Renascor Resources [ASX:RNU] has announced an upgrade to the mineral resource estimate for its Siviour graphite project in South Australia.

The new estimate represents a 17% increase in the indicated resource and a 14% increase in the measured and indicated resource.

RNU expects the upgraded resource to improve the Siviour pit design and mining schedule.

RNU shares are up 135% in the past 12 months.

Source: www.tradingview.com

Renascor upgrades Siviour mineral resource

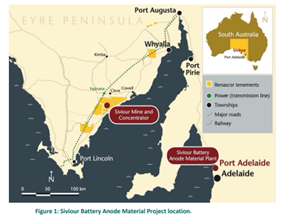

This morning, Renascor Resources provided an update regarding a mineral resource upgrade for its Siviour Graphite Deposit in South Australia.

Independent mining consultant Snowden Optiro updated the JORC Mineral Resource estimate for Renascor’s Siviour project following recent infill drill program.

Renascor reported a 17% increase to its Indicated Resource estimate as well as a 14% increase in Measured and Indicated Resources.

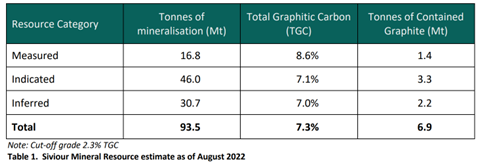

The results from the infill drilling resulted in a measured plus indicated resource estimate of 62.8Mt at 7.5% TGC for 4.7Mt of contained graphite.

The total Siviour mineral resource estimate is now 93.5Mt at 7.3% total graphitic carbon for 6.9Mt of contained graphite.

Source: RNU

Renascor’s Managing Director, David Christensen, stated:

‘The Resource upgrade offers continued evidence of the quality of the Siviour Graphite Deposit, confirming to a higher degree of confidence the continuity of widespread, high-grade mineralisation at Siviour.

‘We are particularly pleased with the upgrade in the Measured and Indicated Resource estimates, as this will directly assist in optimising the pit design and mine schedule in our updated Battery Anode Material Study and further support our objective of becoming a leading global supplier of 100% Australian-made Purified Spherical Graphite.’

RNU looks to expand

Renascor also said it will be chasing a resource drilling expansion, once the company secures a north-western extension for its Siviour project, with drilling to begin later in the quarter.

The company is also sourcing a site for a Purified Spherical Graphite (PSG) downstream facility, which will be using its ore mined from its Siviour Deposit.

Renascor has been assessing possibilities to increasing its PSG production capacity to 28,000tpa, which will be imperative with the planned expansions for its Siviour site.

A loan facility of $185 million has been approved by the Australian Government through the EFA, assisting funds for BAM Project development.

The loan was formed through the Australian Government’s $2 billion Critical Minerals Facility, as the government angles to boost critical battery material production in Australia.

Source: RNU

Renascor and the global EV battery metals race

In the US, President Joe Biden is looking to boost the local EV industry.

The EU is set on scrapping higher-emission vehicle sales entirely by 2035.

And the European Commission is looking to boost raw material output with green energy ambitions, lowering regulations around lithium, cobalt, and graphite mining and production.

The lithium-ion battery market is fast ramping-up and vehicle manufacturers are madly securing supply chain deals.

Our energy expert Selva Freigedo thinks this means the industry faces a supply crunch, and the EV battery tech materials race may be entering a new stage.

Selva has recently penned a research report on the EV battery tech sector.

Access her battery tech metals report for free here.

Regards,

Kiryll Prakapenka