An expected 8% drop in revenue has global plus-size women’s apparel retailer City Chic Collective [ASX:CCX] riding a bumpy start to the 2023 financial year — resulting in reduced gross margins, higher costs, EBITDA loss, and rising cash outflow.

The retailer has said higher expenses will be incurred through heightened promotional activities. The company is hoping to boost demand as inflation-bitten consumer confidence falters.

The CCX share price has been performing quite strongly in the new year, up 22% in the past month and having surged by 40% in the last week alone.

Compared to the wider S&P 200 [ASX:XJO] benchmark over the past 12 months, the retailer has plunged 87%, still far below the market average lost nearly a year ago.

Source: marketindex.com

City Chic shares trading update for 1H FY23

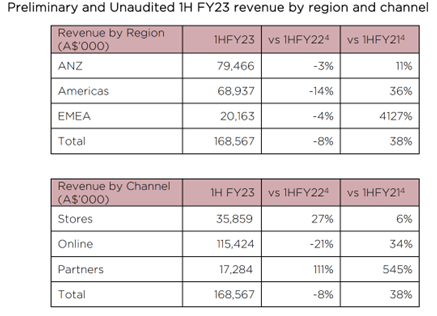

The company has collated its preliminary and unaudited numbers for the first 26 weeks of the financial year, expecting group sale revenue to be down around 8% to $168 million in comparison with the first half of last year. However, the numbers are still a 38% increase on FY21’s report.

CCX says it continues to see continuing volatility, which has lent the need to boost promotional activity, hoping to fan the flames of demand.

City Chic, therefore, believes it will need to continue efforts likened to those used for Back Friday, Cyber Monday, and the Christmas holiday period, which will also result in continued higher cost of doing business (CODB) as a percentage of sales.

While deemed necessary, the promotional activity has already impacted the company’s gross margins.

Phil Ryan, CEO of City Chic, said:

‘We maintain strong engagement with our core customer groups and are on track to deliver our strategic logistics initiatives. Meanwhile we continue to focus on cost management and with the support of our lender have amended our debt facility in line with our changing business needs. We remain extremely confident in executing on our strategies and returning to profitable growth as these cyclical headwinds unwind. We thank our stakeholders for their support and look forward to progressing our vision to lead a world of curves.’

Below is a breakdown of CCX’s revenue by segment:

Source: CCX

City Chic braced for challenging market demand

CCX says that in shrinking revenue and gross margin, and with higher expenses, it expects underlying EBITDA to suffer, now estimated for 1H FY23, to the range of between $2.5–4.0 million.

City Chic is on track to deliver an inventory balance of $125–135 million by the end of the financial year.

The company has amended its debt facility to $46.5 million and increased the amount available for working capital.

In conclusion, CCX’s debt is expected to total $12.9 million by the end of the first half, though the company will be focused on strict cost management in conjunction with managing ways to work through the current macroeconomic uncertainty.

City Chic will announce its audited 1H FY23 financial results on Monday, 27 February 2023.

Five bargain stocks for your portfolio

The end of 2022 was a period fraught with challenges.

With some effects of the pandemic still lingering, we were handed an influx of new challenges — inflation, the war, continually rising rates…

The hard yards aren’t quite over yet, which is why everyone is looking to save a pretty penny where they can.

And it’s in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning