The Rhinomed Ltd [ASX:RNO] share price is soaring this morning after the Victorian Department of Health placed initial orders for one million Rhinoswabs for SARS-CoV-2 testing.

This follows the recent HSW Health Pathology purchase of one million Rhinoswabs announced in August.

Investors are now flocking to the stock in droves.

Rhinomed share price has ballooned 450% since this time last year. Check out the last 12 months for Rhinomed shares in the chart below.

Moreover, their year-to-date gain is sitting above 175%.

Let’s take a closer look at this morning’s announcement and what this could mean for Rhinomed shares in the months ahead…

What’s so unique about Rhinomed’s Rhinoswab technology?

Rhinomed is a leader in the wearable nasal and respiratory space, partly due to its one-of-kind Rhinoswab technology.

Rhinoswab integrates seamlessly into existing PCR pathology workflows and equipment and has a similar cost and quality to standard of care nasopharyngeal swabs used in the US and Europe.

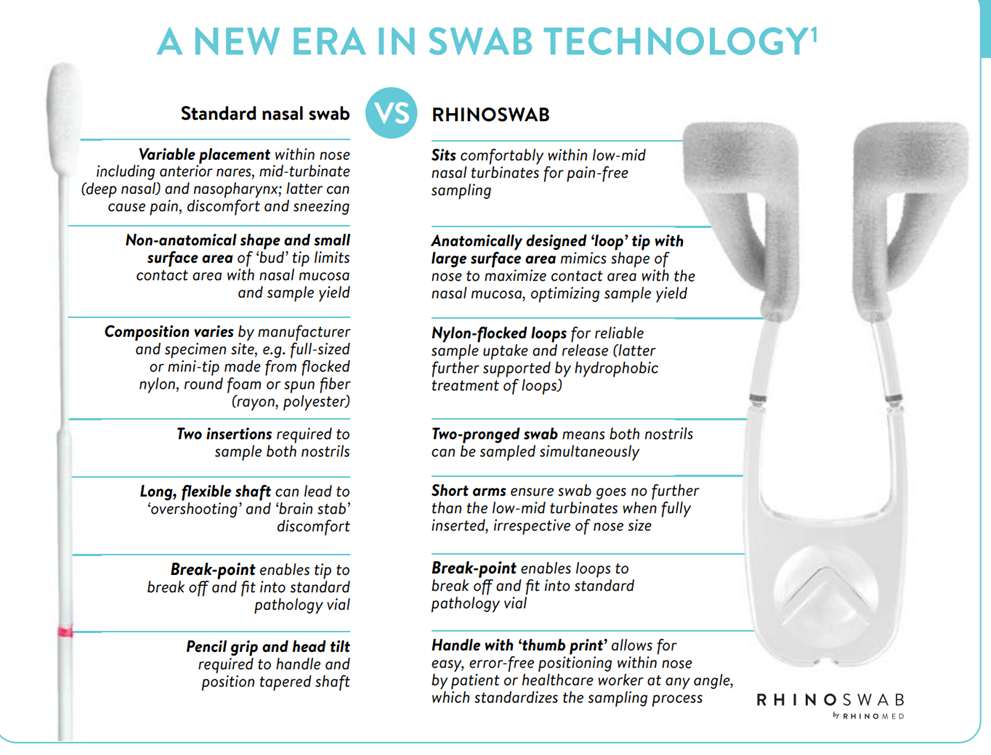

According to the release, the Rhinoswab is:

‘Substantially more comfortable and easier to use than the standard nasal swab, captures a larger sample, can accelerate the sample collection process and significantly reduce queues and waiting times.’

Source: Company presentation

In a post-COVID era, it’s no surprise Australian state governments are trying to get their hands on as many of these Rhinoswabs as they can.

Today, Rhinomed CEO Michael Johnson commented:

‘We are pleased to receive further validation of the Rhinoswab from the Victorian Government.

‘The Rhinoswab can make a meaningful impact on the SARS-CoV-2 testing process and enable more people to be tested quickly and easily.

‘With well over 2 billion SARS-CoV-2 tests having been carried out globally over the past 18 months (close to 26 million* in Australia alone), there is a major opportunity for Rhinoswab to radically improve the testing process, clinical outcomes and user experience and we look forward to working with the Department of Health to deliver these outcomes.’

In the announcement, management also revealed news that the company had appointed several new local and international Rhinoswab distributors: AntiMicrobial Technologies Group (AMTG) in Western Australia and bioTRADING Benelux BV in Belgium, the Netherlands, and Luxembourg.

The terms, pricing, and details of these agreements remain confidential.

What’s next for the Rhinomed share price?

It’s clear that Rhinomed are in the right business and at the right time.

The company is scaling fast as the demand for its innovative technology grows, both here in Australia and abroad.

Investors can expect to hear more about Rhinomed’s increasing sales pipeline as further agreements are signed in the months ahead.

As for those yet to invest, has the boat already sailed on this ASX medtech play?

Only time will tell, but it doesn’t seem like this company is slowing down anytime soon.

The question, of course, is the sustainability of demand for Rhinoswabs.

Will there be similar demand for Rhinoswab in three to five years? Can RNO find further applications for its product beyond SARS-CoV-2 tests?

Again, only time will tell.

Now, if you’re interested in finding other stocks like Rhinomed that have the power to thrive in post-COVID markets, I recommend you read our small-cap expert Murray Dawes’s latest research.

According to Murray, there are seven Aussie small-cap stocks on the ASX right now that could reach dizzying heights in the 2020s (and make killer gains for early investors!).

Download his free report here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Along with your free report, you’ll also get a complimentary subscription to Money Morning, an e-letter that has been designed to deliver the most-exciting investing opportunities straight to your inbox seven days a week. Click here to get started.