Rio Tinto Ltd [ASX:RIO] is set to acquire the Rincon Resources Ltd [ASX:RCR] lithium project in Argentina for $825 million.

RIO is buying the lithium project from Rincon Mining, a firm owned by private equity group Sentient Equity Partners.

RIO expands its battery materials business

Rio Tinto said the lithium acquisition shows its ‘commitment to build its battery materials business and strengthen its portfolio for the global energy transition’.

Lithium adds to RIO’s portfolio of minerals, which include iron ore, bauxite, aluminium, copper, and titanium dioxide.

For context, typical lithium-ion batteries contain lithium, cobalt, nickel, graphite, aluminium, and copper.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Rio’s lithium target is a large undeveloped brine project

The Rincon Mine is an undeveloped lithium brine project in the Salta Province of Argentina.

RIO described Rincon’s location as being in the heart of the famed lithium triangle, an ‘emerging hub for greenfield projects’.

The giant miner thinks Rincon has the potential to have one of the lowest carbon footprints, helping RIO’s decarbonisation goals.

RIO expects the transaction to be completed in the first half of 2022.

RIO positions for battery materials demand

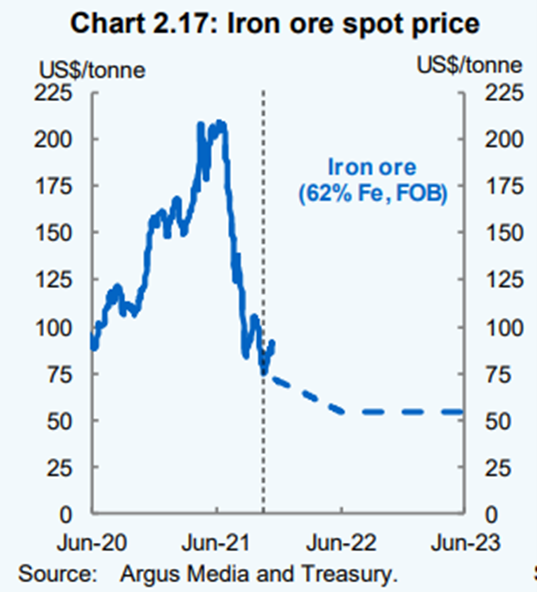

The addition of lithium could attenuate the volatility associated with one of RIO’s biggest exports — iron ore.

Rio could leverage the growing demand for battery materials — especially lithium — at a time of weak iron ore prices.

Source: Federal Budget 2021–22

Source: Federal Budget 2021–22

The latest predictions from the federal budget assume the iron ore price will decline to US$55 per tonne FOB by the end of the June quarter in 2022.

Lithium prices, on the other hand, are expected to remain strong.

Market intelligence agency S&P Global said last week that the strong lithium market is expected to persist in 2022, as supply tightens amid growing demand.

RIO itself is optimistic about the market for battery-grade lithium, writing (emphasis added):

‘The market fundamentals for battery grade lithium carbonate are strong, with lithium demand forecast to grow 25–35% per annum over the next decade with a significant supply demand deficit expected from the second half of this decade.’

Argosy Minerals welcomes new neighbour

RIO isn’t the only one interested in the Salta province.

Junior lithium developer Argosy Minerals Ltd [ASX:AGY] has a current 77.5% interest in the Rincon Lithium Project.

Sharing RIO’s announcement on its official Twitter account, Argosy said having a neighbour like Rio Tinto was ‘very positive’:

‘This is very positive. For one of the world’s largest miners to buy the project next door for ~A$1B shows their confidence in the Salar, jurisdiction, and lithium.

‘They operate extremely professionally and we look forward to a long-standing relationship.’

AGY shares were up 5% in midday trade.

With AGY shares rising today as investors price in positive connotations of RIO’s validating presence in the region, I wonder if RIO’s lithium play will also indirectly impact one other lithium stock.

When Vulcan Energy Resources Ltd [ASX:VUL] was hit with a critical research report from J Capital — known for shorting stocks like Nearmap Ltd [ASX:NEA] and WiseTech Global Ltd [ASX:WTC] — JCap raised concerns about the fledgling direct lithium extraction (DLE) technology.

But in today’s update, RIO seemed confident DLE can be viable.

RIO said:

‘The direct lithium extraction technology proposed for the project has the potential to significantly increase lithium recoveries as compared to solar evaporation ponds. A pilot plant is currently running at the site and further work will focus on continuing to optimise the process and recoveries.’

Now, if you want extra information on evaluating and comparing lithium miners, I suggest reading our comprehensive lithium guide.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector and individual lithium stocks.

Additionally, if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here