The company recorded revenue of US$5.9 billion and free cash flow of US$2.7 billion year-to-date.

This update comes a day after both BHP Group [ASX:BHP] and Whitehaven Coal [ASX:WHC] revealed their quarterly results yesterday.

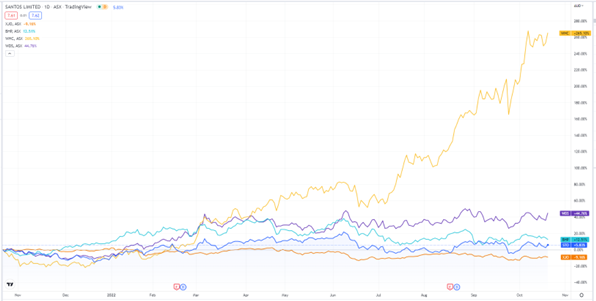

Year to date, Santos shares are up 13%:

www.TradingView.com

Santos’s record quarter

Santos’ CEO, Kevin Gallagher, described the latest quarter as ‘another strong quarter with record sales revenue and free cash flow’.

Santos brought in more than US$1 billion in free cash flow in the September quarter alone, highlighting how elevated energy prices have benefited upstream producers.

Free cash flow for the first nine months of 2022 now totals US$2.7 billion.

Gallagher also said the record quarter was underpinned by the fact that ‘energy security [remains] a top priority for countries in our region’.

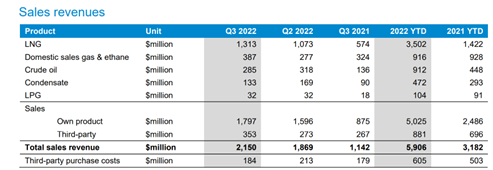

While sales revenue increased 15% quarter on quarter (QoQ) to $2.15 billion, so too did sales volume.

Santos’s Q3 2022 sales volume rose 9% quarter on quarter to 29.9mmboe.

And likewise, production ticked up, rising 2% QoQ to26.1mmboe.

Emphasising the rapidly escalating prices for LNG, STO’s year-to-date sales revenue has risen 86% to US$5.91 billion.

With its rising free cash flows and revenue, Santos was able to reduce gearing to 20.8%.

The company now also has a binding conditional offer to acquire 5% in PNG LNG for US$1.4 billion, adding to its portfolio.

Barossa drilling has been halted by the Federal Court, though Santos asserted that it would be appealing the decision, with the hearing due mid-November.

The company’s Pikka Phase 1 is now underway following a final investment decision, with drilling to begin in Q2 2023.

Santos’ Moomba project is now 25% complete, and Bayu-Undan has achieved FEED and necessary agreements.

Source: STO

What’s STO’s outlook?

Three-month lagging JCC came at the average of US111/bbl, compared with US$86/bbl in Q2 2022.

East coast domestic gas prices also increased due to demand and increasing third-party trading.

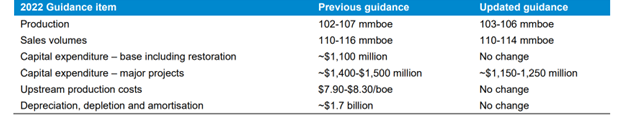

Cooper Basin third-party crude oil volume has been revised and taken out of the equation for sales volumes, however, Santos believes net profit won’t be impacted.

Santos narrowed its production and volume guidance to 103–106 mmboe and 110–114 mmboe, respectively.

STO’s capital expenditure guidance narrowed to a range of $1.15 billion to $1.25 billion, off the back of project timing changes and Barossa drilling suspension.

Source: STO

Five inflation-busting stocks

There has been a growing sense of unease in global markets.

Households and businesses have been squeezed as inflation continues to remain elevated.

Yet, some businesses can deal with inflation better than others.

Just look at the record cash generation by Santos and Whitehaven.

Some stocks, like STO and WHC, can even prove to be ‘inflation busters’ during times like these.

Our team has put together a research report on our five top dividend stocks with the potential to be ‘inflation busters’, despite the current bear market.

Regards,

Kiryll Prakapenka

For The Daily Reckoning Australia