Move over lithium, uranium is now the hottest commodity around!

For the past three years, the push towards clean energy has led to renewed interest with nuclear energy, given its relatively low carbon emissions. However, battery technology, electric vehicles, solar panels and wind turbines took centre stage with respect to investor interest.

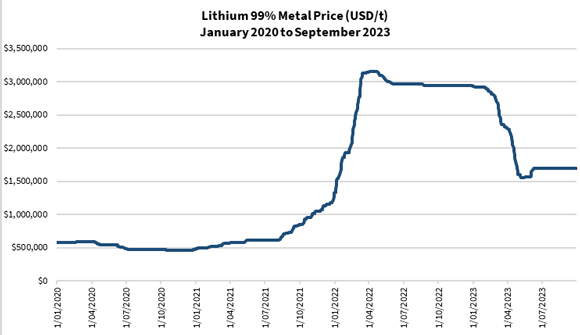

Most of you may’ve seen how lithium surged:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Some of you may have even enjoyed windfall gains buying companies such as Pilbara Minerals [ASX:PLS], Mineral Resources [ASX:MIN], Allkem [ASX:AKE] and Liontown Resources [ASX:LTR]. Those who bought explorers that struck some spectacular drill results or announced lithium deposits such as Galan Lithium [ASX:GLN], Lake Resources [ASX:LKE], Meteoric Resources [ASX:MEI], Wildcat Resources [ASX:WC8] may’ve scored bonanzas.

However, not all who venture into the hottest commodities make a profit. Many who jumped on board do so late in the game, often ending up staying around for too long. They succumb to herd mentality and end up contributing to the success of those who were early.

This occurs time and again with commodity investing. It’s cyclical and volatile.

A commodity is subject to a buying frenzy off the back of positive news coverage. The narrative may be valid, as with lithium on the back of surging global demand for battery storage.

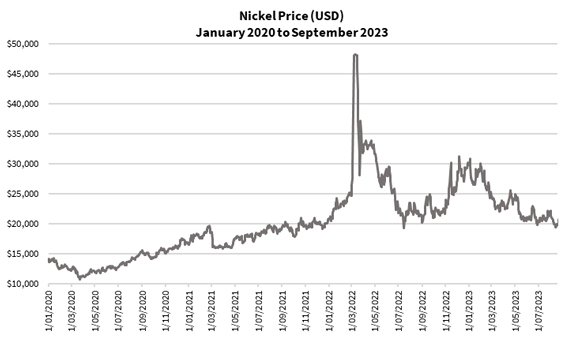

In other cases, it might be a short-term market hype such as with nickel last year in the wake of the Russia-Ukraine conflict, as you can see below:

|

|

| Source: Thomoson Reuters Refinitiv Datastream |

The problem with commodity investing is that many follow the physical supply and demand, thinking this is what drives prices.

Unfortunately, that’s not the case.

And it’s this misunderstanding that costs many speculators to lose their shirt (worse if they trade on a margin!).

Besides that, many who buy commodity stocks chase momentum. Despite their best efforts to read the charts and indicators, they could end up holding the bag if the market turns around quickly.

Today I’ll provide my thoughts into what successful mining investors do to maximise their chances of profiting in this space.

Beyond emotions and sentiments

Commodity prices are highly volatile. This is what attracts many investors, hoping for a quick path to riches.

Many traders make a living reading charts and momentum indicators to determine peaks and troughs. It works with buying commodity futures.

While commodities have an intrinsic value, the basis for determining its price is driven more by sentiment and narratives than from market fundamentals such as supply and demand.

Many aren’t aware that this is not the case with the US, UK and the European Union commodity exchanges. They are driven by fund flows rather than physical trade.

Participants in these exchanges range from primary producers, industry buyers of the commodity, institutional traders and retail speculators.

