There’s always calm before the storm

Everything goes along just fine…until it doesn’t.

In 2023, the narrative has been…

Low unemployment. Inflation pressures easing. Damage from rising rates has been contained. Any troubles in the US banking sector will be short-lived thanks to the Fed and US Treasury. And, no price is too high for anything remotely related to AI.

Repeated warnings about the US commercial property market going over a cliff have been largely dismissed (reminiscent of how concerns over subprime lending were batted away in 2007…we were assured any problems would be contained…yeah right).

In July 2023, Business Insider reported (emphasis added)…

‘Commercial real estate is in for hefty price declines across six top US cities, according to a recent report from Capital Economics.

‘The research firm highlighted cities it dubbed “major markets”: San Francisco, Chicago, New York City, Los Angeles, Boston, and Washington, DC.

‘San Francisco is expected to suffer the largest decline, with commercial property values in the city plummeting 40%-45% from 2023–2025.

‘Chicago and New York will see declines of 30%-35%, while LA and Washington will see 25%-30% drops. Boston is expected to see values slipping around 25%.’

So what?

Who cares?

Party on.

The Fed will save us.

Keep calm and party on.

The Big Short sequel

Last month, The Wall Street Journal warned the systemic risks from a deflating US commercial real estate (CRE) market are far greater than previously realised.

|

|

| Source: WSJ |

To quote (emphasis added)…

‘The regional banking sector’s risk from distress in the commercial real estate industry appears to be larger than previously known, a new analysis found, posing a threat to the wider economy.

‘Banks in total have roughly $3.6T of exposure to commercial real estate, equivalent to 20% of their deposits, according to an analysis The Wall Street Journal…

‘Small and midsized banks — those with less than $250B in assets — held about three-quarters of all commercial real estate loans as of the second quarter, the WSJ found.

‘As fundamentals in some commercial real estate markets erode, banks could face a period of shocks as borrowers default in higher numbers, and the banking pain would further depress CRE — touching off a so-called doom loop scenario.

‘“The plumbing is clogged right now,” RXR Realty CEO Scott Rechler told the WSJ. “And that is going to create a backup that will eventually overflow on the commercial real estate markets and on the banking system.”’

Heavy losses are now being materialised.

Overnight, David Hay, founder of US wealth management firm, Evergreen Gavekal, provided this insight (emphasis added)…

‘According to credible property experts in the Seattle area, apartment buildings have fallen 20% to 25% even on the affluent Eastside. More disturbing, one of Seattle’s most iconic office buildings is close to being sold at a 70% markdown from its 2019 sales price.

‘As you may have seen, there are numerous transactions of office properties selling, or being foreclosed upon, as much as 80% below their high-water marks of just a few years ago.

‘This feeds into one of my other dominant fears that the most recent banking crisis isn’t over. Small- and mid-sized banks are particularly vulnerable, as they hold roughly half of all commercial mortgages.’

This is what’s happening on the ground.

The risks posed by an imploding CRE market have been known for quite some time.

But, while Wall Street still remains elevated, most have chosen to ignore the dangers hiding in plain sight.

Are we witnessing the sequel to The Big Short?

I think so.

Are US banks being true and honest?

Small to midsized US banks — with about three-quarters of all commercial real estate loans on their books — are most at risk from defaulting borrowers.

Back in March (when three US banks failed), US citizens were given these assurances…

‘Questioned closely, sometimes aggressively, [Janet] Yellen told senators at a Capitol hearing that the U.S. banking system “remains sound” and Americans “can feel confident” about the safety of their deposits.’

– AP News 10 March 2023

‘Federal Reserve Chair Jerome Powell on Wednesday called the U.S. banking system “strong and resilient,” voicing confidence in the nation’s financial system and the safety of bank deposits less than two weeks after the failure of Silicon Valley Bank, the second-biggest bank collapse in U.S. history.’

– Yahoo Finance, 23 March 2023

But, what if the financial statements upon which these assurances are based, prove to be false?

What if some US regional banks are engaging in questionable accounting practices to mask the extent of the problems in their books?

It’s not without precedent…remember Enron?

Under the non de plume of Zatoichigo, an analyst/curious investor has taken a thorough look at the financial statements of Western Alliance Bancorporation (WAL).

They have published two reports — here and here.

The reports — highlighting irregularities in the accounts — are quite detailed and raise serious questions…not just about the financial state of WAL but also the potential lack of oversight by market regulators.

To quote from the latest report (emphasis added)…

‘WAL’s fraudulent activities included but were not limited to fraudulent fair value estimation of the loans transferred from held-for-investment (HFI) to held-for-sale (HFS), false statement on growth of core deposits, camouflaged figure of efficiency ratio, comparison with peer banks using distorted data, etc.

‘I also highlighted that the lack of reaction from market regulators, specifically, the U.S. Securities and Exchange Commission (SEC), may encourage such fraudulent accounting activities and consequently bring in negative effect to the integrity of financial market.’

It’s possible Zatoichigo may have interpreted the numbers wrongly and the analysis is flawed.

Or, might this be similar to the three students from University of West Virginia who uncovered VW’s emissions fraud?

Not sure, but one thing is for certain, the market (like it was in 2007) is harbouring concerns.

Echoes of 2007

In 2007, the performance of the banking sector disconnected from the broader market (S&P 500)…then came the collapse of Lehman Brothers in September 2008 and the S&P 500 could no longer turn a blind eye to what was happening in the real world.

KBW — is the index for major US banks.

KRE — is the index for regional US banks.

|

|

| Source: Yahoo Finance |

And, here we are again.

Since the S&P 500 peaked in early 2022, the three indices were mostly in lockstep UNTIL the bank failures earlier this year…now there is a yawning gap between the banking indices and the broader market.

|

|

| Source: Yahoo Finance |

Will this gap also be filled by a wave of bank failures?

And, how much worse could that collapse be if ‘accounting irregularities’ are found to exist in the banking sector?

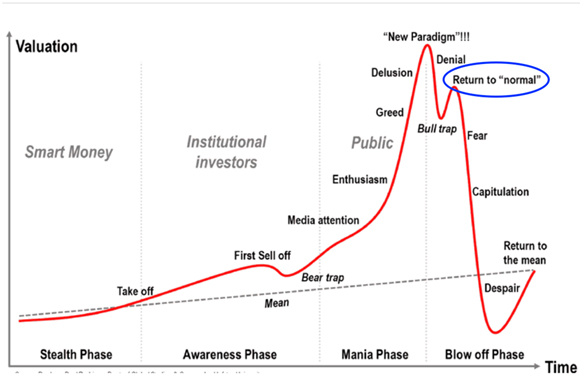

Return to Normal? Not likely

The ‘Return to Normal’ stage of this market cycle has been far more protracted than in previous cycles…

|

|

| Source: Dr Jean-Paul Rodrigue |

With short AND long-term interest rates at and over 5%; record debt levels; US banks tightening lending standards; inflation pressures bubbling away (oil price, wage demands etc); China in a funk; CRE cratering and a host of other negatives, there is a ‘snowball in Hell’s chance’ of going back to the bubble-era ‘normal’.

Get ready…Fear and Capitulation awaits…

Until next week…

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia