The Redbubble Ltd [ASX:RBL] posted record EBITDA, marketplace, and artist revenue today in its FY21 results release.

Investors are bidding up RBL share price on the release, with the online marketplace operator currently trading at $3.53 per share price, up 15% for the day.

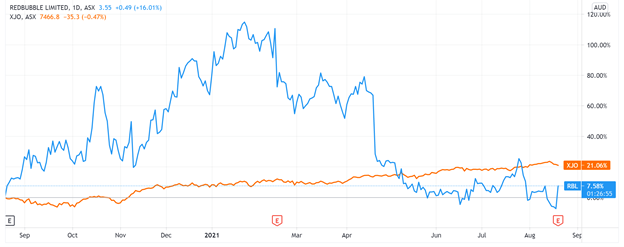

With the RBL stock down 35% year to date, will today’s results lead the market to rerate the stock?

Let’s first examine the results that sent Redbubble stock soaring.

RBL FY21 overview

Redbubble delivered record financial results and operational achievements during FY21.

The company says it is ‘well capitalised to pursue its medium-term aspirations with confidence and conviction.’

RBL’s marketplace revenue rose 58% to $553 million while the artist revenue also climbed 58% to $104 million.

The EBITDA was up by a substantial 930% to $53 million while EBIT came in at $39 million, compared to a loss of $9 million in FY20.

Gross Transaction Value (GTV) was up 48% to $701 million (60% on a constant currency basis).

Redbubble’s gross profit also saw gains, rising to $223 million, up 66% (79% on a constant currency basis).

Net Profit After Tax stood at $31 million, compared to a loss of $9 million in FY20.

RBL also boosted its operating cash flow, with it rising from $47 million in FY20 to $55 million.

The company ended the year with a closing cash balance of $99 million.

Redbubble also showed some strong results in terms of Compound Annual Growth Rate (CAGR).

FY21 Marketplace Revenue grew at a CAGR of 47% since FY19 (49% on a constant currency basis) and a CAGR of 41% since FY17.

Redbubble CEO Michael Ilczynski expressed his views:

‘The Redbubble marketplaces are flywheel businesses, where improving one side creates positive, reinforcing impacts on the other sides of the marketplace.

‘We have witnessed this powerful flywheel effect throughout FY21. I am proud of the record financial results and operational achievements that the team has delivered during that time.

‘Artists earned $104 million in revenue across the platforms in FY21, the largest ever annual amount.

‘Artist activation and engagement remains a core growth pillar for Redbubble and we are committed to growing and optimising the library of unique content available on the platform.

‘We remain focused on the tremendous opportunity we have as a business, and on our medium term aspirations to grow GTV to more than $1.5 billion, to grow Artist Revenue to $250 million, and to produce Marketplace Revenue of $1.25 billion per annum.’

PS: We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

RBL operational highlights

Let’s switch our focus to the Operational Performance of RBL.

Along with a record number of 728,000 selling artists, 9.5 million unique customers came in as of FY21, up 40%.

Redbubble also saw a 67% growth in purchases from repeat customers, which contributed 42% of marketplace revenue.

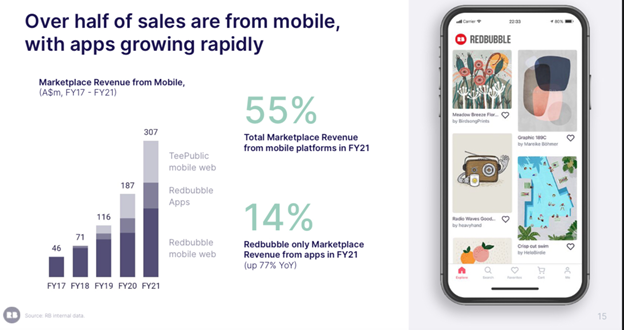

Mobile platforms sales stood at 55%, while 14% of the entire marketplace revenue came from apps.

RBL Share Price ASX Outlook

RBL shares took off during the online and e-commerce boom last year as Australia grappled with extensive restrictions and lockdowns.

The surge in demand saw RBL reach an all-time high of $7.35 in January 2021.

But Redbubble shares soon dipped after the company flagged softening organic demand in 3Q21.

The stock’s slump also coincided with Ilczynski telling shareholders that achieving its long-term ambitions may lead to ‘some short-term reduction in EBITDA margins.’

Today’s results, which showed EBITDA rising more than 900%, may have taken some investors happily by surprise.

With strong EBITDA and a cash pile of $99 million, RBL has plenty of ammo to grow the business.

However, Redbubble did note that:

‘1H FY22 Marketplace Revenue growth will likely be negative YoY as the business cycles a particularly strong prior period (due to COVID and including masks, 1H FY21 saw 96% growth and 105% on a constant currency basis).’

It will be interesting to see how the market appraises today’s results over the coming weeks.

Despite RBL’s recent fall from its all-time highs, the stock is still up a lot having traded for 50 cents in March last year.

But Redbubble isn’t the only small-cap with exciting potential.

If you are interested in small-caps, then I suggest reading the latest thoughts of our small-cap market analysts Murray Dawes and Ryan Clarkson-Ledward.

You can find their latest ideas here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.