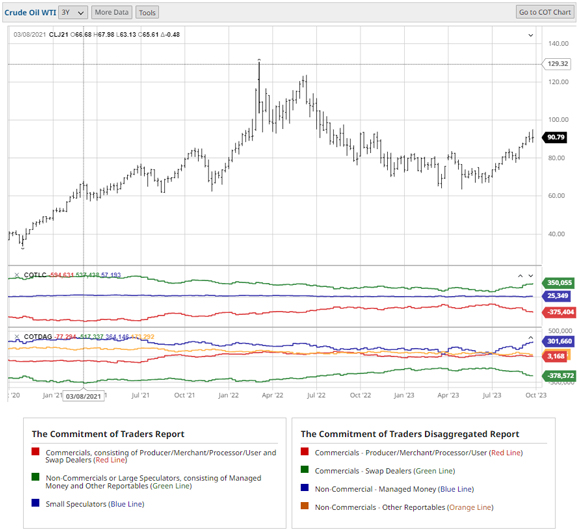

Here’s an example of the market dynamics based on the Commitment of Traders Report for crude oil in the past three years:

|

|

| Source: BarChart.com |

The biggest market movers tend to be the institutional traders comprising investment banks, managed funds and hedge funds (non-commercial or large speculators, the green line) who seek to profit from short-term positions (speculating), risk management (hedging) and exploiting market mispricing (arbitrage).

The small retail speculators (blue line) are but a minor participant in this market.

It’s well-known among market traders that the commodity prices reflect the balance of sentiment from all the market participants, though driven largely by the commercial institutions. Prices rise when funds lean on a brighter outlook for the commodity, and vice versa.

In fact, sometimes the price might simply rise based on the collective consensus that there’ll be a major surge in demand for a commodity.

It happened on many occasions in the past.

Think about the surge in uranium in 2005—07, iron ore in 2009—11, gold and silver in 2008—11 and lithium in 2021—22.

While commodity prices can rise sharply, they can collapse just as quickly and remain depressed for several years. The longest bear markets for commodities in history were in gold (1987—2001), silver (1980—2001) and recently with uranium (2011—21).

Now it’s worth noting the outlook may or may not coincide with the economy. This is especially the case with precious metals such as gold which normally acts as a safe haven asset. It usually goes against the trends of the economy.

Finding an anchor to value — the secret sauce of successful mining stock investing

Not all investors are able or willing to buy commodity futures or contracts as there is a minimum threshold to trade in this market. Instead, they speculate with mining stocks, trading in shares of individual companies.

If you think commodity prices are volatile, you haven’t seen anything yet with mining stocks, especially explorers!

These companies are leveraged to the ups and downs of the commodity price cycle.

Depending on what stage of the mining lifecycle these companies are in — pre-discovery or post-discovery explorers, developers and producers — their risk profile varies.

It’s important to note that mining stocks don’t always follow the price movements of the underlying commodities that they’re exploiting. This is because they are businesses whose drivers of value are their profitability and financial stability.

Commodity prices are but part inputs to these value drivers.

So how do successful mining investors play the game right?

It’s a combination of timing their trades, identifying opportunities of mispricing from the markets, and deciding when to hold or fold.

Notice how market timing is important, but is not the only ingredient?

I’ve studied many mining investors such as Eric Sprott, Rick Rule, Pierre Lassonde, Don Durrett of GoldStockData.com, Adam Hamilton of Zeal LLC, and Bill Powers of Mining Stock Education, in the past decade to see what made them successful.

The common theme is that they have a good idea of how much the companies they’re following should be worth at any given time.

They may not be able to give you the exact value to the nearest million dollars (you don’t need to be THAT precise). However, they can compare this with what the prevailing market price and decide if the potential returns and expected time frame justify the risk they’d take.

Sometimes their payoff is quick when the commodity is in a bull market. On other occasions they may wait longer, even years, to see their expectations being fulfilled. And on several occasions, they make the wrong call and suffer heavy losses.

But in the long term, their results speak for themselves. They have many followers who took their advice and enjoyed better outcomes.

Improve your game with the Fat Tail expertise

I know that the global markets look toppy right now. However, we’re watching the setup of a major global rebuilding at the other side of the recession.

If you’re keen to see better returns with investing in mining stocks, now’s the time to get started!

And you’ve come to the right place.

At Fat Tail Investment Research, we’ve got experience with market timing and identifying value opportunities in the commodities market.

Check out my colleague James Cooper’s Diggers and Drillers or my precious metals investment newsletter service, The Australian Gold Report, to get you started on your own investment journey today.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments