Online retailers of original printing designs for clothing, mugs, stickers, and posters Red Bubble [ASX:RBL] released a third quarter report for the nine months ending 31 March.

The report takes shape of a trading update, in which the group revealed that its gross margin went up 7.7% after adjustments to pricing, marketing and promotions.

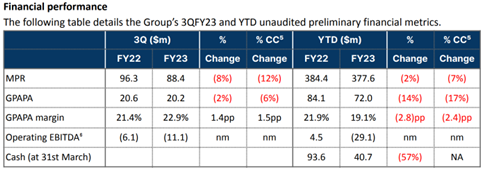

Post-pandemic, the group has seen activity slowing as shoppers returned to real-world retail experiences, taking revenue down as much as 8% on the same time last year.

RBL dropped 2.5% in share price by the early afternoon, and the designs distributor has been bumped down 19% in the past month and nearly 70% (69.72%) over the past year:

Source: TradingView

Redbubble’s third quarter trading update

Creative online marketplace Redbubble posted an update for its trading position in the third quarter of fiscal 2023, its gross margin having risen 7.7% on the December quarter, with consolidated adjustments to prices, marketing, and promotional activity.

Marketplace revenue in the third quarter was 8% lower than the previous corresponding period (the same time last year), the group explaining that this was due to its hyper-focused GPAPA (gross profit after paid acquisitions) maximisation strategy.

Also to blame were softer trading conditions in the US, overall bringing the marketplace revenue down 2% year-to-date when compared to last year.

Redbubble has now introduced account tiers for its marketplace, with fees linked to some accounts. The group says this new concept will be rolled out from the beginning of May this year.

As for marketplace revenue guidance, the group reaffirms that it will be slightly below that of fiscal 2022, while the GPAPA margin guidance has been narrowed to sit between 18% and 20%.

FY23 operating expenditure guidance has also been fine-tuned, now to the slimmer range of between $128 million and $133 million. This decision was made after cost-reduction measures announced in January were implemented, leaving the group to home in on strategies for returning to profitability.

The group’s cash had declined to $41 million by 31 March 2023.

Redbubble Group CEO and Managing Director Martin Hosking stated:

‘The Group drove significant GPAPA margin improvement this quarter as a result of optimizing its price, promotional and paid marketing activities across both the Redbubble and TeePublic marketplaces. The 3QFY23 GPAPA margin is 140 basis points above the Group’s 3QFY22 GPAPA margin and highlights that the Group’s unit economics remain compelling.

‘Today, we announce a significant change to the Redbubble marketplace, the introduction of artists tiers and associated fees for some artists’ accounts. We believe the Redbubble marketplace is now at a scale where it makes sense to take this step.

‘Consumer demand has weakened since the beginning of the year and we expect market conditions to remain challenging in the short term. As a result, and to achieve our aim of returning to cash-flow positive by the end of the calendar year, we are looking for further opportunities for cost savings, while making targeted investments in initiatives, which have or will deliver a financial benefit in the near term.’

Source: RBL

Jim Rickards’ ‘Sold Out’ book offer

You may have noticed — supermarket shelves still have some empty spaces.

Banks have been permanently closing more and more branches.

Used car prices are rising, in fact, prices in general are skyrocketing — and packaging is shrinking.

Is it all just inflation, COVID ramifications, and market volatility, or is there more to the story?

Geopolitical expert Jim Rickards has been making very apt, on-point predictions for decades.

And now he’s predicting ensuing financial chaos, and this is just the start.

He explains it all, information that should not be ignored, in his book, SOLD OUT: How Broken Supply Chains, Surging Inflation, and Political Instability Will Sink the Global Economy.

Grab a free copy and sign up for The Daily Reckoning Australia right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia