The S&P500 hit a recent peak in July. Following the Silicon Valley Bank panic low in March, it rallied 20% into that peak. This was the market realising that the economy remained strong.

The rally into the July peak priced in the strong economic growth in the three months to September. It’s as simple as that.

But since that peak, you’ve seen the S&P500 fall nearly 10%.

And as I show you in this week’s episode of What’s Not Priced In, major share markets in the US and here in Australia are now developing into bearish trends.

What is the market seeing?

A rapid slowdown ahead, that’s what.

The market knows that higher rates are biting. It’s taken a while, but the pain is here. Meanwhile, the mainstream media looks in the rearview mirror and reports on lagging indicators (GDP, inflation) as if it is the here and now.

In this week’s podcast episode, I also take you through the latest research report from Lacy Hunt. Lacy is a legend in the world of macro and monetary analysis. His quarterly reports are ‘must-reads’.

His latest offering shows that a US recession is all but inevitable. Which means a rapid slowdown is underway.

Let me give you just a few reasons why…according to Lacy.

Deficit spending. Everything thinks huge US fiscal deficits will drive growth. In the short-term, yes. But longer term…no not.

‘The current widely held view that fiscal policy can remain stimulative and inflationary is not supported by scholarly research. The fiscal multiplier is positive for the first four to six quarters after an action. Estimates from econometric studies of highly indebted industrialized economies indicate the multiplier is negative after three years.’

In other words, the huge deficits that began in 2020 will now act as a drag on growth. Why? Because the private sector (households and businesses) finance government spending. As Lacy points out, that means the private sector isn’t investing these funds. And private sector investment has a ‘positive multiplier’ effect on economic growth.

Government sector spending, due to its unproductive nature, has a negative multiplier effect.

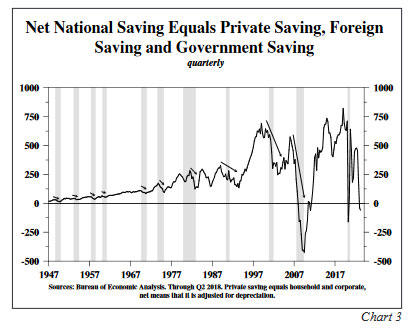

Another way of looking at this is via the ‘net national savings’ rate. Why is this important? Because whenever it declines for more than a few quarters, the US economy goes into recession.

The chart below shows this relationship clearly.

|

|

| Source: Hoisington Asset Management |

As the title says, net national saving equals private saving (households and businesses) foreign savings and government saving.

The US runs a current account deficit, which foreigner’s finance. So foreign saving is positive.

But massive government spending saw net saving decline to -US$59 billion in the second quarter. It’s only ever been negative before during the GFC and the COVID shock.

As Lacy writes:

‘Without saving, a country’s capital stock does not rise on a sustained basis. When the downturn hits, private saving will fall, and government dissaving will rise as spending for built-in stabilizers surge and tax collections drop.’

Another anomaly for the ‘strong’ US economy is the fact that bank loans (adjusted for inflation) are in decline.

‘Real bank loans and investments have decreased over the latest 12-, 24- and 36-month intervals. This is entirely unprecedented for an economy where GDP is rising.’

And if you needed more evidence, let me leave you with this:

‘The peak in the financial cycle occurred in the fourth quarter of 2021, seven quarters ago. This is right in the middle of the five to nine quarter average monetary policy lag since World War II. Monetary conditions have steadily tightened through the end of the third quarter of 2023 and the process is widely expected to hold through the end of the year, and possibly even into 2024. Historically, these more restrictive conditions will expose, through bankruptcy and liquidation, those who took excessive risk during the monetary largess of 2020 until early 2022. Through September, the yield curve between the two- and ten-year Treasury yields has remained inverted for over twelve months. As Duke Professor Campbell Harvey’s research has shown, this barometer has, without exception, preceded each of the last eight recessions over the course of seventy years.’

This is what the market is now starting to price in. A rapid slowdown from tighter monetary policy.

While there is more pain to come, don’t think this is a reason to ‘get out’ of the market. There are already many cheap stocks that offer good long-term value here.

They can always get cheaper. But remember, recession and fear produce good long-term value. Now is the time to look for opportunities, not run from them. I’m not saying to pile in. But you should definitely look to deploy capital here as prices go lower.

Or you could always take a position in the best performing asset of the year. Check out the podcast for a discussion on that!

And remember, from next Wednesday, instead of Money Morning, your daily dose of financial wisdom will come from our all-new Fat Tail Daily e-letter.

New look. New brand. Combined team. Same forward-looking insights you will not hear about anywhere else.

We can’t wait to unveil it.

Regards,

|

Greg Canavan,

Editor, Money Morning