We’re in a bit of an investment ‘no-man’s-land’ right now.

And I don’t see much conviction among the bulls or the bears.

Instead, everyone is waiting around trying to work out if the worst is behind us. Or if there’s another landmine about to go off.

Aside from the US banking crisis, the big risk everyone’s talking about is, of course, the imminent US debt ceiling.

While I think it extremely unlikely that this won’t be resolved — the consequences would be catastrophic for the global financial system and end US dollar hegemony — I do think we’ll see a few more weeks of grandstanding and bickering.

And that will weigh on markets.

But at the 11th hour, I reckon a deal will be done.

The other big risk on the table is stubborn inflation and, in turn, more rate hikes.

However, again, I think the worst is behind us on this front.

Check out this chart:

|

|

| Source: Truflation |

This non-official source of inflation uses real-time prices across millions of data points. If it’s correct, we’re already almost back down to 3% inflation target.

We could get confirmation of this from a US retail data dump due on Tuesday…

Why you should watch this

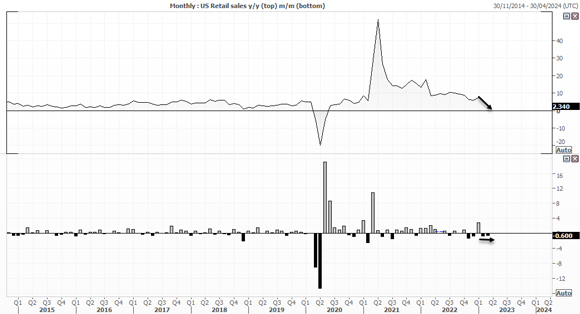

Check out the charts:

|

|

| Source: Forex |

As Forex.com noted:

‘With cracks continuing to widen for some metrics of US employment, consumer trends will continue to garner greater interest.

‘But already we are seeing weakness in retail spending, with the annual rate falling to a post-pandemic 34-month low of 2.34% and contracting for the past two months.

‘If retail sales are to deteriorate further whilst coincident indicators such as industrial production disappoint, it could weigh on the US dollar as traders try to price in ‘higher for less’ or even cuts sooner than later.’

Interest rate cuts sooner than later?

That’s certainly a curveball few are predicting in the analyst community.

Though, as I noted last week, the traders of the bond markets are pricing in just such an outcome.

The yield on the key two-year US Treasury has fallen from a top of 5.05% on 8 March to finish last week at 3.92%.

Data Trek’s Nick Colas said on the move:

‘It is telling that their recent decline has had little effect on stock prices. Even though Fed Funds Futures are predicting rate cuts by the end of the year, equity markets are not quite sure if that’s good news or bad.

‘That is a break from the previous relationship between these 2 assets and therefore signals a change in market narrative.’

Like I said before, no one is quite sure what to make of anything yet.

Mainly because there are signs the real economy is softening fast too. And stock markets don’t like recessions.

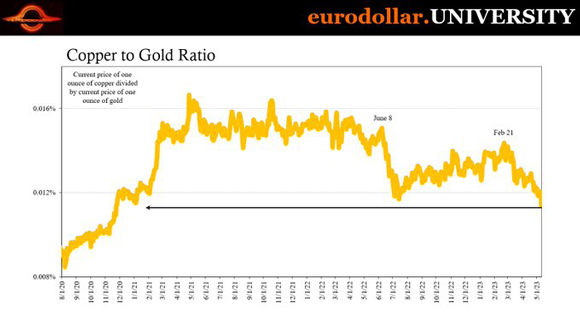

Check out this chart of the copper-gold ratio:

|

|

| Source: Eurodollar University |

A falling copper-gold ratio says investors are positioning themselves defensively in gold opposed to the growth prospects of copper.

But my colleague James Cooper thinks this pullback in copper is a great buying opportunity in copper stocks, rather than the harbinger of doom.

And if you can take advantage of the general market fear, you can get set in some fantastic small-cap mining stocks poised to benefit.

You can read more on his underlying thesis here.

But like I said at the start, it’s a bit of no-man’s-land right now.

The doomsayers have plenty to harp on about. But the bulls are seeing the glass half-full side of things too.

Half full, half empty

My favourite perspective from last week probably came from legendary investor Stanley Druckenmiller.

He told the Sohn investment conference that a ‘hard landing would offer unbelievable opportunities’.

His glass is both half full and half empty at the same time!

Though, he noted he wasn’t forecasting one, just reflecting on the possibility.

This is a good way to think about markets.

Often, the biggest investing opportunities in history have come from the times of maximum panic.

So while I wouldn’t be out of the market completely right now, I think having a decent pot of cash at the ready for when opportunistic buying makes sense too.

Good investing,

|

Ryan Dinse,

Editor, Money Morning