At time of writing the share price of Rhythm Biosciences Ltd [ASX:RHY] is trading at $1.37, up 5.79%.

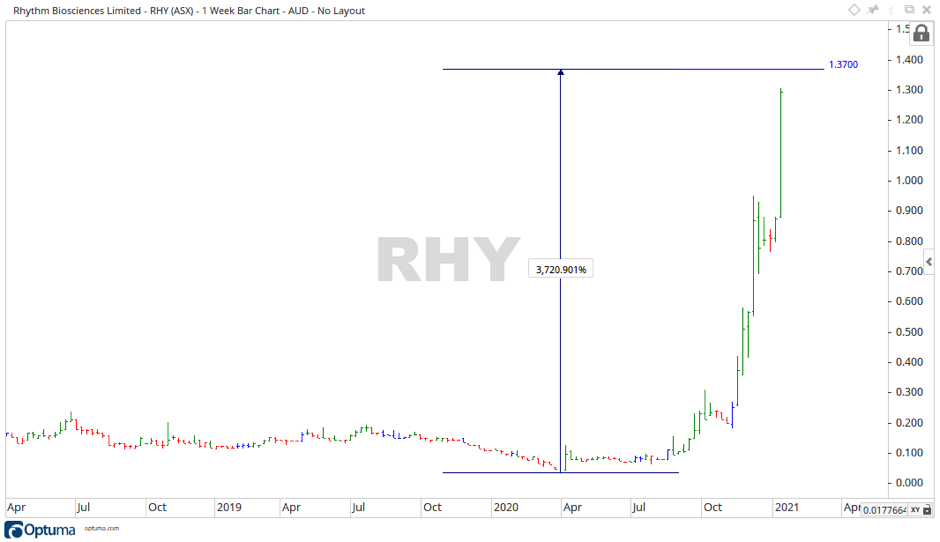

Rhythm Biosciences experienced explosive growth in its share price throughout 2020, moving up over 3,720%.

Giving the company a market cap value of $260.94 million at the time of writing.

Source: Optuma

What’s pushing the RHY share price up?

Rhythm Biosciences is focusing on colorectal cancer.

The second largest cause of cancer-related deaths in Australia, Europe, and the United States.

As with most cancers, early detection is key.

RHY is focused on early detection of colorectal cancer using a simple, low-cost blood test that could revolutionise colorectal cancer detection and mass-market screening.

The company has developed ColoSTAT.

A low-cost blood test designed to be:

- Minimally invasive

- Another option for those currently unwilling to screen

- Easily run by laboratories, with minimal training or need for new infrastructure

- Comparable to, if not better than, the current FIT tests in detecting early-stage colorectal cancers

The test is designed to efficiently test for cancer at all stages.

One of the main issues with testing for this type of cancer is that patients are not comfortable with the traditional method.

This blood test looks to solve that issue.

Rhythm Bioscience and the future

While most of the world is at a standstill, 2020 was a standout year for the company.

- Granting of ColoSTAT® trademark in the US

- Granting of US patent

- Granting of China divisional patent

- Completed approx $6 million capital raise.

- Received $1.1 million FY20 R&D tax incentive

The progress made is reflective in the share price.

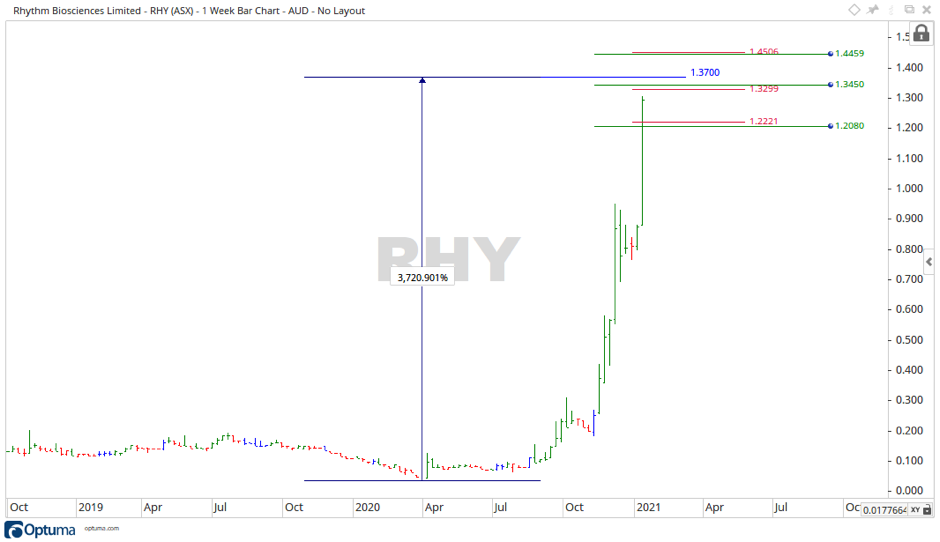

Source: Optuma

Trading at $1.37 at the time of writing, the share price rocketed up from the march low.

Should the move up continue, then the level of $1.45 may become the focus.

If the price falls back, then the levels of $1.33 and $1.22 may be enough to halt the fall.

The global population is aging with 703 million people aged 65 or over in 2019.

The company estimates there are around 250 million people aged between 50 and 75 years that should have regular screening, while the majority remain unscreened.

This gives the company massive growth potential going into the future.

If you are trading RHY you need to wrap your head around risk. Learn how to do that in this report from our chart guru Murray Dawes. If you’ve wondered what kind of patterns these stocks follow, it’s a must read. You can download that right here.

Regards,

Carl Wittkopp,

For Money Morning