At time of writing, the share price of Resimac Group Ltd [ASX:RMC] is up 15.6%, trading at $1.89.

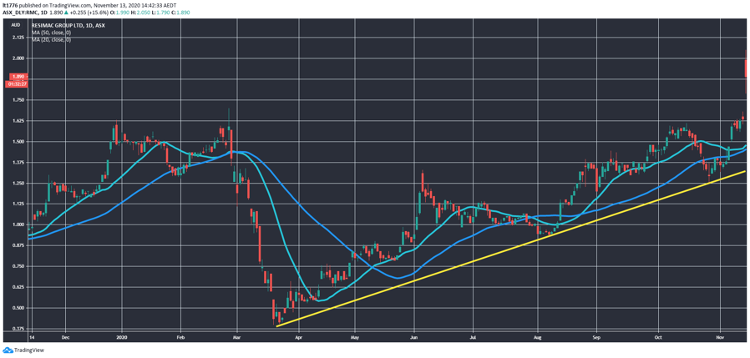

The RMC share price chart is in a relatively steady uptrend as you can see below:

Source: tradingview.com

Is Resimac defying the odds? Is the housing market doomed? We dig into the latest trading update out of the company.

Positive trading update results in big move up for RMC share price

Here are the key points from the RMC update:

‘• 1H21 Normalised NPAT guidance in the range of $48m – $53m reflecting low 30 day BBSW resets, disciplined cost control, and Assets Under Management growth.

‘• Home loan settlements from July to October were $1.4b (c65% Prime; c35% Specialist).

‘• Resimac home loan Assets Under Management [AUM] at 31 October 2020 was $12.7b (30 June 2020 $12.4b).

‘• At 31 October, approximately 4.4% of customers were in COVID payment deferrals (30 June 2020 10%).’

Solid numbers, particularly given the crowing about an Australia-wide housing crisis that frequently pop up.

No doubt buying a home is expensive in Australia — but the fact that RMC was able to grow its AUM in this environment is partly due to government intervention, partly due to the ineptitude of the Big Four banks.

And of course, factors internal to RMC.

Outlook for RMC share price

With strong upward momentum, Melbourne out of lockdown, and a government that knows how much the residential property market matters to citizens, RMC looks to be in a strong position.

RMC has a P/E ratio of 11.9 and a dividend yield of just below 2% after the run up, but the RMC share price may keep moving up after a retracement.

For context, with moves this size it’s not uncommon to see a smaller move down the next day.

Today’s announcement was brief, but it does also hint at stronger conditions in the housing market than many outlets would have you believe.

Find out why Catherine Cashmore believes that a housing crash may not happen until 2026.

It’s got a lot to do with history and even more to do with the ‘Law of Rent’.

You can download the special report for free right here.

Regards,

Lachlann Tierney

For The Daily Reckoning Australia