet another milestone on time and within budget. Having witnessed firsthand the operation’s restart I can only express admiration for this achievement, which demonstrates we have the experience and expertise to run a successful operation.

As the electrification revolution continues, Québec is in pole position thanks to its sustainable hydropower, leading infrastructure and proximity to market. For Sayona, the opportunity is only getting bigger and we are proud to play our part as North America’s emerging leading hard rock lithium producer.’

Sayona has a strategic partnership with Piedmont Lithium [ASX:PLL]. The two are working together to deliver materials to the EV supply chain, while Piedmont invests in Sayona’s capital and projects.

Sayona already has offtake deals with Tesla through its partnerships with Piedmont, and more recently, Korean chemical giant LG Chem.

After raising CA$50 million in a recent share raising. SYA plans 50,000 metres of drilling at NAL and Jourdan’s Resources.

Jim Rickards’ ‘Sold Out’ book offer — grab your copy now

Supermarket shelves are bare, with glaring random gaps in place of once readily available items.

Banks are permanently closing more and more branches across towns and suburbs.

Used car prices are rising, and sourcing new ones for speedy delivery is getting harder by the day.

Prices in general are skyrocketing while packaging is shrinking.

Is it all just inflation, COVID ramifications and market volatility, or is there more to the story?

Thing is, these are just some of the seemingly unrelated signs pointing to something bigger.

Mere ‘inconveniences’ are just the start.

Geopolitical expert Jim Rickards has been making very apt, on-point predictions for decades.

And now he’s predicting ensuing financial chaos — yes, more so than there is right now.

He explains it all, offering a unique perspective that should not be ignored, in his book, SOLD OUT: How Broken Supply Chains, Surging Inflation, and Political Instability Will Sink the Global Economy.

You can grab a free copy when you sign up for The Daily Reckoning Australia, also free, right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning