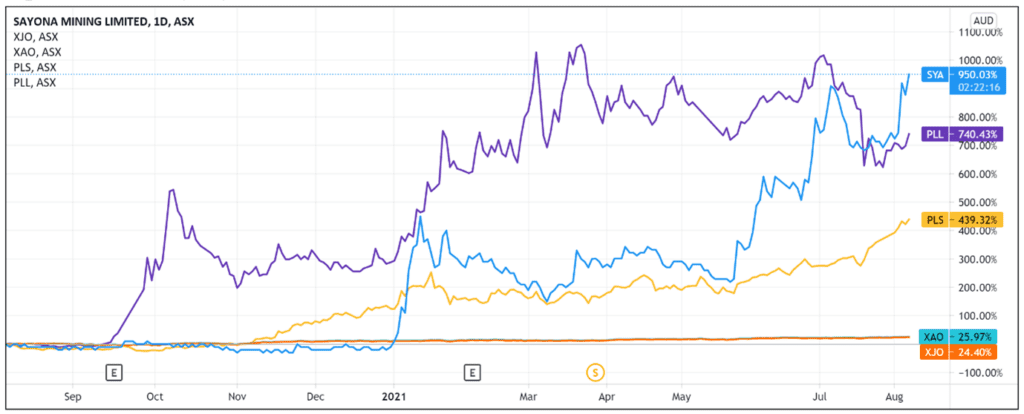

The Sayona Mining Ltd [ASX:SYA] had a strong day in trading today and is up more than 5% at 10 cents per shares, at time of writing.

This comes after the Brisbane-based mining company issued an ASX update this morning revealing a healthy progression of its Western Australian exploration assets.

Sayona Mining focuses on finding and developing raw materials for lithium-ion batteries — an emerging space at the centre of EV (electric vehicle) innovation.

What were the highlights of Sayona’s ASX announcement?

Several key developments indicate that Sayona could be on track to become a key lithium producer internationally.

In response to the rising demand for lithium across the globe, the company’s exploration efforts have ramped up and several operations are in effect as a result.

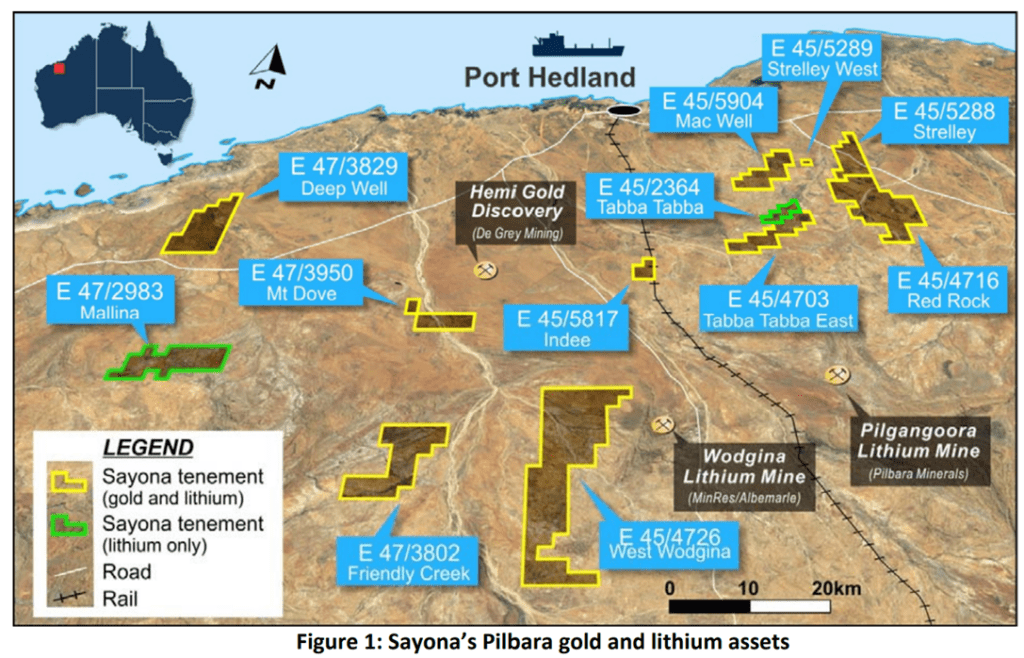

For one, the company’s WA partner (Altura Mining) has completed due diligence on Pilbara lithium projects, and the earn-in period has now commenced.

