Junior Lithium producer Sayona Mining [ASX:SYA] announced new lithium discoveries at its Moblan lithium project, ‘strengthening’ its potential.

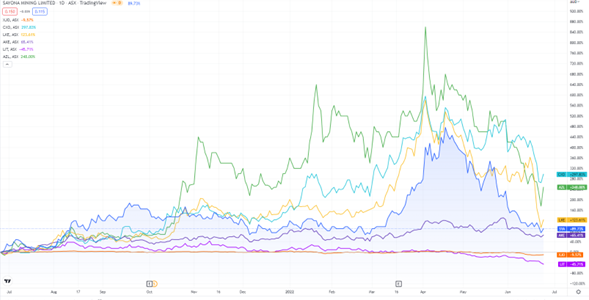

SYA shares were up 12% in late afternoon trade on the news, as lithium stocks continued to rebound:

Lake Resources [ASX:LKE] was up 8%

Core Lithium [ASX:CXO] was up 13%

Liontown Resources [ASX:LTR] was up 9%

Pilbara Minerals [ASX:PLS] was up 5%

Despite the rebound in recent days, ASX lithium stocks are still deep in correction territory.

Sayona is still down 30% in the last month, while LKE is down 13% year to date.

Source: Tradingview.com

Sayona’s new spodumene pegmatite findings

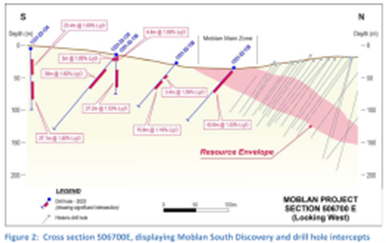

This morning, Sayona revealed that a new lithium spodumene discovery has been made at its Moblan Project site in Québec.

This is a discovery that the miner expects forecasts stronger results for its ongoing Moblan projects, with multiple new mineralised spodumene pegmatites located 200m south of the company’s primary deposit.

Sayona’s winter diamond drill program — which spans 25 holes at 4,683 metres deep — has revealed spodumenes with 2% lithium oxide grading.

The lithium miner reported the pegmatites have developed substantially at greater depths, resulting in a 20,000m deep drilling campaign that is well underway at the Northern Lithium Hub.

The discovery should expand resource yield potential at the North American base, which Sayona owns 60% of, and SOQUEM Inc holds the remaining 40%.

Source: SYA

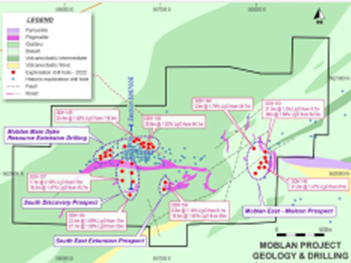

More recently, Sayona found a similar mineralised spodumene discovery at its Main Dyke Moblan lithium project in Moleon.

Sayona said that the results from all Moblan’s project holes in Moleon ‘have been encouraging, identifying more subsaincial mineralisation at depth than recognised at surface’.

Source: SYA

SYA share price outlook: What’s happening with lithium?

SYA’s Managing Director Brett Lynch commented on the new lithium discoveries:

‘These latest results are another boost to our emerging northern lithium hub, demonstrating Moblan’s potential to become a world‐class deposit in a proven lithium region.

‘Moblan adds to our Abitibi lithium hub to the south in giving Sayona a leading lithium resource base in North America, amid continued increases in demand for this key battery metal from the North American EV and battery sector.’

As a lithium developer, growing one’s resource base is important as it can help increase the potential production output and decrease costs as throughput scales.

Now, as EV adoption ramps up, car manufacturers are scrapping a five-decade-long pattern of outsourcing to tighten supply chains by seeking partnerships all along the supply chain to secure supply.

Chief among them is Tesla, seeking deals with several EV battery resource companies, some of which are based here in Australia.

Our small-cap expert Callum Newman believes the rush to secure battery materials isn’t over yet.

In fact, Callum thinks there are ASX stocks flying under the radar who could be the next ‘chosen ones’ — stocks tipped by Tesla to be their battery materials supply partners.

Callum thinks that one of the three battery stocks in his latest report ‘could be one of the most exciting nickel projects in the world. I’m not kidding’.

To find out more, read Callum’s battery materials report, ‘Elon’s Chosen One’, here.

Regards,

Kiryll Prakapenka,

For Money Morning