Shares in global online marketplace Redbubble Ltd [ASX:RBL] have continued upwards today, thanks to a solid trading update released this morning.

RBL has had a strong start to October, growing more than 33%.

Source: Tradingview.com

Year-on-year, RBL shares have returned 255% thanks large growth in online shopping during the lockdown period.

At the time of writing the RBL share price is up 13.54%, or 65 cents, to trade at $5.45 per share.

Redbubble sets new record

In their latest quarterly trading update, Redbubble announced it produced record quarterly results in Q1 FY2021.

Marketplace revenue came in at $147.5 million, up 116% YoY.

The company also posted gross profit of $64.5 million, up 149%.

These are impressive figures.

However, when compared to FY2020 full-year results, they tell an even more impressive story.

Full-year marketplace revenue for FY2020 was $349 million.

And gross profit was $134 million.

A strong quarterly performance to say the least.

Earnings before interest and tax for Q1 FY2021 also showed considerable improvement.

Up from a loss of $1.5 million in the previous corresponding quarter to $22.1 million.

An improvement of 1,550%.

Redbubble CEO, Martin Hosking, said:

‘The strategic priority for the group now is to ensure we extend the market leadership we have established. We intend to invest in the customer experience to improve loyalty and retention and ensure long-term higher levels of growth.

‘The company has the resources to undertake the anticipated investments and the margin structure to ensure it can do so while remaining profitable.’

Where to for Redbubble?

When we last took a look at the RBL share price it was sitting around the $3.38-mark.

And that was at the beginning of September.

The share price has then rocketed up well past the $5-mark.

RBL say there are several strategic growth opportunities they are currently pursuing to generate ongoing profitable growth.

These are:

- Artist acquisition, activation, and retention

- User acquisition and transaction optimisation

- Customer understanding, loyalty, and brand building

- Further physical product and fulfilment network expansion

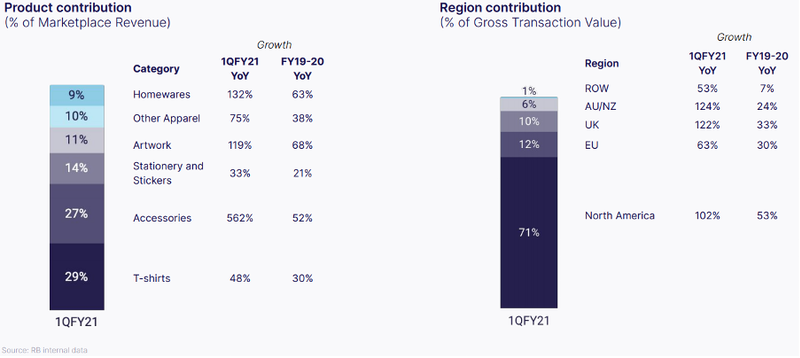

Growth across all RBL’s operating regions just about doubled (more than doubled for some) during Q1 FY2021.

Though the US contributes the lion’s share of transaction value, the ANZ region produced the most significant growth.

Source: Redbubble

What could be a concern in the near future is the end of the JobSeeker and JobKeeper payments.

With the jobless rate on the rise again in Australia, growth could begin to slow once stimulus is rolled back.

There is no doubt that Redbubble has shown some incredible growth. And with a market cap of $1.3 billion, Redbubble is no longer one of the ASX’s small-capped star. But if you’re on the hunt for the next RBL, then check out these three exciting tech trends and three small-cap stocks that could explode as we close out 2020. Claim your free report here.

Regards,

Lachlann Tierney,

For Money Morning