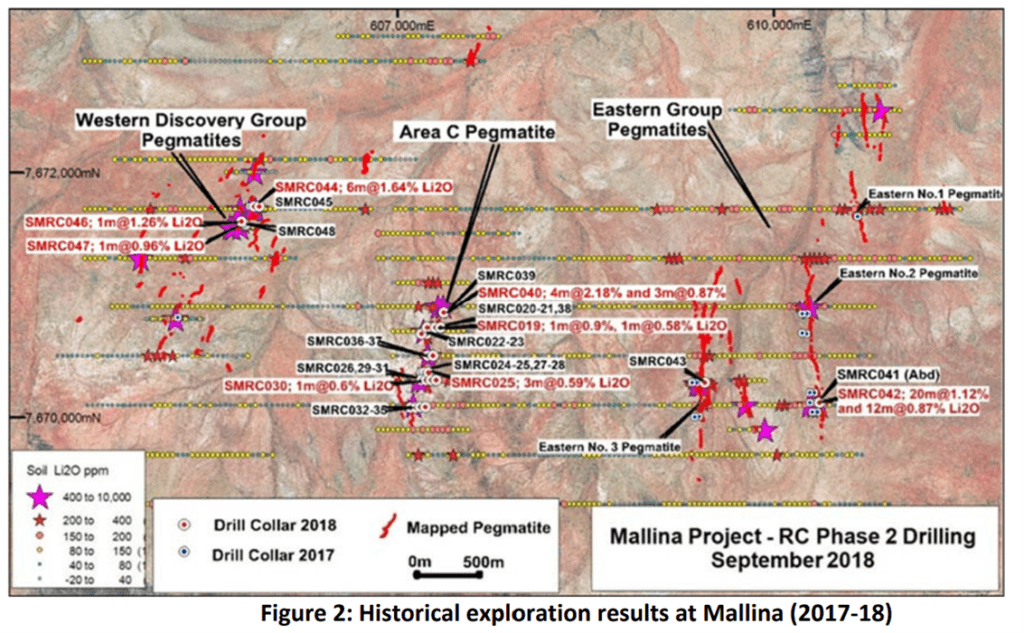

Secondly, it’s been revealed that exploration will now begin at the Mallina Lithium Project.

This milestone holds promise, as previous drilling in this area in 2017 returned intercepts of up to 1–2% Li20 (the chemical compound for lithium).

Further drilling a year later delivered similar results. Here’s a historical summary of this project below:

Sayona’s management has also dangled the carrot that a major presence in both Asia Pacific and North American lithium markets is now in the works.

Prices are rising. Demand is rushing in. And if Sayona’s strategic positioning pays out, shareholders could stand to benefit.

Getting down to the dusty details…

Western Australia is home to the world’s largest spodumene mine, so it’s not surprising that the so-called Wildflower State hosts several lithium companies.

Spodumene is a major mineral source of lithium, and its concentrate in WA has recently been quoted at more than US$1,200 per dry metric tonne.

Analysts predict the price will rise by up to 30% through to 2025.

So what are the terms of Sayona’s earn-in agreement?

As per the 2 June 2021 announcement, Altura will earn a 51% interest on lithium rights across an exploration portfolio of 765 square kilometres in the Pilbara and Murchison regions.

This will be done through a work program on the tenements.

Sayona is retaining 100% of the gold and other non-lithium rights within this area, and its portfolio comprises 12 leases within the world-renowned Pilgangoora lithium district.

SYA’s Western Australian operations are only a portion of the company’s scope worldwide.

In June this year, Sayona also made moves in Quebec, Canada, with a scale-up in several projects underway north of the hemisphere.

Stocks on the forefront of the EV revolution

Experts predict strong growth in the adoption of electrical vehicles over the next 10 years.

The International Energy Agency (IEA) in Paris said in April that the worldwide number of electric cars, vans, heavy trucks, and buses will rise to 145 million by 2030, up from only about 10 million in 2020.

This indicates that any company that is dealing in the lithium space — and making steady progress — could be a contender for what could be one of the hottest investment themes of this decade.

Sayona certainly appears to fit the bill.

But in such a competitive space, how do you choose where to put your money?

As we’ve covered before, lithium producers find themselves in an industry that deals with a commodity. In that sense, lithium stocks are largely price takers.

So long-term success will likely rest in finding competitive differences — whether a higher-grade product or more efficient processing.

But how can you potentially identify companies aiming to develop these competitive advantages?

A good place to start is Money Morning’s free 2021 lithium report, which also goes through three lithium stocks that could rise on renewed interest in the sector.

Regards,

Lachlann Tiernney,

For Money Morning

PS: In addition to your free report on lithium stocks, you’ll also get a free subscription to Money Morning, a daily e-letter that focuses on helping Aussie investors find the most exciting and current investment opportunities available on the ASX. Click here to subscribe.