The Renascor Resources Ltd [ASX:RNU] share price is up 8% today after RNU begins investigating green financing options for its battery anode project.

The diversified explorer’s shares were up as much as 14.6% in early trade.

Renascor’s Siviour battery anode project in South Australia produces purified spherical graphite (PSG), a key raw material for manufacturing lithium-ion batteries.

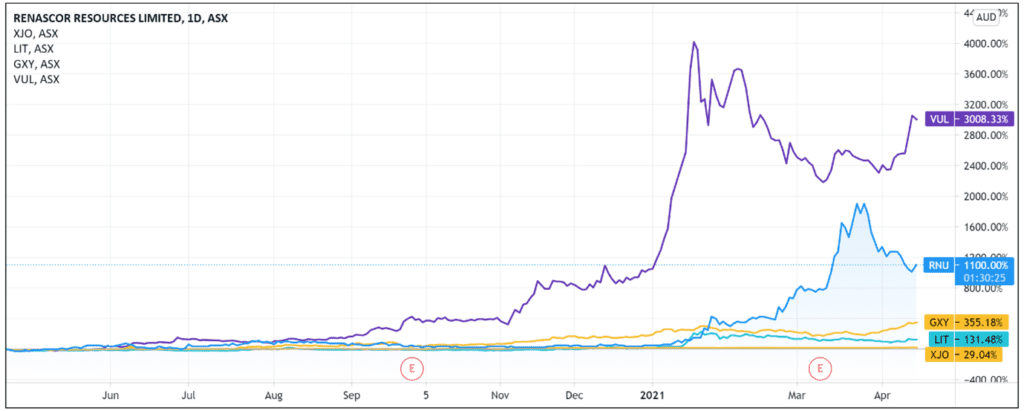

As we’ve covered recently, ASX lithium stocks had a big week.

Stocks like Galaxy Resources Ltd [ASX:GXY], Orocobre Ltd [ASX:ORE], and Vulcan Energy Resources Ltd [ASX:VUL] saw their share price rise in recent days.

Lithium stocks are benefiting lately as investors seek exposure to the electric vehicle revolution.

Year-to-date, RNU shares are up 700% and up 1,200% over the last 12 months.

Source: Tradingview.com

Renascor investigating green financing options

Citing ‘increasingly high levels of interest from equity and debt capital markets’ for projects with high environmental, social and governance (ESG) standards, RNU announced it is investigating green financing options for its Siviour battery anode material project.

How to Find Promising Energy Stocks, This Investment Sector Is Ripe for Massive Disruption. Download Your Free Report Now.

Renascor reported that Siviour’s ‘strong ESG credentials’ helped attract principle financial support from Australia’s Clean Energy Finance Corporation (CEFC).

CEFC is an Australian government-backed clean energy technology financier.

RNU also reported that it’s engaging with Nordic investment bank ABG Sundal Collier and financial advisers BurnVoir Corporate Finance to arrange ‘financing solutions’.

Renascor’s Managing Director David Christensen commented:

‘We anticipate our investigation of financing options will result in further validation of the Project’s ESG and economic robustness, complementing previously announced support received from the Australian Government’s Clean Energy Finance Corporation and Export Finance Australia.’

Green Credentials of the Siviour Project

RNU explained that it’s on track to construct the first integrated, in-country mine and PSG operation outside of China.

According to the company, 100% of PSG produced from natural flake graphite is produced in China.

In contrast, Renascor wishes to conduct all operations in South Australia, which is a Tier-1 ESG jurisdiction.

RNU stated that its Siviour project vertically integrates the production of graphite concentrate into PSG in a ‘low-cost and eco-friendly manner, while providing a direct route to market.’

RNU share price outlook

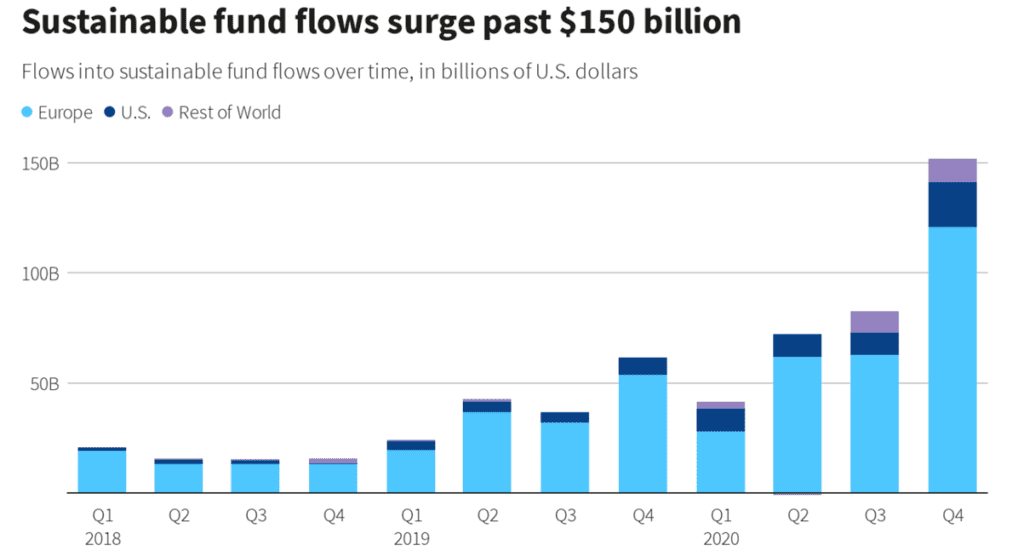

Projects focused on environmental, social, and governance good practice — such as RNU’s Siviour project — are in high demand from equity and debt capital markets following rising awareness of global environmental issues.

According to Bloomberg, investor demand for environmental, social and governance products is surging.

Source: Reuters

Source: Reuters

A Morgan Stanley report found 95% of millennials were interested in sustainable investing as recently as 2019, up 9% from 2017.

As Bloomberg reported, that’s a lot of buying power that helps explain why behemoth fund-management firms like BlackRock and Vanguard are ‘flooding the market with ESG-focused funds.’

For reference, sustainable funds in the US attracted US$51.2 billion in 2020, dwarfing the previous calendar-year record of US$21.4 billion set in 2019.

Worldwide, US$347 billion flowed into ESG-focused investment funds last year, with more than 700 new funds launched.

With Renascor already planning a ‘substantial increase’ of PSG production capacity beyond the currently planned 28,000tpa, investors will likely be eagerly monitoring the progress of RNU’s green financing investigation.

There is certainly emerging recognition that the lithium battery and electric vehicle sector is a growth market. If you want further reading on investment opportunities in the lithium sector, then our free report on lithium stocks is a great place to start.

Regards,

Lachlan Tierney,

For Money Morning