I caught 10 minutes of a talkback radio show on ABC Melbourne on Sunday morning.

They had a financial advisor on air who was giving advice on all things investing.

Most of it was stock standard stuff.

Diversify, invest (don’t trade), make sure your investments match your risk tolerance and timeline, etc.

None of this was bad advice.

But I did take issue with one thing I heard.

When asked about specific investments to buy, the advice was to stick to ‘boring and safe’.

This is a common refrain I hear from the ‘respectable’ mainstream a lot.

Here’s the problem with it…

Far from safe

Let me ask you, what asset is boring and safe?

Well, bonds are supposed to be the most boring and safest of them all.

You lend out your money to a lot of different borrowers (usually through a fund that does it for you) and get a fixed rate of return.

It’s a bit like a term deposit in the bank but with a juicier interest rate.

I won’t get into the complexities of how it works, but the main thing to understand is that the value of a bond usually goes up when interest rates go down and vice versa.

The other feature of bonds is that they’re supposed to provide some protection against the risks in your stock portfolio.

Again, if stocks go down in value, say because of a recession, typically, bonds go up in value as interest rates are reduced to prop up the economy.

Anyway, the point is bonds are the asset class a mainstream advisor would typically advise you to invest a decent chunk of your portfolio in.

Especially if you were a conservative or defensive investor.

Now get this…

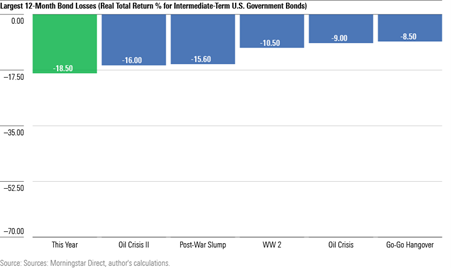

2022 has been an absolute bloodbath for bonds.

According to Morningstar, it’s actually been the worst year ever!

Check out the chart:

|

|

|

Source: Morningstar |

Morningstar commented:

‘…the current bond market rates as the past century’s worst. Barring substantial further losses, the stock market’s decline will soon be forgotten, buried in a database for future internet columnists to disinter. But the bond market’s downturn will long be remembered.

‘The after-inflation loss for intermediate-term government bonds has been even greater than during the second oil crisis that ran from 1979 through 1981, when 10-year Treasury yields peaked at 15.8%.’

Right, so we can now confidently say that bonds might be boring, but they’re certainly not safe…at least not all the time.

What about so-called ‘blue-chip’ stocks then?

This is probably the most common myth the mainstream perpetuates.

That there are certain stocks out there that are somehow immune from the dangers of an uncertain and ever-changing world.

I’m afraid it’s just not true.

Many big-name brands that looked unassailable 20 years ago have been decimated by the rise of e-commerce, iPhones, and cloud computing.

Kodak, Blockbuster, and Borders are three famous examples of big companies that bit the dust.

But don’t think the era of tech-led disruption is going to end.

These days, every sector, from logistics to banking to energy, is undergoing a seismic shift in how they operate.

I’ve even gone on record saying I think Australia’s Big Four banks’ days are numbered as their various services are unbundled by nimble fintech competitors.

That might still sound like madness to many, but history is on my side.

From Investopedia:

‘Vijay Govindarajan, a professor at Dartmouth’s Tuck School of Business, has studied this subject and provides some insight. For one, he believes companies that have invested heavily in their systems or equipment don’t want to invest again in newer technologies.

‘Then there is the psychological aspect in which companies tend to focus on what made them successful and don’t take notice when something new comes about.

‘There’s also the matter of strategic missteps, which may occur when companies are too focused on today’s market and don’t prepare for change or technological shifts in the marketplace.’

When push comes to shove, most disrupted companies just can’t bring themselves to kill their golden geese.

Time will tell if the big banks can manoeuvre through this moment intact.

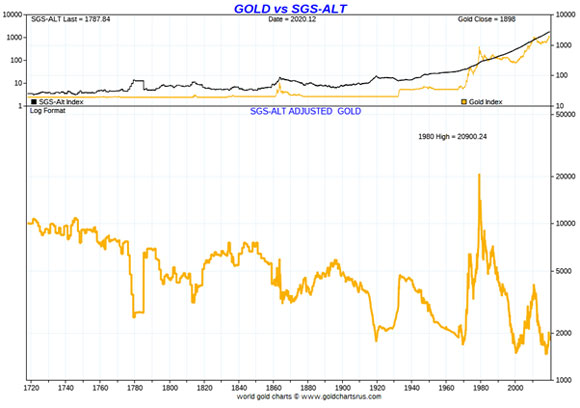

What about the old favourite, gold?

It’s billed as an ‘inflation-proof’ store of value asset and a safe alternative from the perils of manipulated fiat.

Again, unfortunately, the statistics don’t back that up.

Check out this chart:

|

|

|

Source: ShadowStats |

The top chart is the nominal gold price, which looks good at first.

But then you look at the bottom chart…

Amazingly, when you adjust the price of gold for inflation (using ShadowStats’ alternate CPI data), you can see that the price of gold is massively down from its 1980 high.

We’re talking a 90% decline.

You can also see that it’s far from stable, with sharp price moves both up and down.

Lastly, you can see the trend over time has been a slow bleed of value in real terms.

This leaves us with…

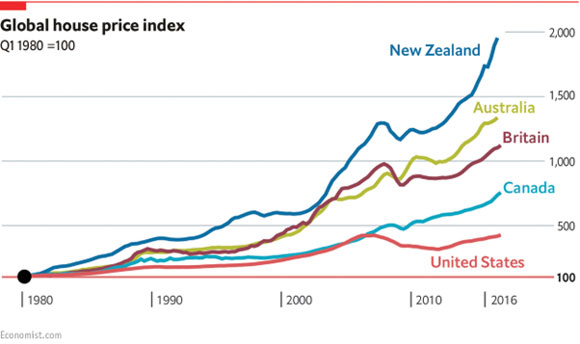

Property.

We’re a nation of landlords and investing in property has been a pretty sweet strategy for Aussies since the mid-1990s.

But this certainly isn’t the experience of property investors around the globe.

Check out this chart to see how much of an anomaly Australia (and New Zealand) are:

|

|

|

Source: Economist.com |

This chart is a bit old, but the US was barely back to 2008 highs eight years after the GFC.

And the roadblocks in front of Aussie property are pretty clear these days.

If interest rates keep rising, there’s a chance Australian and NZ property investors will see some serious falls in the next year or two.

Funnily enough, New Zealand house prices just suffered their biggest annual drop in 13 years in 2022.

My point is…

Investing is hard

If you’re not investing in some innovation — and that means delving into small caps, cryptocurrencies, and other more ‘speculative’ areas — then you’re actually the one taking the big risk, not me.

I can assure you the bloke on ABC radio didn’t say this!

But I think we can all admit that the world is changing faster than ever before.

How fast?

Futurist Michael Simmons puts it this way:

‘20 years from now, the rate of change will be 4X what it is now.

‘Said differently, for someone who is about 40 today, when they’re 60 in 2040, the rate of paradigm change will be 4X what it is now.

‘They will experience a year of change in three months. For someone who is 10 today, when they’re 60, they’ll experience a year of change in 11 days.’

Technology is moving at a breakneck pace and innovators are disrupting almost every industry in real time.

Some of it might even be scary.

You can close your eyes to this and pretend there are ‘safe and boring’ alternatives immune from this future.

Or you can open your mind to them and tackle the challenge of change head-on.

Investing isn’t, and has never been, easy.

But the sheer pace of change is a new, unique factor the modern investor must build into their models.

Psychologically, this is hard.

What feels comfortable and safe is often a lot riskier than people realise. And what feels uncomfortable and ‘risky’ can often be a step in the right direction.

As the great actress Lauren Bacall once said:

‘Standing still is the fastest way of moving backwards in a rapidly changing world.’

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.